A few remaining municipal bond deals hit screens on Thursday to wind down the week’s issuance.

Barclays priced the Department of Water and Power of the city of Los Angeles’ $345.845 million of power system revenue bonds. The deal is rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

Raymond James priced the Cypress-Fairbanks Independent School District’s $261.9 million of unlimited tax refunding bonds on Thursday. The deal is backed by the Permanent School Fund Guarantee Program and is rated triple-A by Moody’s and S&P.

On Wednesday, Chicago closed the books on its nearly $3 billion sales tax securitization bond program with a $600 million taxable issue that fared well given the risks some investors see in the changing of the guard in city and state leadership, several market participants said.

The coupon on the nearly $303 million 2040 maturity landed at a spread of 155 basis points to Treasuries and the $303 million 2048 maturity offered a coupon that landed at a 170 basis point spread, according to the pricing wire.

“This is really good execution given that we have a new governor and we are not sure who the next mayor will be, so all political management is going to be new and the city managed to get a $600 million sales tax securitization deal done at a reasonable market level,” said Brian Battle, director of trading at Chicago-based Performance Trust Capital Partners.

The risks associated with the securitization bonds range from the sturdiness of the revenue asset sale to a bankruptcy-remote special entity, whether the state will honor the lockbox on the transfer of the sales taxes, and whether sales taxes will perform as anticipated.

Thursday’s bond sales

Secondary market

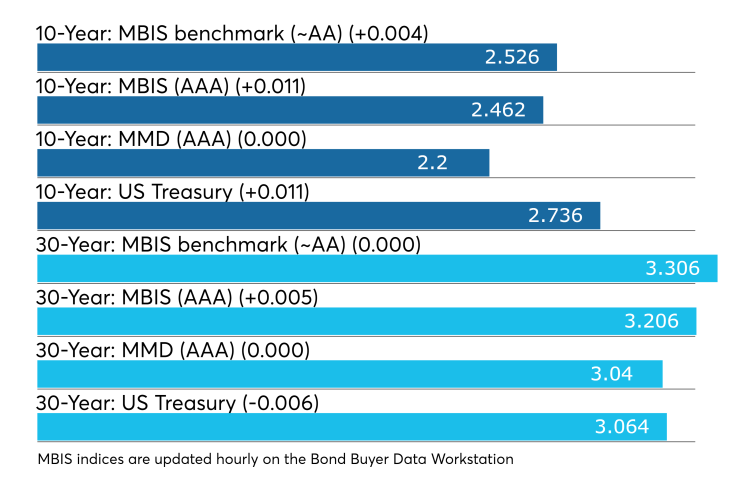

Municipal bonds were mostly weaker on Thursday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose as many as two basis points in the one- to four-year and nine- to 30-year maturities. The remaining four maturities saw yields decreasing by as much as one basis point.

High-grade munis were also mostly weaker, with yields calculated on MBIS' AAA scale increasing as many as two basis points in the one- to four-year and 9- to 30-year maturities. The rest of the maturities saw yields decrease by no more than a basis point.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the 30-year muni maturity unchanged.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 80.5% while the 30-year muni-to-Treasury ratio stood at 98.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Muni money market funds see outflows

Tax-free municipal money market fund assets decreased $775.8 million, lowering their total net assets to $145.76 billion in the week ended Jan. 14, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds fell to 0.98% from 1.19% last week.

Taxable money-fund assets declined $16.22 billion in the week ended Jan. 15, bringing total net assets to $2.867 trillion.

The average, seven-day simple yield for the 805 taxable reporting funds dipped to 2.03% from 2.07% last week.

Overall, the combined total net assets of the 995 reporting money funds declined $17 billion to $3.012 trillion in the week ended Jan. 15.

Previous session's activity

The Municipal Securities Rulemaking Board reported 45,338 trades on Wednesday on volume of $15.217 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.317% of the market, the Empire State taking 10.557% and the Lone Star State taking 10.339%.

Treasury announcements

The Treasury Department said Thursday it will auction $42 billion 91-day bills and $39 billion 182-day discount bills Tuesday.

The 91s settle Jan. 24, and are due April 25, and the 181s settle Jan. 24, and are due July 25.

Currently, there are $64.997 billion 91-days outstanding and no 182s.

Treasury auctions bills

The Treasury Department Thursday auctioned $40 billion of four-week bills at a 2.370% high yield, a price of 99.815667.

The coupon equivalent was 2.407%. The bid-to-cover ratio was 3.05.

Tenders at the high rate were allotted 70.96%. The median rate was 2.350%. The low rate was 2.320%.

Treasury also auctioned $30 billion of eight-week bills at a 2.365% high yield, a price of 99.632111.

The coupon equivalent was 2.407%. The bid-to-cover ratio was 3.47.

Tenders at the high rate were allotted 68.24%. The median rate was 2.350%. The low rate was 2.300%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.