The municipal bond market was quiet Monday as traders waited for this week’s new issue sales to get underway with competitive deals on Tuesday from Massachusetts and Fairfax County, Va.

Trading was subdued in the secondary, with prices ending the day little changed.

Primary market

After a slow start to 2018, this week’s volume picks up a bit and is estimated at $3.30 billion; the calendar is made up of $1.72 billion of negotiated deals and $1.58 billion of competitive sales.

"January tends to be a tad sluggish in the beginning of the month,” Stephen Winterstein, managing director at Wilmington Trust, wrote in a weekly market comment. “In point of fact, over the past 32 years since 1986, the first month of the year has averaged only 6% of that year’s total supply, whereas the final three months of the year have averaged 9%. The month with the highest average new issuance over that same time period is May, at 11%.”

Wilmington Trust expects supply to accelerate to a more normal pace, though Winterstein said that the elimination of tax-exempt advance refundings will subdue issuance in 2018. The firm’s municipal supply estimate for 2018 is about $350 billion, a 20% decline from last year.

“After December’s $62.502 billion flood of new issuance, supply slowed in the first week of 2018 to a scant $42.100 million,” Winterstein wrote. “The slowing of new deals should serve as a support mechanism for municipal bond prices. While we are closely watching retail demand as measured by mutual fund flows, the institutional market appears to be on firm footing for the upcoming week.”

Others also saw light issuance ahead for the near-term.

“With a rush to issue in Q4 ahead of new tax laws, we expect Q1 2018 will see a lull in supply,” Morgan Stanley said in a Monday market comment. “We think about $20 billion was pulled forward into Q4, and now expect 2018 gross supply will be $315 billion, net supply of -$23 billion.”

Michael Pietronico, chief executive officer at Miller Tabak Asset Management said he expects new issue supply will be met with solid demand.

"The technical forces in the market remain quite favorable," he said. "We think that buyers have plenty of cash and are looking for tax-free bonds. So perhaps taxable deals might need more concession to garner interest."

Primary activity on Tuesday will center in the competitive sector.

The

Both deals are rated Aa1 by Moody’s Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings

The last time the state competitively sold comparable bonds was on Oct. 18, 2017, when Bank of America Merrill Lynch won $300 million of consolidated loan of 2017 Series E GOs with a true interest cost of 2.8724%.

Fairfax County, Va., is selling $225.19 million of Series 2018A unlimited tax GO public improvement bonds.

The deal is rated triple-A by Moody’s, S&P and Fitch.

The Roseville Area Schools Independent School District No. 623, Minn., is selling $139.24 million of Series 2018A unlimited tax GO school building bonds.

The deal is being sold under the Minnesota School District Credit Enhancement Program.

Later in the week, Morgan Stanley is expected to price the Stanford Health Care’s $500 million of Series 2018 corporate CUSIP taxables on Wednesday, RBC Capital Markets is expected to price the Pennsylvania Commonwealth Financing Authority’s $410 million of Series 2-018A taxable revenue bonds on Thursday while JPMorgan Securities is set to price the Illinois Finance Authority’s $218.67 million of Series 2018 taxable revenue refunding bonds on Thursday.

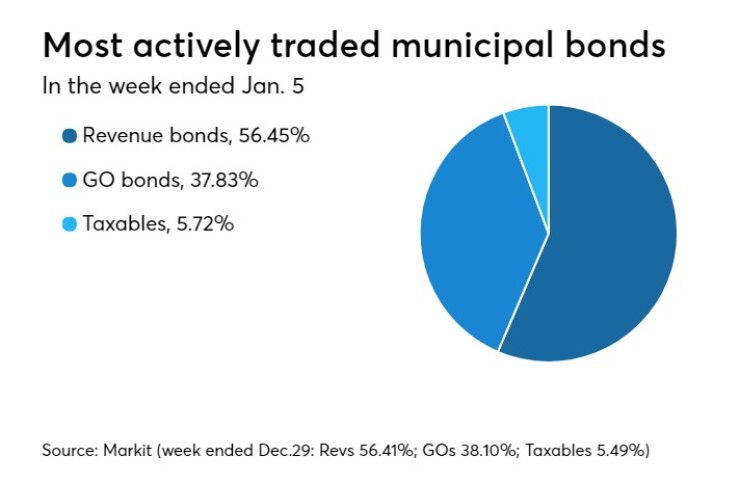

Previous week's actively traded issues

Revenue bonds comprised 56.45% of new issuance in the week ended Jan. 5, up from 56.41% in the previous week, according to

Some of the most actively traded bonds by type in the week were from New York and Illinois issuers.

In the GO bond sector, the New York City zeroes of 2042 were traded 31 times. In the revenue bond sector, the New York City Municipal Water Finance Authority zeroes of 2050 were traded 24 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 12 times.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was steady in late trading.

The 10-year muni benchmark yield was unchanged on Monday from the final read of 2.275% on Friday, according to

The MBIS benchmark index is updated hourly on the

Top-rated municipal bonds finished mixed on Monday. The yield on the 10-year benchmark muni general obligation was steady from 2.01% on Friday, while the 30-year GO yield rose one basis point to 2.59% from 2.58% according to the final read of MMD’s triple-A scale.

U.S. Treasuries were little changed in late activity. The yield on the two-year Treasury slipped to 1.95% on Monday from 1.96% on Friday, the 10-year Treasury yield was unchanged from 2.48% and the yield on the 30-year Treasury was flat from 2.81%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 81.0% compared with 81.2% on Friday, while the 30-year muni-to-Treasury ratio stood at 92.1% versus 91.8%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,762 trades on Friday on volume of $10.35 billion.

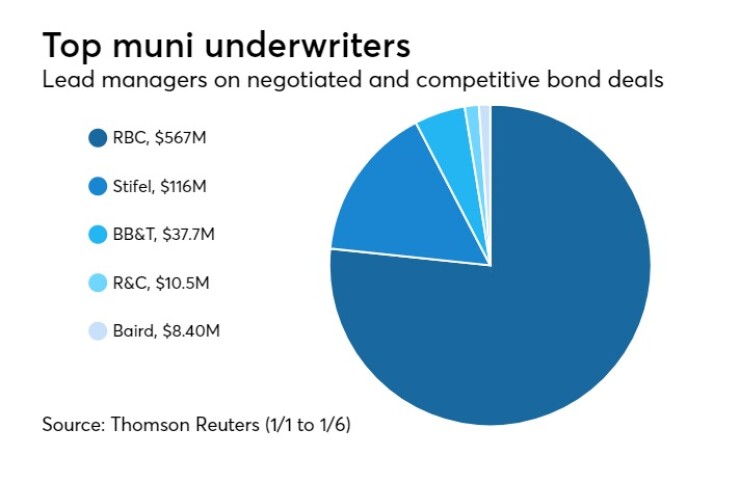

Prior week's top underwriters

The top municipal bond underwriters of last week included RBC Capital Markets, Stifel, BB&T Capital Markets, Roosevelt & Cross and Robert W. Baird, according to Thomson Reuters data.

In the week of Jan. 1 to Jan. 6, RBC underwrote $566.7 million, Stifel $116.0 million, BB&T $37.7 million, R&C $10.5 million, and Baird $8.4 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.