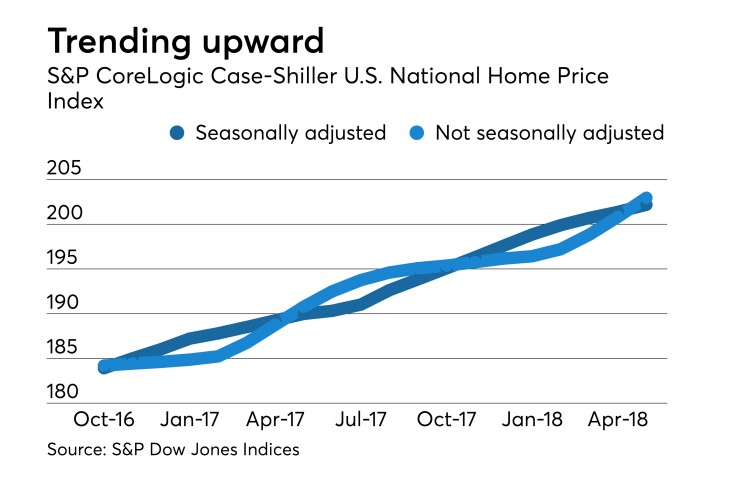

Home prices rose 6.4% on an annual basis in May, not seasonally adjusted, according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index, released Tuesday.

In April, the index rose 6.4% on an annualized basis.

The 10-city composite index grew 6.1% year-over-year, down from 6.4% in the prior month, while the 20-city index grew 6.5% year-over-year, off from 6.7% in April.

Seasonally adjusted month-over-month, the national index rose 0.4% in May, the 20-city composite grew 0.2%, and the 10-city composite increased 0.1%. Before adjustment the national index was up 1.1% in the month, while the 10- and 20-city composites gained 0.5% and 0.7%, respectively.

Economists polled by IFR Markets expected a 0.2% rise month-over-month and 6.4% year-over-year.

“Seattle, Las Vegas, and San Francisco continued to report the highest year-over-year gains among the 20 cities,” according to a release. “In May, Seattle led the way with a 13.6% year-over-year price increase, followed by Las Vegas with a 12.6% increase and San Francisco with a 10.9% increase.”

Seven cities saw larger price increases for the year ending May than in April.

“Continuing price increases appear to be affecting other housing statistics,” David M. Blitzer, managing director & chairman of the index committee at S&P Dow Jones Indices, said in a release. “Sales of existing single family homes — the market covered by the S&P CoreLogic Case-Shiller Indices — peaked last November and have declined for three months in a row. The number of pending home sales is drifting lower as is the number of existing homes for sale. Sales of new homes are also down and housing starts are flattening. Affordability — a measure based on income, mortgage rates and home prices — has gotten consistently worse over the last 18 months. All these indicators suggest that the combination of rising home prices and rising mortgage rates are beginning to affect the housing market.”