BRADENTON, Fla. — The Kentucky Asset/Liability Commission Wednesday expects to price $269.7 million of taxable notes, though the timing of the sale depends on another major taxable deal that may hit the market this week.

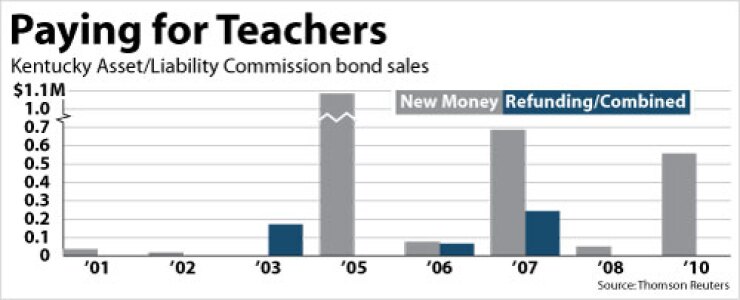

The offering is the second tranche to refinance obligations Kentucky owes to the Teachers’ Retirement System for medical benefits.

The deal currently is structured with serial maturities between 2012 and 2022. However, the structure could change depending on market conditions and be modeled like the first tranche: a $468 million taxable note sale in August with a new index-eligible term structure that broadened the universe of investors. The first deal won The Bond Buyer’s large Southeast Deal of the Year Award in 2010.

The second tranche “probably won’t be index-eligible if the economics for serial bonds is better than a large term bond,” said Tom Howard, executive director of Kentucky’s Office of Financial Management.

He said pricing may also be affected by large outflows from the muni market and Illinois’ planned $3.7 billion taxable general obligation pension deal this week, noting that both deals are selling in the same part of the curve.

Illinois postponed its deal to give investors time to digest the governor’s budget, which was released last week. The deal is now slated to price Tuesday and Wednesday.

Kentucky’s notes are refinancing loans the state obtained starting in fiscal 2005 from the teacher’s pension fund to pay the state’s share of medical benefits promised to retired teachers. The loans carried 7.5% interest rates so officials decided to restructure them with taxable notes to lower financing costs.

The first tranche sold last August resulted in an overall interest rate of 3.304%, including fees, and will save the state $87.7 million over the life of the 10-year final maturity.

In addition to the loan restructuring, Kentucky began pension reforms beginning in 2008 that included increasing workers’ contributions and prohibiting employees from “double dipping,” or retiring and then returning to work for the state to earn a second pension.

Howard said it would be difficult to predict if the second tranche would price as well as the first because of outflows, the Illinois deal, and Fitch Ratings’ recent revision of its outlook on the note rating to negative, citing pension funding concerns.

“Given our improving revenue picture, proactive actions to address our current budget situation, and pension reforms enacted in 2008 and 2010, I think investors realize that this is part of the long-term solution to address these structural issues,” Howard said. “I believe investors will give us proper consideration even though these issues may be weighing on our current rating outlook with some of the agencies.”

The notes are rated AA-minus by Fitch, Aa2 by Moody’s Investors Service, and A-plus by Standard & Poor’s.

Moody’s maintained its negative outlook — which is based primarily on Kentucky’s overall credit — due to budget deficits and draws on reserves largely caused by the economic downturn. Standard & Poor’s maintains a stable outlook.

Analysts said the state still has budgetary pressures to resolve, but the economy is slowly improving. They cited low pension funding and high liabilities.

According to bond documents, the most recent studies found that the Kentucky Retirement Systems’ unfunded accrued liability is $7.28 billion and is 40.8% funded.

The teacher’s pension has an unfunded liability of $9.5 billion and is 61% funded. In fiscal 2010, the state’s annual required contribution for KRS was $385.1 million, though the actual contribution was $171.2 million. While $633.9 million was due for teacher’s pensions, $418.6 million was contributed.

The unfunded accrued liability for KRS’ other post-employment benefits is $4.5 billion, while the OPEB liability for teachers is $2.97 billion.

JPMorgan is the senior managing underwriter for the upcoming note deal. Others in the syndicate are Citi, Edward D. Jones & Co., First Kentucky Securities Corp., J.J.B. Hilliard, W.L. Lyons LLC, Morgan Keegan & Co., Morgan Stanley, PNC Capital Markets LLC, Ross, Sinclaire & Associates, and Stifel, Nicolaus & Co.

Kutak Rock LLP is bond counsel. Peck, Shaffer & Williams LLP is underwriters’ counsel.