The primary municipal market is up and running again after a long holiday weekend, however market participants will pretty much not have any new issuance to work with, as action in the primary won't get started up again until the New Year.

Secondary Market

U.S. Treasuries were weaker on Tuesday. The yield on the two-year Treasury rose to 1.22% from 1.20% on Friday, while the 10-year Treasury yield increased to 2.57% from 2.54%, and the yield on the 30-year Treasury bond gained to 3.14% from 3.11%.

The 10-year benchmark muni general obligation yield was two basis points lower to 2.39% from 2.41% on Thursday, while the yield on the 30-year GO decreased two basis points to 3.11% from 3.13%, according to the final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 94.1% on Friday, compared with 94.5% on Thursday, while the 30-year muni to Treasury ratio stood at 100.0%, versus 100.0%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 23,724 trades on Friday on volume of $7.88 billion.

Prior Week's Actively Traded Issues

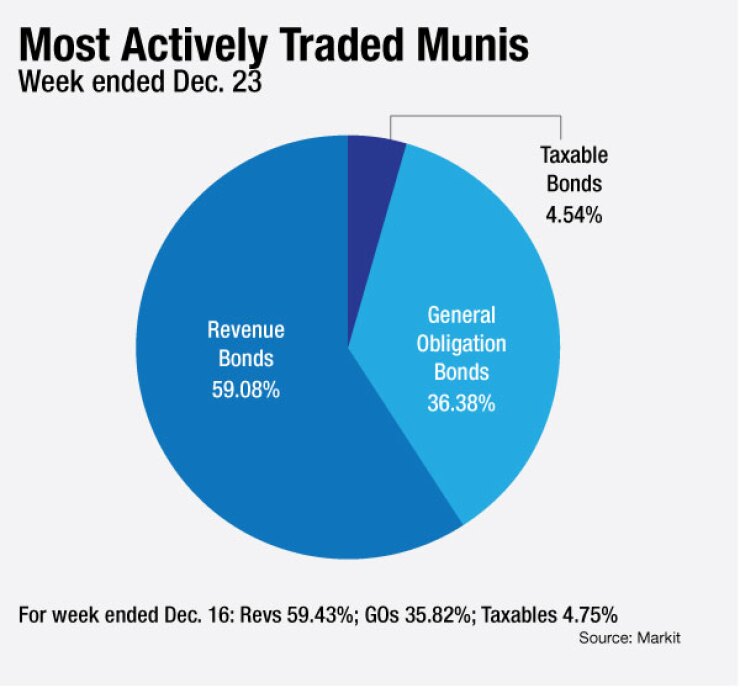

Revenue bonds comprised 59.08% of new issuance in the week ended Dec. 23, down from 59.43% in the previous week, according to Markit. General obligation bonds comprised 36.38% of total issuance, up from 35.82%, while taxable bonds made up 4.54%, down from 4.75%.

Some of the most actively traded issues by type were from Puerto Rico, Florida and California. In the GO bond sector, the Puerto Rico 8s of 2035 were traded 31 times. In the revenue bond sector, the Miami-Dade County, Fla. Aviation 5s of 2041 were traded 21 times. And in the taxable bond sector, the California 7.3s of 2039 were traded 12 times.

Primary Market

There are no deals larger than $100 million scheduled for the rest of the calendar year. Municipal bond issuers have pretty much packed it in for the remainder of the year. Issuance is not expected to reach normal levels again until 2017.

Volume for the week is forecast by Ipreo to drop to about $2 million, comprised of no negotiated deals and only one competitive bond sale of $2 million.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $522 million to $6.91 billion on Tuesday. The total is comprised of $1.30 billion of competitive sales and $5.61 billion of negotiated deals.