Top-shelf municipal bonds finished slightly stronger in the last session before the holidays, as yields on some maturities were as many as two basis points lower, according to traders. With the holidays here, the market closed early at 2 pm on Friday and will not open again until Tuesday.

Secondary Market

The 10-year benchmark muni general obligation yield was two basis points lower to 2.39% from 2.41% on Thursday, while the yield on the 30-year GO decreased two basis points to 3.11% from 3.13%, according to a final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mostly stronger on Friday afternoon. The yield on the two-year Treasury ticked up to 1.20% from 1.19% on Thursday, while the 10-year Treasury yield dipped to 2.54% from 2.55%, and the yield on the 30-year Treasury bond fell to 3.11% from 3.13%.

The 10-year muni to Treasury ratio was calculated at 94.1% on Friday, compared with 94.5% on Thursday, while the 30-year muni to Treasury ratio stood at 100.0%, versus 100.0%, according to MMD.

Primary Market

There are no deals larger than $100 million scheduled for the rest of the calendar year. Municipal bond issuers have pretty much packed it in for the remainder of the year. Issuance is not expected to reach normal levels again until 2017.

Volume for the week ending Dec. 30 is forecast by Ipreo to drop to $2 million, from a revised total of $790.1 million in the previous week, according data from Thomson Reuters. The calendar is comprised of $0 of negotiated deals and $2 million of competitive sales.

"It is traditionally one of those weeks where maybe 50 percent of the population of the market is not at work and firms are short staffed, with not everyone at their posts," said Jim Colby, senior municipal strategist at VanEck Global. "That means two things: one is that anyone who is going to sell bonds will have a hard time getting buyers and not executed the way they hoped. The other thing is, on the flip side, is on the dealer side positions are set at certain levels and there is the upcoming perceived January effect, which I think this year is more real and apparent than other year in recent memory."

With the issuance as low as it is, the demand is severely outweighing the supply and this is the time of year where you have maturities due, bonds being called and payments coming in.

"I would say with the low supply, the price activity could go higher and yields could potentially lower more if we make it through the week without any broader markets turmoil," he said.

Colby also noted that the value is still fairly clearly in the camp of munis – despite all the questions surrounded by and numbers being thrown out about Trump and his administration plans, particularly with tax reform and infrastructure plans.

"I know the Republicans have a grip on the power but the question is will the leaders in the house and senate follow Trump's lead on his main proposals? It might take 60-90 days into his administration before we really know and without clarity, we can't expect the markets to move with any more volatility," Colby said. "Munis aren't 100% ratios of munis/Treasuries but we are in the 90s up and down the curve and that is an attractive metric to base your strategies on."

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended Dec. 23 were from Puerto Rico, Florida and Calif, according to

In the GO bond sector, the Puerto Rico 8s of 2035 were traded 31 times. In the revenue bond sector, the Miami-Dade County, Fla. Aviation 5s of 2041 were traded 21 times. And in the taxable bond sector, the California 7.3s of 2039 were traded 12 times.

Week's Most Actively Quoted Issues

Puerto Rico, New Jersey and Florida names were among the most actively quoted bonds in the week ended Dec. 23, according to Markit.

On the bid side, Puerto Rico GO 5s of 2041 were quoted by 70 unique dealers. On the ask side, the New Jersey Transportation Trust Fund taxable 6.104s of 2028 were quoted by 62 unique dealers. And among two-sided quotes, the Florida Hurricane Catastrophe fund financial corporation taxable 2.995s of 2020 were quoted by 22 unique dealers.

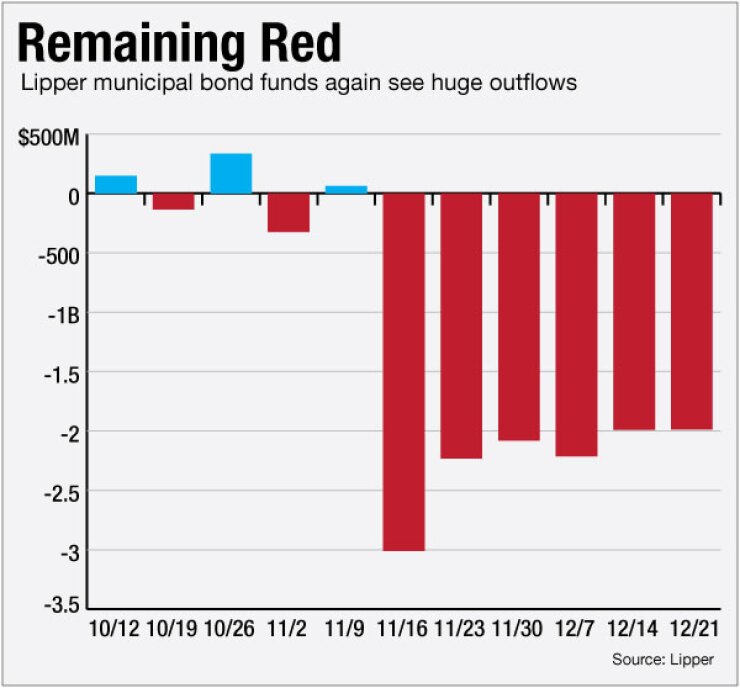

Lipper: Muni Bond Funds Report Outflows

Municipal bond funds experienced outflows as investors continued to pull cash out of the market, according to Lipper data released late Thursday.

The weekly reporters saw $1.989 billion of outflows in the week ended Dec. 21, after outflows of $1.990 billion in the previous week.

The four-week moving average remained in the red at negative $2.068 billion after being negative $2.129 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows, losing $1.020 billion in the latest week after shedding $771.676 million in the previous week. Intermediate-term funds had outflows of $841.292 million on top of outflows of $798.693 million in the prior week.

National funds had outflows of $1.580 billion after outflows of $1.414 billion in the previous week. High-yield muni funds reported outflows of $346.048 million in the latest reporting week, after outflows of $147.676 million the previous week.

Exchange traded funds saw inflows of $547.797 million, after inflows of $154.871 million in the previous week.