LOS ANGELES — With tightening credit spreads, favorable market conditions, and an improving financial position, California may achieve its lowest pricing in years when it issues $1.6 billion of debt next week.

The Golden State is planning to sell the general obligation bonds next week in a combined new money and refunding deal.

About $900 billion will go toward financing various capital projects throughout the state, and $700 million will be refunding bonds, according to Tom Dresslar, a spokesman for the state treasurer's office.

Bank of America Merrill Lynch and RBC Capital Markets, joint senior managers, will price the bonds on Thursday after a two-day retail order period Tuesday and Wednesday.

Orrick, Herrington & Sutcliffe LLP is bond counsel.

Dresslar said the maturities and structure of the deal have not yet been set.

"It seems like last year the state had very good timing when they did their borrowing," said Craig Brothers, managing director and portfolio manager at Bel Air Investment Advisors. "They got it done just before the market really kind of gave up a lot of ground and it feels like maybe they're on to something again."

In a $2.28 billion GO bond sale last October, California priced the tax-exempt portion with yields ranging from 0.15% in 2014 to 4.89% in 2043. The 10-year maturities priced at 3.19%.

So far this year, interest rates have been dropping and the market has been very thin, with light issuance for the first few months, Brothers said.

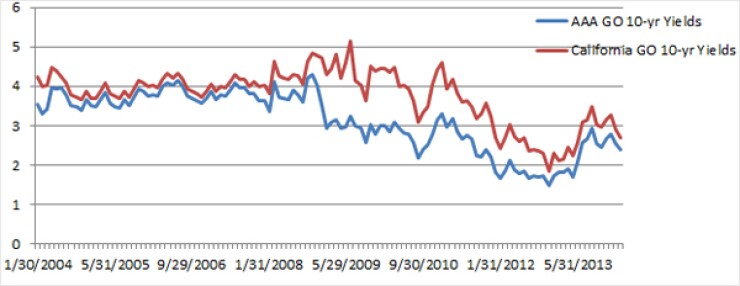

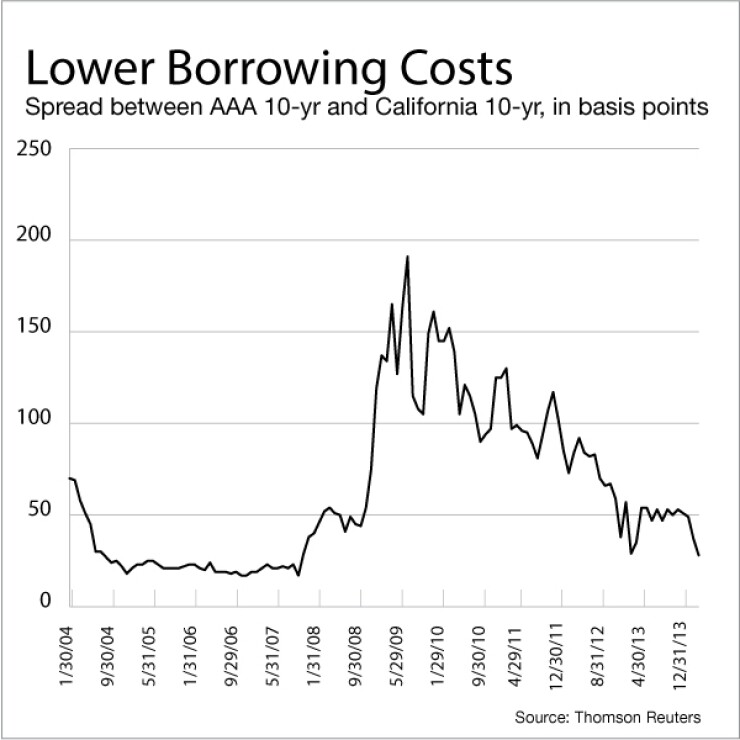

As yields have dropped, California credit spreads have tightened against Municipal Market Data's generic triple-A municipal bond.

Since the beginning of the year, spreads have come down 28 basis points — from 56 basis points above the triple-A benchmark in the ten-year maturities to 28 basis points by March 4.

"We're seeing those spreads in the secondary market and, assuming the market doesn't correct a lot in the next week or so before they do their deal, they're going to be borrowing basically at one of the lowest levels they've been able to borrow at," Brothers said. "Not just from an absolute yield level but from a spread basis."

California's credit spreads have been narrowing over the past couple of years as its credit quality has improved, which has largely been a result of a strengthening economy and improved approach to budget development, according to Standard & Poor's.

The credit ratings agency has not yet assigned a rating to the new GO bonds, but assigns A rating and positive outlook to its outstanding bonds.

The outlook was revised from stable in January, when the agency said it could upgrade the state's rating in the next two years.

Moody's Investors Service affirmed its A1 rating and stable outlook Wednesday and Fitch Ratings affirmed its A rating and stable outlook Thursday.

In 2010, California voters approved a ballot measure allowing state budgets to pass on majority votes in the legislature, replacing a previous two-thirds vote requirement that was often blamed for late and out of balance budgets.

Investors sense that California as a credit has improved under the new law, said Rob Williams, director of income planning at the Schwab Center for Financial Research.

"And certainly the rating agency commentary on the improved credit quality, and the recent widely publicized tax increase, as well as tax revenues leading to more solid budgets, is a positive on the credit side," he said.

He added that tightening credit spreads over the last year have been largely a result of an increase in comfort among investors with the California credit, as well as demand from higher net-worth investors for after-tax income.

Going back even further, the state's credit spreads haven't been around these levels since 2004. From that year through 2007, yields on California's 10-year GO bonds stayed around 20 to 25 basis points over the MMD triple-A scale. In the years that followed, spreads started to climb as the recession hit and the state's financial troubles worsened, peaking at 191 basis points in June 2009.

Since then spreads starting coming back down and are now close to levels from the 2004 to 2007 period.

"We view the state as an improving credit," Brothers said. "Proposition 30 is working, the revenues are coming in, and the state's been disciplined about their spending."

Proposition 30, passed by voters in November 2012, increased personal income tax over seven years for California residents with an annual income over $250,000. The measure also increased the state sales tax by 0.25% over four years.

For Brothers, however, the spreads on California bonds are not at the level at which he would consider buying them.

"It's not to say that it won't be successful, this is nothing about the credit being a bad credit," Brothers said, adding that he thinks the deal will do very well next week. "It's the value. From a value standpoint, we don't see that there's much upside in spreads tightening on the name."

One reason why he said the deal would likely go well is due to its size. There haven't been many large deals in the past few months, so size is a benefit right now in the thin market.

Williams said he also believes the deal will receive strong interest, particularly from high net-worth investors, as well as Schwab clients, who are interested in putting money to work in this market.

"There's still very solid demand for GO credits, and certainly state credits in California, given the high tax rates and the lack of tax-exemption status for other forms of investment," he said. "That said, yields have fallen pretty dramatically since the beginning of the year, so they don't look as appealing for some of these credits."

Since Jan. 1, yields on the five-year AAA-rated GOs have come down 36 basis points to 0.96% by March 4. In the 10-year maturities, they were down by 42 basis points at 2.37%, and in the 30-year maturities, 52 basis points at 3.68%.

"I think you'll see interest, but I don't think you'll see investors falling all over their selves for the yields that they're finding in the market right now," Williams said.

Matt Fabian, a managing director at Municipal Market Advisors, said that while the deal should sell well next week, it's less likely that it will price much through recent spreads.

"More likely would be buyers being a bit more cautious on price, but still being aggressive enough to get their orders filled," he said.

"The market has a lot of fresh capital to spend and there isn't much to buy," Fabian said. "And while there are good reasons to be optimistic through year end, there is some risk of a setback in performance in the near term. March seasonals are a difficult hurdle for the market to overcome."

According to a

After next week's deal, the state has two more bond sales scheduled, both by the State Public Works Board. An $800 million lease revenue bond sale is set for March 26, and another lease revenue bond sale of $400 million is for April 10.