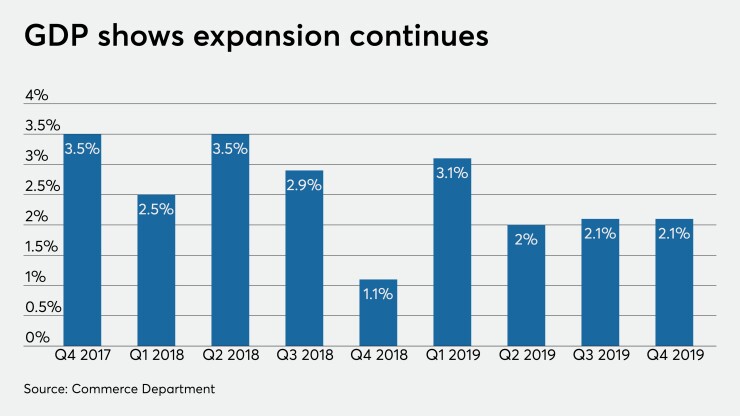

With many economic indicators released Friday, the main takeaway is gross domestic product will struggle.

The Federal Reserve Bank of New York's Nowcast prediction for first quarter GDP confirmed this, falling to 1.4% on Feb. 14 from a 1.7% expectation a week earlier. "Negative surprises from capacity utilization and industrial production data drove most of the decrease," the Fed said.

Consumer spending appears sluggish, although consumer sentiment readings jumped to levels not seen since May, and business inventories, which also play into GDP, didn’t grow much. Unusually warm weather likely hit sales totals, and also cut down on the need for utilities to crank.

Retail sales rose 0.3% in January, while sales excluding autos also rose 0.3%, as expected. The control figure — which excludes gas stations, food services and drinking places, building materials and auto sales — was flat in the month, the Commerce Department said Friday.

The December figures were downwardly revised to gains of 0.2% for the headline number (from an initially reported 0.3%) and 0.6% ex-autos (from 0.7%). The control gained 0.2% in December, revised down from a 0.5% rise. These sales factor directly into gross domestic product and have been weak since the fall, and are now below August’s level.

Sales at clothing and accessories stores dropped 3.1% in the month, perhaps related to the warmer-than-average winter weather, and factored into the control sales flat read.

“The fundamentals that suggest retail activity could be stronger include: sustained and strong job growth and healthy gains in real earnings that are lifting real disposable incomes; low interest rates that are reducing debt services costs; and strong labor market demand, which is keeping worker confidence elevated,” said Berenberg Capital Markets U.S. Economist Roiana Reid.

But consumers remain optimistic, as the University of Michigan preliminary February consumer sentiment index rose to 100.9, its highest level since May, from 99.8 in January.

Economists expected a 99.3 read.

The current conditions index fell to 113.8 from 114.4 in January, while the expectations index gained to 92.6 from 90.5.

The one-year inflation index held at 2.5%, while the five-year fell to 2.3% from 2.5% in January.

Commerce also reported business inventories grew 0.1% in December after falling 0.2% in November, while sales dipped 0.1% after a 0.5% rise a month earlier.

Separately, import prices for January came in flat, after a 0.2% gain in December, while export prices climbed 0.7% after a 0.2% drop in December, the Labor Department said.

Economists polled by IFR Markets expected import prices to fall 0.2% and export prices to hold.

Elsewhere, the Federal Reserve said industrial production was down 0.3% in January, after a downwardly revised 0.4% drop in December, first reported as a 0.3% slide. Production has fallen five of the past seven months. It is 0.8% below the year-ago read.

Capacity utilization fell to 76.8% from an upwardly revised 77.1%, first reported as 77.0%.

“Unseasonably warm weather held down the output of utilities,” the Fed said, while Boeing “significantly slowed production of civilian aircraft.”

Economists were expecting a 0.2% fall in production and a 76.8% capacity use level.

“Despite the prolonged and frustratingly sluggish IP, its declines are far less than those observed during 2015-16,” Berenberg’s Reid said. “The decline in January’s IP was accentuated by a sharp 4% m/m decline in utilities production due to the unseasonably warm weather that reduced heating demand and the 10.7% m/m decline in production of aircrafts and parts due to Boeing’s suspension of the 737 MAX production in January.”

And the Boeing slowdown should “lead to a below-trend 1.5% q/q annualized increase in real GDP in Q1,” she said.