Many in the municipal market saw this week as the right time to dump inventory and dive into what is one of the last large calendars of the year.

Though new issuance

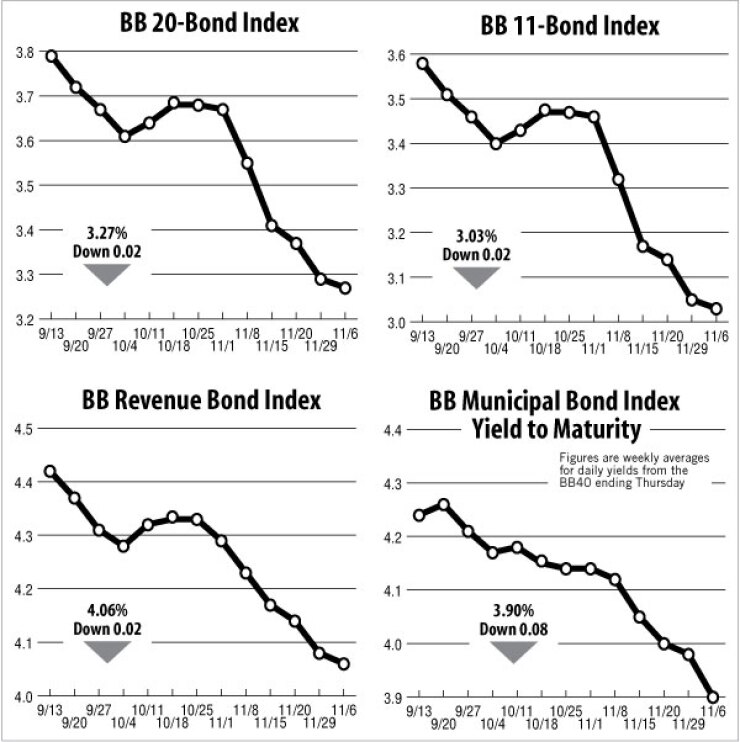

Treasury yields narrowly outperformed their muni brethren. But muni ratios to Treasuries remain rich beyond the front end of the yield curve. Muni indexes mostly fell on the week, reflecting investors’ interest in the calendar, if not exactly the yield curve. The 20-bond GO index of 20-year general obligation yields declined two basis points this week to 3.27%, its lowest level since Aug. 26, 1965, when it was 3.25%. The 11-bond GO index of higher-grade 20-year GO yields also dropped two basis points this week to 3.03%. That is its lowest level since Feb. 10, 1965, when it was 2.99%.

The yield on the Treasury’s 10-year note dropped four basis points this week to 1.58%. That is its lowest level since Nov. 15, when it was also 1.58%.

The yield on the Treasury’s 30-year bond fell two basis points this week to 2.77%, which is also its lowest level since Nov. 15, when it was 2.72%.

New issuance and political uncertainty drove munis this week as investors continued to search for yield in a market that is trading right up against historic levels, said Dan Pecoraro, an analyst at SumRidge Partners, a Jersey City, N.J.-based broker-dealer. The primary market softened somewhat this week, he said, as new deals didn’t see the strong follow-through witnessed in the secondary market during previous weeks.

“Benchmark scales have moved little, as market participants have looked to Washington to avoid the ubiquitous fiscal cliff,” Pecoraro said. “With markets heading into a historically slow holiday season we would expect to see a similar trading environment in the absence of a solution from the nation’s capital.”

There was a trading upsurge in the secondary this past week, according to numbers from the MSRB EMMA system. The numbers showed more customer buying than selling on the week, consistent with the 30-day average. Traders executed an average of 45,492 trades a day from Friday through Wednesday, including 50,889 on Wednesday itself. That compared to 35,636 trades a day executed, on average, over the past 30 trading sessions.

Triple-A tax-exempt yields hardly moved on the week since last Friday, Municipal Market Data numbers showed. The benchmark triple-A inched up one basis point on the week from its record low to 1.48%, a level it’s held for four consecutive trading sessions.

The 30-year also ticked up one basis point on the week from its record low to 2.48%, for four straight sessions. The two-year yield remained unchanged at 0.30% for a 49th consecutive session.

The Bond Buyer’s revenue bond index, which measures 30-year revenue bond yields, fell two basis points as well this week to 4.06%. That’s its fifth consecutive all-time low. The Bond Buyer’s one-year note index, which is based on one-year GO note yields, increased one basis point this week to 0.23%, the same level as two weeks ago. The weekly average yield to maturity of The Bond Buyer muni index, which is based on 40 long-term bond prices, declined eight basis points this week, to an all-time low of 3.90%.

It is the fifth week in a row and ninth time in 11 weeks that the weekly average has reached a record low. The Bond Buyer began calculating the average yield to maturity on Jan. 1, 1985.