LOS ANGELES — Hawaii will sell bonds competitively for the first time in more than a quarter century.

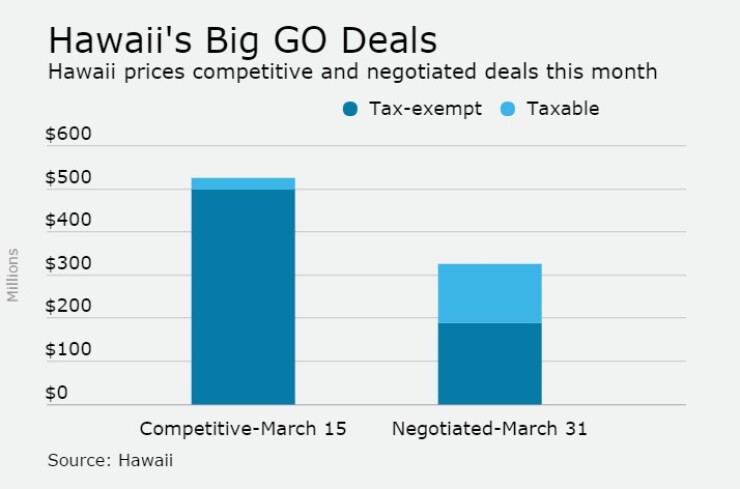

Tuesday's $525 million competitive new money pricing is the first of two general obligation sales the Aloha State plans this month.

Splitting its annual spring GO bond sale in two, Hawaii follows March 31 with a $325.5 million negotiated refunding.

The $851 million of bonds come with Hawaii buoyed by a strong economy and a better rating outlook from Standard & Poor's, which revised its outlook to positive from stable and affirmed its AA rating ahead of the sale.

Strong revenues have enabled Hawaii to build impressive general fund balances that "could lead us to raise the state's credit rating within the next two years," S&P analysts wrote.

"It's really just the continued better-than-anticipated fiscal performance putting them on a trajectory to have a very strong budget position by the end of the fiscal year," said Gabriel Petek, an S&P credit analyst.

Fitch Ratings affirmed its AA rating and stable outlook ahead of the sale.

Moody's Investors Service revised its outlook to positive in September and affirmed its Aa2 rating.

Hawaii Gov. David Ige and predecessor Neil Abercrombie made it a priority to shore up the state's finances, Petek said.

"Abercrombie shored up the state's finances and put them on a good course – and the current governor is following through on that approach," Petek said.

Ige has

Decreasing the OPEB liability would save the state half a billion dollars over the next 20 years, said Wes Machida, Hawaii's finance director.

"We have made a commitment to deal with pension and OPEB obligations, because we know putting it off would put a greater strain on future generations," Machida said. "We don't want to burden future taxpayers with the obligations of the past."

A growing economy and unemployment of 3.7%, one of the lowest in the nation, have helped the state meet its goals, Machida said.

Over the past 10 or 15 years, Machida said, the percentage of the economy driven by tourism has dropped to 17% from 33%. The shift to a more diverse economy has come from growth in the military, healthcare and education sectors, he said.

Ige traveled to New York with the finance team when they met with rating agencies about the ratings ahead of the sale. He also spoke about improvements in the state's economy on the net road show.

"I think it was a credit to the governor that he was in attendance – and that he was very engaged and knowledgeable," said Joseph T. Yew Jr., a managing director with FirstSouthwest, a division of Hilltop Securities, the financial advisor on the competitive sale.

The state has above-average liabilities between debt and pension obligations, but because of the pension reforms, Petek said that S&P does not see the state getting into a position where the liabilities spiral out of control and damage the state's credit quality.

Hawaii has a debt burden of $6.48 billion of tax-supported GO, certificate of participation and gas tax debt, which translates to $4,520 per capita, according to S&P's report. But Hawaii's debt level is high relative to other states because the state performs numerous functions that are funded at the local level in other states, such as paying all K-12 education costs and for hospitals, Petek said.

The state also has a very conservative debt profile, Yew said. The state has no variable-rate debt and debt service is restricted to no more than 18.5% of the average of general revenues from the prior three years, he said.

Even if the economy starts to slow, Petek said, in most reasonable scenarios it could get through without much impairment to its credit quality.

The March 15 competitive pricing will bring $500 million in tax-exempt bonds and $25 million in taxable GOs.

Bond proceeds will fund improvements to K-12 schools, public hospitals, housing developments and universities, Machida said.

Orrick, Herrington & Sutcliffe is bond counsel on both pricings.

"The Hawaii Department of Finance hasn't done a competitive sale since the 1980s," Machida said.

Machida said state officials speaking to colleagues at conferences were hearing that other states have achieved good outcomes doing competitive sales.

The state made the decision to run the competitive and negotiated sales close to each other, as a test case, to compare the two methods, said Steve Rodgers, chief investment officer and lead portfolio manager of three municipal bond funds that invest heavily in Hawaii municipal bonds.

"The deal is split by a couple of weeks, so it is not a perfect comparison, but close," Rodgers said.

The March 31 negotiated $325.5 million refunding will be split into a $6 million tax-exempt FD Series, a $182.3 million FE tax-exempt series and the $137.1 million FF taxable series.

Bank of America Merrill Lynch is the lead co-senior manager and Goldman Sachs is the co-senior manager. Katten Muchin Rosenman is underwriter's counsel and Public Financial Management Inc. is pricing advisor.

"We decided to stick with negotiated on the refundings, because we know what the outcome would be in respect to present value savings," Machida said. "In the future, we may do competitive refundings as well."

Hawaii expects to achieve between $25 million and $30 million in net present value savings on the refundings with interest rates around 3%.

The state has brought similar-sized GO deals in the spring for the past several years.

Rodgers and his colleagues, Janet Katakura and Yvonne Lim Warren, senior portfolio managers in the asset management group at the Bank of Hawaii, expect a healthy market reception for the Hawaii bonds.

The state is a clean double-A credit, so it shouldn't have a problem achieving good pricing on the bonds, Warren said.

"Even though the municipal market has recently had a lot of issuance with the $2.9 billion California deal, with the state's good, clean credit, the state should do okay," Katakura said.

Even with the ramped-up supply of the past few weeks, cash inflows into municipal bonds have been on the positive side, Warren said.

Though it's a sizeable deal, Warren said she doesn't see absorption being a problem.

The volatility in the equity markets is also making munis and treasuries more attractive when compared to other asset classes, she said.

"There is a flight to quality in munis and Treasuries with what we are seeing in the equity markets," Warren said. "You have people looking for income and avoiding the volatility seen in the equity market. It bodes well for bonds in general."

A less volatile market is generally better for a competitive sale, Rodgers said.

"It is not a bad environment for a competitive sale," he said. "Rates have gone up a bit recently, but muni markets are stable. The only issue is that there is a lot of supply coming out right now."