PHOENIX - A survey of more than 200 government finance officers revealed that three-quarters of them lack confidence in their long-term fiscal projections.

The survey, conducted by PFM Solutions LLC during the Government Finance Officers Association conference in Denver last month, revealed that 74% of the local government financial executives polled lacked confidence in their long-term financial decision-making. The survey further found that 58% of respondents viewed the reliability of their long-term financial projections as “limited or problematic” and 36% of those surveyed characterized their current process for long-term financial planning as “problematic or burdensome.”

“Even though the national economy has been growing, local governments are still facing long-term budget pressures,” said Brett Matteo president of PFM Solutions. “Tax growth has been weak, the prospect of cuts in state and federal aid is increasing and challenges related to infrastructure, healthcare costs and pensions continue to mount. It’s critical that local governments have confidence in their modeling so they can make the best decisions for their municipalities, and yet most don’t.”

Matteo said that PFM, which offers a multi-year financial modeling platform called Whitebirch, wanted to do “a little science around the edges” in an effort to confirm existing suspicions about some of the challenges public financial executives face. Matteo said that while local government finance leaders are generally excellent at budgetary work, projections based on variables such as market performance of pension investments are a different story.

“That’s a heavier lift for them,” Matteo said.

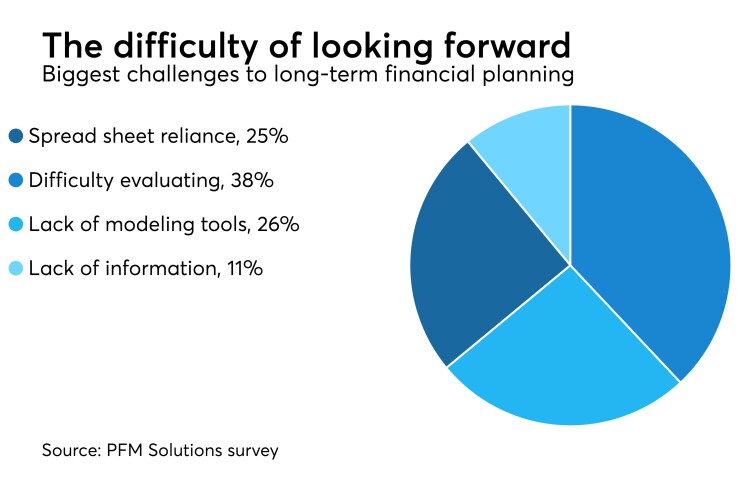

When asked to identify what poses the greatest challenge to their organization’s long-term financial planning, respondents identified: difficulty in evaluating different future financial scenarios (38%); lack of advanced modeling tools (26%); over reliance on Excel spreadsheets (25%); and lack of complete financial information (11%).

When asked to select from a group of issues in their budgets which are most contributing to their challenges, survey participants chose healthcare costs, pensions, and infrastructure needs as the top three. All three of those issues are growing sources of worry in the muni finance world. Healthcare costs and the fate of states which expanded medicaid under Obamacare are uncertain in the face of Republican efforts to undo that legislation, pension liabilities are a growing concern for investors and finance officers alike, and the once bipartisan agreement on infrastructure spending at both state and federal levels has largely devolved into partisan sniping over tax increases.

“Fiscal health is the cornerstone of municipal health,” said Matteo. “Financial executives must be able to map competing priorities across a range of what-if scenarios, and – especially now – have the capability to stress test potential outcomes against potential setbacks and downturns. Ultimately, the long-term sustainability of their organizations depends on this type of fiscal planning.”

The survey did not approach the participants based on bond issuance, so they were not broken down by frequency or volume of issuance.