CHICAGO - The Indianapolis Local Public Improvement Bond Bank will enter the market next week with $164 million of refunding bonds in a move that will nearly complete the city's effort to eliminate the bulk of its variable-rate debt.

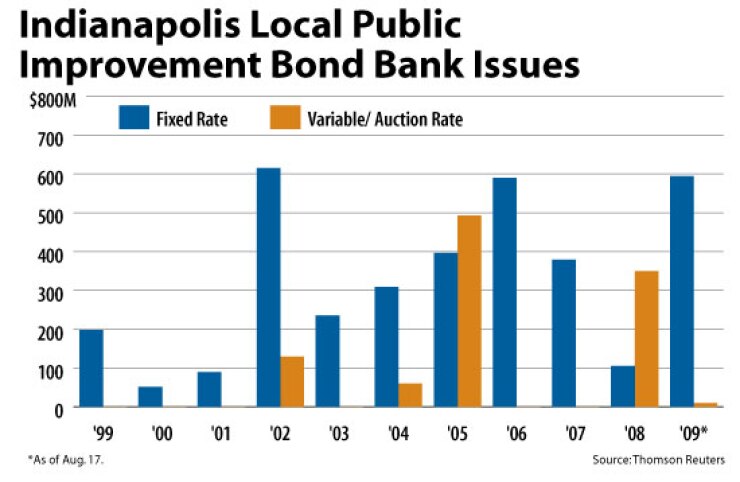

The sale comes several weeks after the bond bank, which is Indianapolis' borrowing arm, refunded $550 million of costly variable-rate water debt into a fixed-rate mode. After next week's sale, the city will have reduced its variable-rate debt exposure by 90%.

"All of our variable-rate debt, due to insurance and liquidity, has not been trading as well, with resets higher than they should have been," said bond bank deputy director and general counsel Deron Kintner. "We were forced to do something, and issuing fixed-rate [debt] was either the best, or sometimes the only, option."

After the sale, the city's roughly $4 billion debt portfolio will include only about $70 million of variable-rate debt, Kintner said, down from about $700 million. "We're going to take a deep breath after getting the water works and now this done," he said.

The bond bank's troubled variable-rate debt has damaged its credit over the last several months. Last week, Indianapolis lost its AAA rating from Fitch Ratings, which knocked the city's unlimited-tax general obligation debt down to AA-plus. Fitch also downgraded the bond bank debt that is supported by the city's moral obligation pledge and downtown tax-increment revenues - including the current offering - to AA-minus from AA. The outlook at the lower rating is stable.

Fitch put all other bond bank bonds that are backed by the city's moral pledge or ad valorem tax pledge on rating watch negative. The downgrade and negative watch reflect concerns over the impact of statewide property tax reform on the city's residential tax base, Fitch said.

Those concerns are echoed by analysts at Moody's Investors Service, which rates the upcoming bonds Aa3, two notches below the city's Aa1 GO rating, both with a stable outlook. Standard & Poor's rates the upcoming bonds AA.

While citing concerns over the city's fiscal pressures, Moody's noted that the move of the bond bank to shift much of its debt into a fixed-rate mode improves the stability of the credit.

The upcoming issue is divided into two tranches, a $144.6 million tax-exempt series and an $18.8 million taxable series. The taxable piece includes proceeds to pay part of the $30 million swap termination payment and $14 million to reimburse the city for a deposit into a debt-service reserve fund earlier this year.

The bond bank will hold a retail order period on Aug. 25, opening the deal up to institutional buyers the following day. JPMorgan is senior manager with M.R. Beal & Co. and Wells Fargo Securities also on the underwriting team. Barnes & Thornburg LLP is bond counsel. Crowe Horwath LLP is financial adviser.

The refunding will allow the city to eliminate MBIA Insurance Corp. insurance on the bonds and a costly standby bond purchase agreement and will fund the termination payment associated with an interest-rate swap on the bonds. "The purpose of this is to reduce our exposure to the variable-rate market," Kintner said. "And liquidity is hard to come by and expensive in today's world. Liquidity tilts the numbers in favor of going fixed."

The bonds were originally issued in 1993 to finance construction of Circle Centre Mall, part of Indianapolis' high-profile, sprawling downtown development area that is a tax increment finance district. The district includes the headquarters of Eli Lilly and Co. and was expanded last year to include a new JW Marriott hotel complex that will serve the convention center.

The bonds are backed by TIF district revenues and are supported by the city's moral obligation pledge.

While revenues from the TIF district are considered strong, credit analysts warn that, like most of the state of Indiana, the city faces possible deep declines in property tax revenues stemming from statewide property tax overhaul. Under the new law, property tax bills are limited to 1.5% of a residential home's assessed value, 2.5% of a rental building's value, and 3.5% of a commercial building's value. Those percentages drop to 1%, 2%, and 3% respectively in 2010.

In its downgrade, Fitch cited an expected shrinking tax base resulting from the so-called circuit breaker. "This is expected to result in real revenue declines and limit the city's financial flexibility," wrote Fitch analyst Melanie Shaker.

Aggravating the potential property tax revenue decline is the state's shift to annual assessments of property values. The shift has resulted in widespread collection delays across the state and in Indianapolis, which, like many local governments, has had to issue tax anticipation warrants to cover cash flow over the last few years.

"For most of the decade, the state of Indiana has been coping with the effects of overhauling the method of assessing real property," said Moody's analyst Edward Damutz in a recent report. "In some cases the delay was mild, but in others the delay was more severe."

On the bright side, Indianapolis is less exposed to the weak U.S. automobile industry than the rest of Indiana, and as part of the property tax overhaul, the state agreed to take over responsibility for the city's pre-1977 police and fire pension costs.

Going forward, the bond bank will consider refinancing some of the smaller issues that make up the bulk of its remaining variable-rate debt, but its next "big-ticket" item will be financing a roughly $1.5 billion plan to update the city's sewer system, Kintner said.

Indianapolis, like many Midwestern cities, has older sewer systems that combine storm and sewage wastewater in the case of overflows. An Environmental Protection Agency decree requires municipalities to update the systems to eliminate the combined sewers, and after years of planning, cities across the nation are beginning to issue debt to finance the projects.

Officials originally estimated they would need to spend $3 billion to update the system but have since brought the estimated cost down to around $1.5 billion. It is uncertain how much of the plan will be financed with bonds, but the bond bank expects to issue some of the debt within the next six months, Kintner said.

In addition to the federal decree, the city will need to spend another nearly $2 billion to improve its waterworks system. A task force will begin considering alternative financing proposals - including public-private partnerships - on Friday, the deadline for input from companies interested in working with the city, according to a report in the Indianapolis Star.