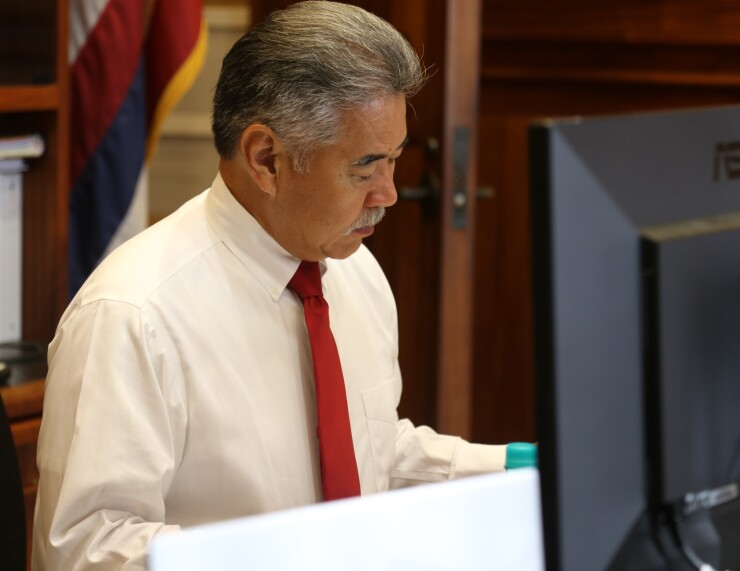

Hawaii Gov. David Ige unveiled a $30.9 billion belt-tightening biennium budget Monday for fiscal 2022-23 that includes cuts to operations and capital improvements.

The tourism-dependent state has been particularly hard hit by the reduction in travel amid the COVID-19 pandemic.

“This budget represents sudden, sharp reductions to revenues because of the pandemic’s impact on the state’s economy and the tax revenue that funds government services and programs,” Ige said.

Ige had already

His two-year budget proposal would eliminate 550 vacant state government positions and cut the jobs of 149 active employees, who could be laid off. Ige said the state will try to shift as many of those workers as it can into vacant positions.

Ige also said tax increases are a possibility that could be discussed when the Legislature reconvenes.

The state issued $750 million in five-year deficit bonds in October, as part of a $1.1 billion bond deal.

Ige urged the state’s residents during a Monday night press conference to wear masks, wash hands and socially distance.

“Our economy will recover, and the state’s budget will normalize if we contain COVID-19, preserving the health of both residents and visitors,” he said. “I’m hopeful that federal aid will allow us to refrain from imposing furloughs until later.”

The governor added that he might seek emergency appropriations to support COVID-19 efforts to cover the estimated $387 million cost of vaccinations, hospital surge staffing and to support the state’s Safe Travels program.

The budget represents a 1.8% decrease or $276.4 million in cuts to $15.4 billion in fiscal year 2022 and a 1.1% decrease or $171.8 million in cuts to the $15.5 billion fiscal year 2023 budget.

Hawaii runs on a two-year budget, making changes through a supplemental budget passed the second year.

The general fund budget is $7.7 billion for fiscal year 2022 and $7.98 billion in fiscal year 2023.

The capital improvements program budget includes $1.24 billion in fiscal year 2022 and $1.1 billion in fiscal year 2023. Those amounts include general obligation requests of $679.4 million for the first year and $512.1 million for the second year, which is nearly $800 million in GO bonds less than the previous biennium.

The operating budget adds debt service payments of $398.6 million over the two fiscal years for the Department of Education, University of Hawaii and other state CIP projects. It also decreases health premium payments by $603.3 million over the two fiscal years, primarily due to the suspension of healthcare retiree benefits prefunding. It also decreases retirement benefits funding by $19.2 million over the two fiscal years.

Hawaii lawmakers had

State general treasury collections

“Given the magnitude of the revenue shortfall, state government must re-engineer the way we provide services,” Ige said. “The extent of the expected revenue loss means that permanent and ongoing changes must be made to state government. Understandably, these changes will be difficult.”