Chicago paid slightly wider-than-before spreads for its latest O'Hare International Airport deal, but still booked considerable refinancing savings.

The $1.2 billion O'Hare International Airport refunding

“The spreads definitely widened from the last deal, but it’s a fantastic pricing because air travel is so far down as this is the part of the economy that is bearing the brunt” of the pandemic’s hit, said Brian Battle, director of trading at Performance Trust Capital Partners. “The fact that the spread is not more than 90 basis points is a testament to how good a credit O’Hare is and what an important hub it is.”

O'Hare uniquely is the hub for two major airlines: United and American.

Investors are more discerning because of the COVID-19 pandemic, Battle said, and take a better view of those hub airports central to airline operations.

The city is taking the $257 million of

Wider spreads compared to O'Hare's 2018 issue reflect airport sector risks and the Chicago name or view of O’Hare, traders said.

The lower interest rates paved the way for the significant savings.

“These refinancing savings, along with CARES funding and operating efficiencies at the airport, lock-down a holistic two-year finance plan in a time of considerable uncertainty,” Chicago Chief Financial Officer Jennie Huang Bennett said in a statement.

The senior lien general airport revenue bonds carried an A rating and negative outlook from Fitch Ratings and S&P Global Ratings and A-plus and negative outlook from Kroll Bond Rating Agency.

O'Hare holds unique dual hub status with American Airlines and United Airlines.

The tax-exempt piece of the deal totaled $755 million in four series with a mix of premium prices and 4% and 5% coupons offering maturities out to 2040. Several later maturities carried insurance from Assured Guaranty.

“The enemy of credit is time so it makes sense to insure the long maturities. With the insurance you are buying some certainty that the rating won’t go below an A,” Battle said.

The premium prices on some maturities raise additional proceeds for the airport and appeal to some buyers while the lower 4% coupons are attractive for their liquidity as it “makes the bonds more saleable.”

A 10-year 2030 maturity with a 5% coupon offered a yield of 1.50%, 70bp to early MMD, the 2035 with a 5% coupon was at a 2.11% yield and a 95 bp spread, and a 2040 insured maturity with a 4% coupon was at 2.32%, 95bps to MMD but adjusted to 74bp to reflect the 4% coupon. The information came from Refinitiv-MMD’s Thursday market close. The bonds were not subject to the alternative minimum tax although one series was labeled as private activity.

The city’s last O’Hare deal in late 2018 saw a 20-year maturity with a 5% coupon in the non-AMT series settle at a 57 basis point spread to the AAA.

Pricing guidance initially issued on the taxable tranche totaling $465 million offered the 10-year at a 170 bp spread to Treasuries and the long 18-year maturity at 165 bps. Spreads tightened by five to 15 bps.

The taxable tranche in the 2018 sale offered long term bonds in 2049 and 2054 term with spreads of 130 bps and 140 bps to Treasuries.

O’Hare bonds are thinly traded but a recent trade of a 2048 bonds was at an 89bp spread, down from 120 bps in April, Refinitiv-MMD’s team wrote in last week’s Municipally Speaking column.

“The fact that it was able to come to market and the bonds were placed is an accomplishment” given the sector’s troubles, said Refinitiv-MMD senior market strategist Dan Berger, adding that the extra yield offered by the sector also may have

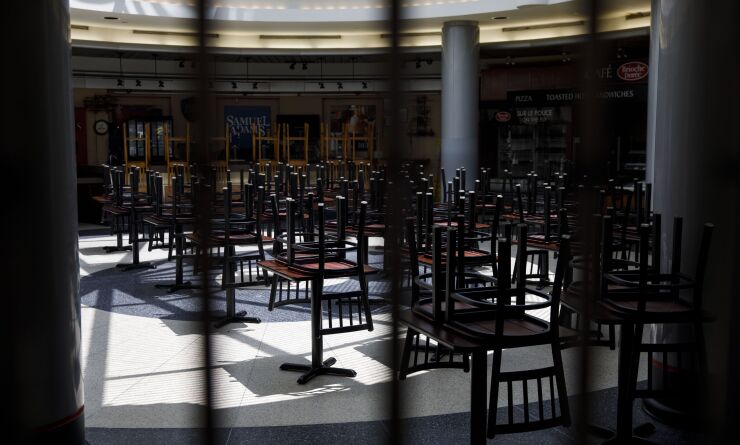

The 138 references to the pandemic in the deal’s offering statement underscored the pandemic’s gut punch. O’Hare headed into the pandemic with total passenger levels hitting a peak of 42.2 million in 2019.

Passenger levels between January and July tumbled by about 60% to 9.47 million compared to the same period last year. Non-airline revenue that comes from parking and concessions and auto rental was down 55% to $67 million.

O’Hare is managing the current year’s blow with its $294.4 million share of airport relief in the federal CARES Act package signed March 27 and the city raised airline landing fees allowed under its new residual model airline agreement. It will not dip into $1 billion of reserves from cash, investments, and surety bonds through next year.

Capital work at the airport continues but the timing of some future projects is fluid due to the pandemic.

Bennett said the $8.5 billion plan to redevelop one terminal and build new concourses is still in the design stage so timing is not final. The offering statement hedges the city’s bet on the 2028 completion date cited when Lightfoot’s predecessor Rahm Emanuel announced the upgrades.

“The estimated completion date remains subject to change due to the impacts of covid-19 and other economic and operational factors,” the offering statement says. Groundbreaking is currently expected in 2022 to 2023.

The various capital programs total $11.3 billion when combined with $7.8 billion still to be funded. Airport consultant Ricondo & Associates projects traffic levels will return to 2019 levels in mid-2022 to late 2023 depending on the pandemic’s course.

Jefferies and Loop Capital Markets LLC served as lead underwriters on last week's deal.

Passenger demand will gradually improve but it will take some time, Moody’s warned in a report last week.

The lingering economic impact of the coronavirus will keep demand below 2019 levels until 2024. But the sector's long-term credit quality will remain strong after the downturn and recovery cycle. The recovery should pick up steam in 2022 assuming vaccines, medicines and improved treatment protocols to combat the coronavirus are available by the end of 2021, said Moody’s senior analyst Earl Heffintrayer.

“Small and non-hub airports in the shadow of larger airports” face the “greatest credit risk” because their recovery could lag while “larger airports will have ample capacity in the next couple of years and carriers that are looking to cut costs can save by eliminating airports served,” Moody's said.

Fitch Ratings cautioned in a report last week of a prolonged recovery period for U.S. and Canadian airports that will amplify revenue and cost pressures on airports and airlines.

Passenger traffic, which fell by 95% during the first two months of the pandemic, is still down about 65% to 75% and Fitch projects traffic volumes will remain 75% lower this quarter and remain 60% lower for the fourth quarter.

“A new normal in air travel has materialized and will persist over the next several years, exacerbated in part by general decline in demand coupled with risks to continued use of imposed travel restrictions at national and state levels,” wrote Seth Lehman, a senior director.