Interest rates should be less than 1.5%, not the current 1.75% to 2%, according to Federal Reserve Bank of Minneapolis President Neel Kashkari.

The current interest rates and the trade war are hindering the economy, he told the Washington Post.

“I’m concerned that we’ve needlessly raised interest rates over the past three years and put the economy into a more dangerous position that makes it more vulnerable to shocks that could hit us,” he is quoted as saying. “Why are we trying to contract the economy?”

Although he doesn’t have a vote on the Federal Open Market Committee until he rotates in next year, Kashkari said he pushed for a larger cut at the latest meeting, and argued conditions justify a rate 50 basis points lower than it is now.

He told the paper, “I hope we don’t end up back at zero.”

A slowdown in the labor market and yield curve inversion are troubling, and the Fed needs to move before hiring stops completely, he told the paper.

“Monetary policy is a little bit science, but it’s also mass psychology,” Kashkari said. “Right now one concern I have is the job market does appear to be slowing. It has stepped down pretty markedly from a year or two ago.”

Evans

Federal Reserve Bank of Chicago President Charles Evans said he believes “we’re pretty well positioned now to see how things play out,” according to published reports of his appearance at a Rotary Club breakfast on Wednesday.

While fundamentals remain strong, uncertainty could cause “fragility,” he said.

The two recent Fed rate cuts were an appropriate mid-cycle adjustment.

Fed Gov. Lael Brainard also pointed to global risks endangering the U.S. economy. She termed the problems with the repo market a "simple imbalance," although she allowed the possibility that “reserves are more scarce than we intended,” and it may be time to let the Fed’s balance sheet grow.

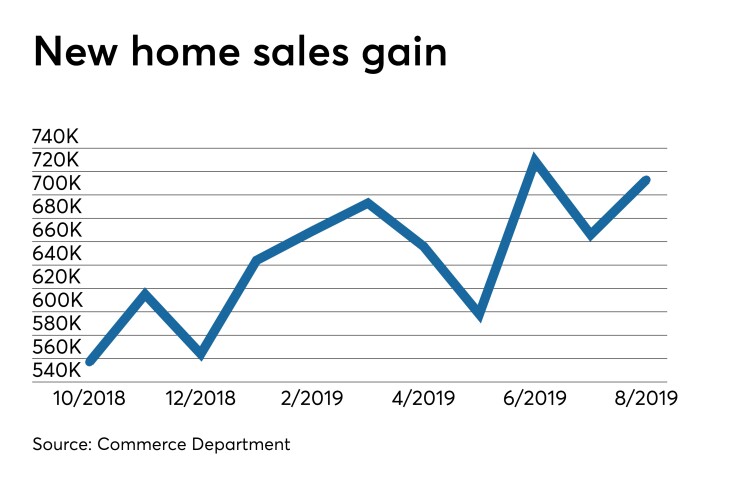

New home sales

In a positive sign for the economy, new home sales surged 12.8% to a seasonally adjusted 713,000 annual rate in August, the U.S. Commerce Department reported Wednesday.

Economists polled by IFR Markets expected 660,000 sales in the month.

The July level was revised up to 666,000 from the 635,000 first reported.

Sales were up 18% from last August, when the rate was 604,000.

The median sales price was $328,400, and the average price was $404,200.

There were 326,000 homes for sale at the end of August, a 5.5 month supply, down from 5.9 months at the end of July.

"With job growth continuing and lower interest rates in place, builders report rising confidence levels, and this is reflected in today's solid sales report," according to Greg Ugalde, chairman of the National Association of Home Builders (NAHB).

But affordability continues to hamper sales, "because buyers can't benefit from lower interest rates if they don't have the money for a downpayment," said Danushka Nanayakkara-Skillington, NAHB's AVP for forecasting and analysis.