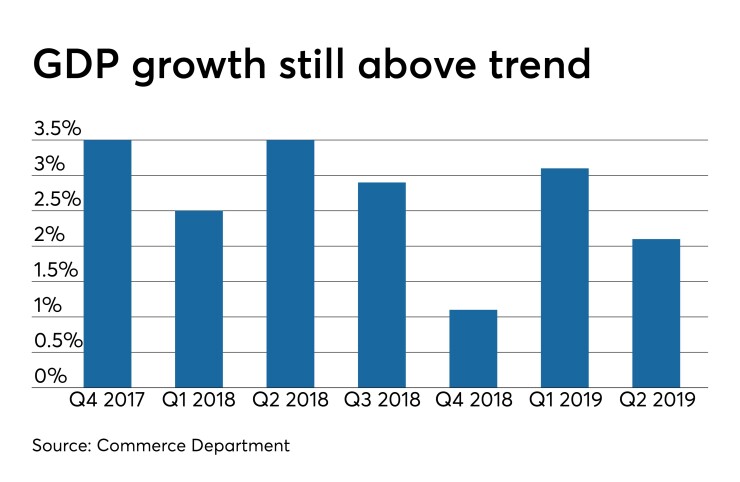

Gross domestic product rose 2.1% in the second quarter, as consumers continued to prop up the economy, according to the advance estimate by the Commerce Department, released Friday.

“Growth of 2.1% is better than expected, but highly reliant on a surge in household consumption,” said Charles Seville, co-head of Americas Sovereigns at Fitch Ratings. “Investment was weak, as was net trade, which could add to the case for rate cuts at next week’s Fed meeting.”

Economists polled by IFR Markets expected 1.8% growth in the quarter.

For the first quarter, GDP growth remained at 3.1%. The fourth quarter 2018 growth was revised down to 1.1% from 2.2%, bringing 2018 GDP down to 2.5% growth from the previously estimated 3.0%.

Personal consumption expenditures soared 4.3% in the quarter after 1.1% growth in the first three months of the year. Business investment dropped 0.6%.

“The underlying details suggest that U.S. domestic demand picked up decidedly after slowing sharply in Q1 2019 and Q4 2018,” Berenberg Capital Markets U.S. Economist Roiana Reid wrote in a note.

Real final sales to domestic purchasers grew 3.5% quarter-over-quarter on an annualized basis, after a 1.8% gain in Q1 and 1.3% in Q4. “Real final sales to private domestic purchasers increased by 3.2% q/q annualized, doubling its 1.6% increase in Q1,” she wrote.

Berenberg expects “continued healthy increases in consumption and government purchases, and for business fixed investment to rise again as one-off factors fade,” she wrote. “We expect exports to decline further and slower inventory building to continue to subtract from growth as businesses draw down inventories to more desirable levels. We forecast real GDP growth around 2% in H2.”

The Federal Reserve Bank of New York’s Nowcast GDP projection, released Friday showed its estimate for third quarter GDP rising to 2.21% from 1.88% the prior week, while its second quarter projection was raised to 1.5% from 1.41% in last week’s estimate.

No intervention

The White House will not intervene in currency markets to weaken the dollar, the president’s economic adviser Larry Kudlow said in a CNBC interview Friday. “We had a meeting with the president and the economic principals, and we have ruled out any currency intervention,” he said. “The steady, reliable, dependable dollar is attracting money from all over the world.”

Services sluggish

The Federal Reserve Bank of Kansas City’s services survey suggested activity was “sluggish” in the region and expectations declined from recent months.

“Regional services activity has been fairly flat the past two months,” said Chad Wilkerson, vice president and economist at the bank. “Some contacts have indicated increased uncertainty about the economy, due to weak domestic demand and trade concerns. Still, 80% of firms reported confidence in their local economy.”