The municipal bonds market geared up for a busy Tuesday, when the vast majority of the week's deals will hit the screens, as trading on Wednesday and Friday will be limited to half sessions.

Primary market

Citigroup is set to price the Main Street Natural Gas Inc.’s (A3/NAF/NAF/NAF) $632.01 million of Series 2019C gas supply revenue bonds.

On Monday, the underwriter circulated a pre-marketing scale on the issue, which had been on the day-to-day calendar. The scale showed bonds priced as 5s to yield from 1.39% in 2020 to 1.98% in 2026; a 2050 maturity was priced as 4s to yield 1.98% with a 2026 mandatory put date.

Goldman Sachs is set to price the National Finance Authority of New Hampshire’s (Aaa/VMIG1/NR/NR/NR) $315 million of Series 2019 exempt facilities revenue refunding bonds for the Emerald Renewable Diesel LLC project.

The non-callable deal is due June 1, 2049 and has a mandatory tender date of Aug. 31, 2020. Susquehanna Group Advisors is the financial advisor; Ballard Spahr is the bond counsel. Proceeds will refund the Port of Port Arthur Navigation District of Jefferson County, Texas’ $315 million of Series 2018 exempt facilities revenue bonds for the Emerald Renewable Diesel LLC project.

Raymond James & Associates will price the city of Vallejo, California’s (NR/AA/NR/NR) $36.25 million of Series 2019A tax-exempt and Series 2019B taxable water revenue refunding bonds. The city last sold water bonds in 2013, which was its first post-bankruptcy bond offering. The city's water fund-backed debt was not impaired by the Chapter 9 and restructuring proceedings, which the city entered in 2008 and exited in 2011. The deal will be insured by Build America Mutual, which was just affirmed at AA by S&P Global Ratings.

RBC Capital markets is set to price the Board of Trustees of Michigan State University’s (Aa2/AA/NR/NR) $149.39 million of Series 2019C general revenue refunding bonds. Blue Rose Capital Advisors is the financial advisor; Miller Canfield in the bond counsel. Proceeds will refund certain outstanding debt of the issuer. PFM is the financial advisor; Orrick is the bond counsel.

In the competitive arena, New York’s Triborough Bridge and Tunnel Authority (Aa3/AA-/AA-/AA) is selling $200 million of Series 2019C general revenue bonds and $46.05 million of Subseries 2003B-2 SIFMA floating-rate tender notes. The financial advisors are PRAG and RockFleet; the bond counsel are Orrick and Bryant Rabbino. Proceeds will fund the MTA’s capital program to finance bridge and tunnel projects

On Dec. 1, redemptions will total over $19 billion, according to CreditSights.

“We expect $31 billion in redemptions for the month,” Patrick Luby wrote in a Monday market comment, who added that next week would bear watching.

“Most attention will be focused on next week when the heavy calendar will pick up again. As of Monday morning the 25th, next week's expected supply totals $11.6 billion which is 84% above the year-to-date weekly actual new issue supply.”

He said there were several interesting deals on the slate.

“Next week's calendar includes over two dozen loans of $100 million or more; among the taxable loans are $925 million Michigan Finance Authority for Trinity Health and an additional $719 million series to be issued directly by Trinity Health,” Luby said, adding that there were also several large issues in the pipeline which don’t have sale dates yet, such as the New Jersey Transportation Trust Fund Authority’s $2.3 billion (Baa1/BBB+/A-/NR) of $634 million tax exempt and $1.7 billion taxable bonds and Louisiana State University’s (A2/NR/A+/NR) $99 million of taxable revenue bonds.

NYC Water plans $537M sale

The New York City Municipal Water Finance Authority will sell about $537 million of tax-exempt fixed rate bonds on Dec. 4 after a one-day retail order period. Proceeds sale will be used to fund capital projects and refund certain outstanding bonds for savings.

The bonds will be sold via negotiated sale through an underwriting syndicate led by book-running lead manager Siebert Williams Shank with Barclays and Raymond James serving as co-senior managers.

Secondary market

Munis were stronger on the MBIS benchmark scale, with yields falling by one basis point in the 10-year maturity and by three basis points in the 30-year maturity. High-grades were also stronger, with yields on MBIS AAA scale falling by one basis point in the 10-year maturity and by four basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO remained unchanged at 1.49% while the 30-year was steady at 2.09%.

“The ICE muni yield curve is unchanged for the start of the Thanksgiving holiday week,” ICE Data Services said in a Monday market comment. “Taxable yields are following Treasuries one to two basis points lower. Tobaccos, high-yield and Puerto Rico are unchanged.”

The 10-year muni-to-Treasury ratio was calculated at 85.1% while the 30-year muni-to-Treasury ratio stood at 94.7%, according to MMD.

Stocks hit record highs as Treasuries strengthened. Equities moved up after China announced it would raise penalties on intellectual property theft, a positive move in the Sino-U.S. trade negotiations.

“The move suggests that key concessions are being made in order to increase the prospects of a partial U.S.-China deal, which is giving investors another opportunity to capitalize on risk-on trading activity,” said Han Tan, market analyst at FXTM.

“The tone surrounding the ongoing trade talks is likely to overshadow the incoming economic data this week, even as investors try and get a better read on the global economy,” Tan said in a market comment. “With the U.S. dollar gaining on the back of Friday’s better-than-expected PMI readings, more signs of a resilient U.S. economy could help support the greenback, while staying the hand of a data-dependent Federal Reserve.”

The Dow Jones Industrial Average was up about 0.5% as the S&P 500 Index rose 0.6% while the Nasdaq gained almost 1.2%.

The Treasury three-month was yielding 1.589%, the two-year was yielding 1.628%, the five-year was yielding 1.621%, the 10-year was yielding 1.764% and the 30-year was yielding 2.203%.

Previous session's activity

The MSRB reported 30,675 trades Friday on volume of $11.21 billion. The 30-day average trade summary showed on a par amount basis of $10.78 million that customers bought $5.98 million, customers sold $2.86 million and interdealer trades totaled $1.94 million.

California, Texas and New York were most traded, with the Golden State taking 14.484% of the market, the Lone Star State taking 12.013% and the Empire State taking 11.132%.

The most actively traded security was the Dormitory Authority of the State of New York’s Series 2019B taxable 3.142s of 2043, which traded 10 times on volume of $25 million.

Last week's actively traded issues

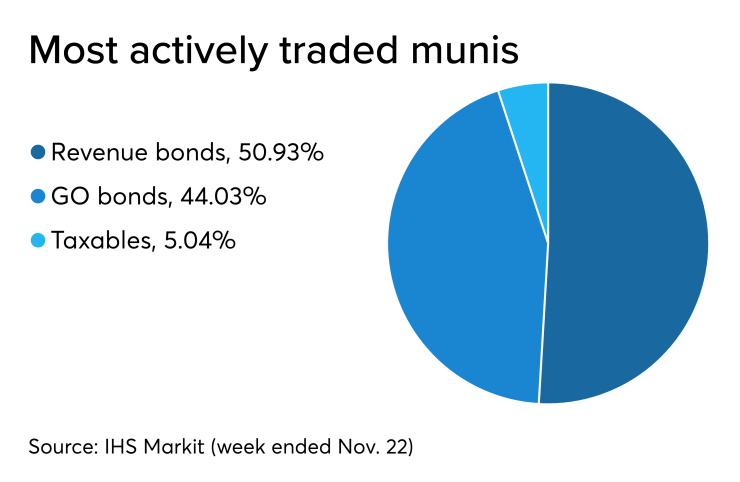

Revenue bonds made up 50.93% of total new issuance in the week ended Nov. 22, down from 51.63% in the prior week, according to

Some of the most actively traded munis by type were from New York, Wisconsin and California issuers.

In the GO bond sector, New York City’s zeros of 2040 traded 20 times. In the revenue bond sector, the Wisconsin Health and Educational Facilities Authority’s 3.125s of 2049 traded 67 times. In the taxable bond sector, the California Health Facilities Financing Authority’s 1.896s of 2021 traded 42 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 90-day and 181-day discount bills were lower, as the $45 billion of three-months incurred a 1.560% high rate, up from 1.540% the prior week, and the $39 billion of six-months incurred a 1.580% high rate, up from 1.540% the week before.

Coupon equivalents were 1.592% and 1.619%, respectively. The price for the 90s was 99.610000 and that for the 181s was 99.205611.

The median bid on the 90s was 1.540%. The low bid was 1.500%. Tenders at the high rate were allotted 29.27%. The bid-to-cover ratio was 2.89.

The median bid for the 181s was 1.540%. The low bid was 1.500%. Tenders at the high rate were allotted 43.54%. The bid-to-cover ratio was 2.73.

Treasury also auctioned $40 billion of two-year notes with a 1 1/2% coupon at a 1.601% yield, a price of 99.802444. The bid-to-cover ratio was 2.63.

Tenders at the high yield were allotted 39.14%. The median yield was 1.578%. The low yield was 1.450%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.