Texas may see about $850 million of additional revenue under a pair of internet sales tax bills that passed the state Senate Friday.

Another bill,

If someone in Texas buys something from an online seller in another state using a marketplace, the marketplace would be responsible for collecting and paying sales tax on the transactions. Officials estimate the bill would yield an additional $550 million in 2020 and 2021 above what lawmakers included in their budget assumptions.

The legislative action follows a 2018 U.S. Supreme Court ruling in the case of

Texas is one of several states enacting legislation based on the court decision. Recently signed legislation in California is expected to generate an extra $759 million in state and local taxes by 2021.

The new levy comes as Texas lawmakers are considering raising the state’s sales tax by a penny to offset the cost of public education and relieve pressure on property taxes.

“If we are able to pass the sales tax increase it will be dedicated to driving down property taxes,” Gov. Abbott said at a Capitol news conference on Friday. Combined with potentially redirecting some current state tax revenue toward property taxes, “we’re going to be able to leave this Capitol and inform our fellow Texans their property tax bills next year are going to be less than they were this year.”

But Democrats are opposed to the shift to sales taxes because they say it is a regressive tax that places a disproportionate burden on the poor and middle income demographics while easing pressure on the wealthy. Some Republicans have opposed any tax increase, fearing a hard sell to conservative constituents.

Under House Joint Resolution 3, voters would get the final say in November on whether to raise the sales tax for public schools.

Texas’ Legislative Budget Board reckons that the top 40% of wealthiest Texas households would see enough property tax savings to offset their increased sales tax payments in fiscal 2021. The bottom 60% of Texas households would pay more in taxes overall.

Households earning less than $99,619 would pay a total of $171 million more in taxes under the tax swap, per the LBB. Households that make more than that would pay a total of $424 million less in taxes, according to the analysis.

With no income tax, Texas gets about 57% of its revenue from sales tax. To support schools, the state’s role is to equalize per pupil funding between districts that levy their own local property taxes. With the value of property in Texas rising, owners have complained about rising property tax collections.

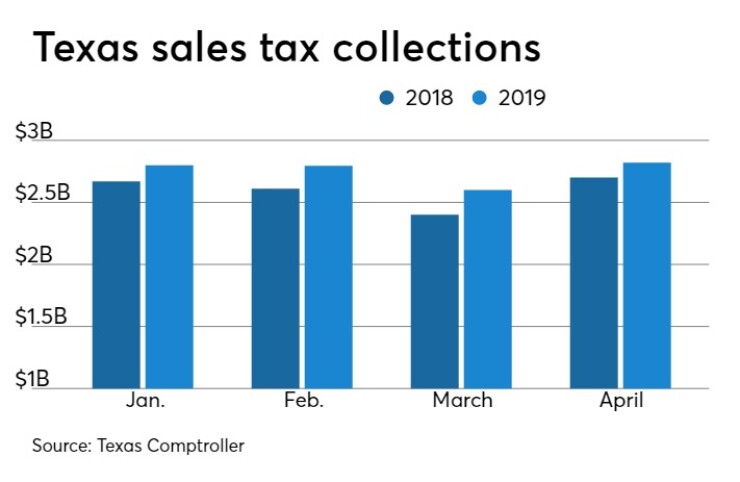

Soaring sales tax revenue has proven a boon for state and local governments over the past two years. In April, Texas set another monthly record for collections, which rose 3% over the same month in 2018 to $2.8 million. Collections for every month this year have established a new high for that month.

“State sales tax revenue continued to grow, but at a modest pace compared to recent months,” Texas Comptroller Glenn Hegar said. “Increased sales tax collections were mostly from the construction and services sectors, while collections from retail trade saw a moderate decline.”

Total sales tax revenue for the three months ending in April 2019 was up 6.2% compared to the same period a year ago.

Texas has also enjoyed a lift from higher prices for oil over the past year, while prices on natural gas have proven less reliable. Production taxes on gas of $128 million were down 0.7% from April 2018 while taxes on oil rose 8.9% to $344.2 million, Hegar said.

Meanwhile, motor fuel taxes that support bonds for the Texas Department of Transportation were down slightly to $322 million. Motor vehicle sales and rental taxes rose 1.3% to $297 million.