BRADENTON, Fla. — Gilt-edged Georgia plans to competitively price up to $842 million in general obligation bonds June 26 in a multi-faceted deal that could have broad investment appeal.

Most of the transaction is new money, and will be sold as $427.4 million of tax exempt GO bonds, $163.2 million of taxable GOs, and $94.35 million of taxable qualified school construction bonds, or QSCBs.

Bond proceeds will be used for various state and public education projects.

A $157 million, tax exempt advance-refunding piece is planned for sale if it can meet the state's minimum savings threshold of 4%.

A final decision whether to price the refunding bonds will be determined closer to sale time, according to Lee McElhannon, director of bond finance with the Georgia State Financing and Investment Commission.

Though the subsidy for tax credit bonds like QSCBs has been cut by 8.7% due to federal sequestration, McElhannon said it makes sense for the state to use its capacity because the subsidy pays nearly 100% of interest costs.

The maturities of all bonds will be 20 years or less.

Triple-A ratings have been assigned to the bonds by Fitch Ratings, Moody's Investors Service and Standard & Poor's. Georgia's GOs have been rated triple-A across the board for nearly 16 years with analysts citing the Peach State's strong and conservative management.

There should be good demand for the bonds, though spreads have widened the past week over the Municipal Market Data's triple-A scale for some highly rated credits, a trader said.

"There will be demand for Georgia GOs, but they may have to be priced at wider spreads than usual," the trader said.

Looking at some recent market data, the trader said gilt-edged Maryland GOs have been trading 5 basis points over MMD, while they usually trade plus-0, right on top of the scale.

Double-A rated Connecticut GOs have been selling 35 and 40 basis points over MMD, while they typically trade 25 and 30 basis points on top of the scale.

"In the past, depending on market conditions, Georgia GO's would have traded anywhere from plus-0 on top of the scale to plus-5," the trader said Tuesday. "Now I think they would trade plus-7 to plus-10, depending on the amount, and how the market is feeling at the time."

McElhannon agreed that the state may see slightly higher spreads since pricing will be a function of market conditions in addition to the issuer's name and ratings.

With three triple-A ratings “we would expect to price as close as anybody could price to MMD in current market conditions,” he said. “And by selling competitively we’ve got the best pricing possible.”

Interest rates still remain at historic lows even with the recent widening of some spreads, McElhannon said, adding that Georgia's sale will close after July 1, and could benefit from the July re-investment cycle.

"July is a huge interest payment month with a lot of maturities and a lot of advance-refunding bonds being called, and maybe some current refundings, so if that money stays in the municipal market it will be looking for some place to go," he said. "We hope we will pick up some of that, and it should help on pricing to the extent [investors] want triple-triple A paper."

Not much Georgia paper available since most of it is held for the long term, and that could be another pricing advantage, McElhannon said.

Georgia is beginning to see revenues recover from the economic downturn.

Gov. Nathan Deal reported that tax collections in May were up 8.6% year-over-year.

Year-to-date, net revenue collections totaled $15.4 billion for an increase of $915 million, or 6.3%, compared to the same period last year.

The state's credit profile is strong, and supported by sound management, a healthy financial condition, and a moderate debt profile, according to a credit review by Morningstar Municipal Research Analyst Candice Lee in February.

"Overall, we expect the strong credit quality of Georgia to remain stable," Lee said. "Management and operating environment is the key driver behind this forecast, as we favor the strong legal frameworks governing balanced budgeting and conservative debt management.

"The state has also demonstrated the willingness to cut expenditures in an environment of strained revenues, which assures us of continued fiscal soundness," Lee wrote.

Lee said a potential area of stress will be the state's sluggish economic recovery. High commodity prices have weighed down on economic expansion and hiring, and housing activity has yet to rebound significantly.

"However, we believe that the state will continue to make good on its outstanding debt obligations due to strong stringent legal covenants to pay debt service and history of positive strong financial results," she said.

The state had $8.58 billion of outstanding GO bonds at the end of fiscal 2012, and total net direct outstanding debt of $9.3 billion, excluding $1.2 billion in self-supporting grant anticipation revenue vehicle bonds.

"Georgia has a manageable debt profile, as net direct debt per capita is below $1,000, and principal amortization is rapid with almost 70% paid off in the next 10 years," Lee said. "Current debt service is a low 3.4% of general fund spending."

Georgia's constitution limits the amount of debt service the state can pay for GO and guaranteed revenue bonds to 10% of revenue collections. The state uses prior-year collections to calculate the ratio.

As part of the state's debt management plan, McElhannon said the fiscal policy is to limit the debt-to-revenue ratio to 7% as part of its strategy to retain the state's across-the-board triple-A ratings.

Georgia contributes to the Employees' Retirement System of Georgia, the Georgia State Employees' Pension and Savings Plan, and the Teachers Retirement System of Georgia.

The employees' pension system is a cost-sharing, multiple-employer plan for workers hired prior to 2009. Those hired after 2009 are members of the State Employees' Pension and Savings Plan, which blends a traditional defined-benefit plan with a defined-contribution 401(k) plan.

Both the employees and teacher's defined benefit plans are well-funded, with funding ratios of 76% and 84%, respectively, as of the June 30, 2011 valuation date, according to Morningstar. The state contributed $414.3 million in fiscal 2012, or 1.2% of total general fund spending.

The state contributes to four other post-employment benefit plans for state employees, school employees, judicial and legislative employees, and the Board of Regents.

"Georgia contributes to all four plans on a pay-as-you-go basis, and has consistently met the full annually required amount for the state and school OPEB funds," Lee said.

King & Spalding LLP is bond counsel for next week's GO sale. Kutak Rock LLP is disclosure counsel.

Public Resources Advisory Group is the state's financial advisor.

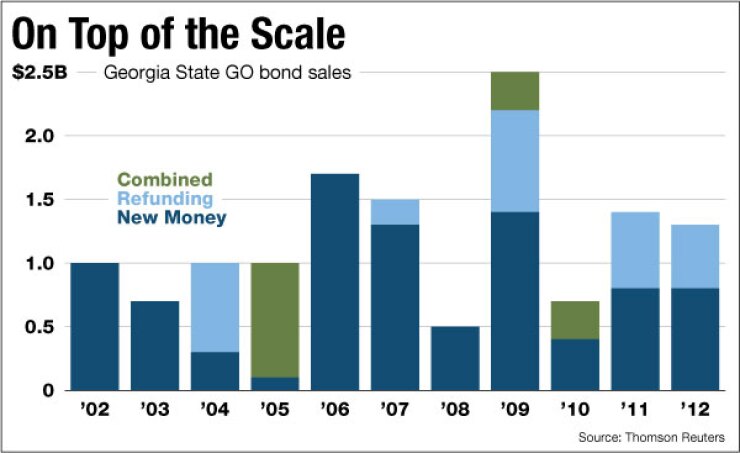

The state was last in the bond market Dec. 12 selling $584.6 million of GO bonds in three series. JPMorgan was the winning bidder on two series, and Bank of America Merrill Lynch the other.