DALLAS - Utah will turn to the bond market to ease its budget crunch, issuing up to $3.3 billion of debt this year for expansion of Interstate 15 under an agreement between Gov. Jon Huntsman Jr. and legislative leaders.

Republican lawmakers have also agreed to finance eight buildings, mostly on college campuses, with $112 million of bonds.

While easing off its pay-as-you-go system for financing most projects, Utah will be careful to protect its triple-A rating, keeping the general obligation debt at 15% of revenues, an arbitrary limit the state has used as a guideline.

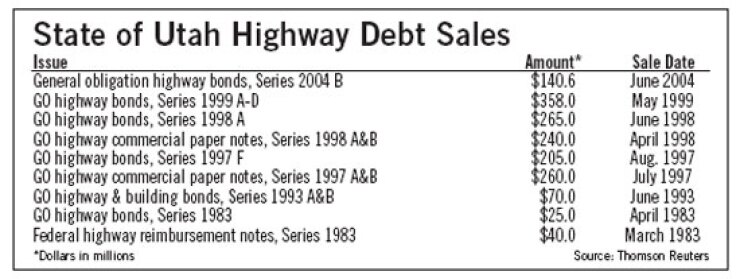

State bond issues are fairly rare in Utah due to the state's conservative financing posture.

Yesterday, Morgan Stanley brought $394 million of Utah GOs to market, drawing yields of 4.17% on bonds maturing in 2024 with coupons of 5%. The true interest cost of the serial bonds was 3.53%, according to state Treasurer Richard Ellis, who said the yields came in about 7 basis points lower than expected.

Proceeds from that issue, the state's first of the year, will go for a several highway projects deemed top priority by the Utah Department of Transportation.

Utah is also benefitting from falling construction costs. One section of I-15 that had been projected at $2.6 billion is now expected to cost about $1.7 billion.

The I-15 project is designed to ease congestion on the major thoroughfare in the Salt Lake City area.

Under Utah's $3.8 billion transportation program, the state is issuing 15-year GO debt for transportation instead of the seven-year maturities of the past.

The pay-go funding drops from $792 million in fiscal year 2008 to $100 million in fiscal 2010.

"Due to the state's strong growth and limited debt issuance, net tax-supported debt of approximately $1.7 billion remains at the low end of the moderate range, by equaling just 2.1% of 2007 personal income," Fitch Ratings analysts observed. "Principal amortization including lease revenue bonds remains rapid, with 86% maturing in 10 years. Pensions are well-funded."

Utah lawmakers, whose current session ends this month, continue to look for ways to cut spending as revenues fall. The current budget of $11.5 billion is $500 million lower than the 2008 spending plan. Using bond debt in the place of pay-go has eased some of the fiscal strain.

Despite employment contractions that are much less severe than the national average, Utah is suffering declines across the board.

"The concert of factors that fueled Utah's economic expansion in the mid-2000s - population growth, low interest rates, a strong national economy, and relatively high levels of defense spending - is gradually fraying," Standard & Poor's analysts wrote in confirming their AAA rating. "While some of these factors remain in place, others, such as the conditions of the national economy, contributed to a perceived plateau in the state's economic growth."