Municipal bond buyers scrambled on Thursday to snatch up the last of this week’s new issues ahead of next week’s chunky slate.

"It's been a little slow the past few weeks, but next week we should get the biggest deal of the year so far," one New York trader said about the scheduled $2.3 billion issue from California. "It’s been a food fight for bonds, so to say the increased supply will be welcomed, is an understatement."

Primary market

Baltimore County, Md., (Aaa/AAA/AAA) came to market with two general obligation bond deals totaling more than $490 million on Thursday.

BofA Securities won the county’s $246 million of consolidated public improvement bonds with a true interest cost of 2.9779%.

JPMorgan Securities won the $245 million of the Metropolitan District’s 81st issue of GOs with a TIC of 3.4758%.

Proceeds will be used to refund bond anticipation notes.

The financial advisor is Public Resources Advisory Group. The bond counsel is McKennon Shelton.

In the negotiated market, BofA Securities received the official award on the Oregon Business Development Commission’s (A1/A+/NR) $138.165 million of AMT Series 250 economic development revenue bonds for Intel Corp.

The Chandler Industrial Development Authority, Ariz.’s $500 million of Series 2019 industrial development revenue bonds for Intel was postponed and placed on the day-to-day calendar.

Ramirez & Co. received the written award on the Los Angeles Department of Airports (Aa3/AA-/AA-) $438 million of revenue bonds. The issue consists of Series 2019A private activity subordinate revenue bonds subject to the AMT, Series 2019B non-AMT governmental subordinate revenue bonds and Series 2019C private activity subordinate refunding non-AMT revenue bonds.

Bond sales

Maryland

Oregon

California

Bond Buyer 30-day visible supply at $4.74B

The supply calendar decreased $1.92 billion to $4.74 billion for Thursday. The total is composed of $2.84 billion of competitive sales and $1.90 billion of negotiated deals.

Secondary market

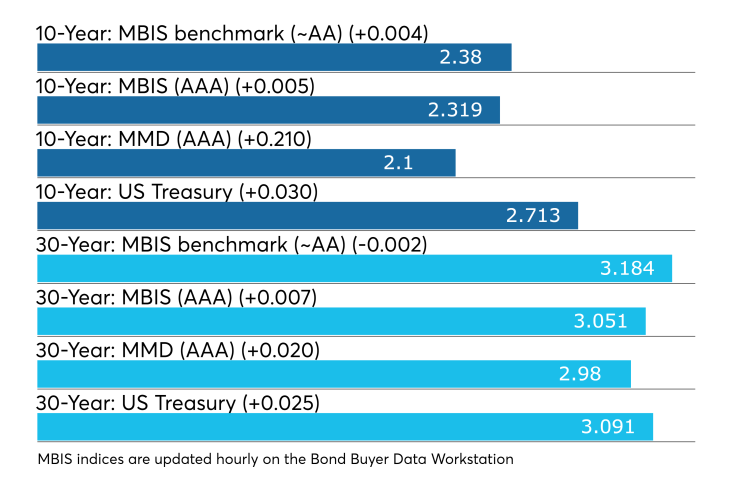

Municipal bonds were mixed Thursday, according to the MBIS benchmark scale, with muni yields falling as much as one basis point in the two- to four-year, six-year, 28-year and 30-year maturities, rising as much as two basis in the five-year, seven- to 26-year and 29-year maturities and remaining unchanged in the one-year, 12-year and 27-year maturities.

High-grade munis were mostly weaker, with yields falling less than one basis point in the three and four-year maturities, rising as much as two basis points in the one- and two-year, five-year and seven- to 30-year maturities and remaining unchanged in the six-year maturity.

Investment-grade municipals were weaker on Refinitiv Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year and 30-year muni rising two basis points.

“The ICE muni yield curve was two basis points higher in the long end from 20-years and out,” ICE Data Services said in a Thursday market comment. “The shorter end was more muted. The high-yield sector was up one basis point in yield today along with the tobacco sector. Taxable yields were up as much as 2.8 basis points in the five-year.”

Treasury bonds were weaker as stock prices traded little changed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 77.3% while the 30-year muni-to-Treasury ratio stood at 96.7%, according to MMD.

Puerto Rico trades

Puerto Rico bonds were higher on Thursday, according to ICE, with the 8% GO bonds of 2035 up 1/8 of a point, along with the Public Buildings Authority revenue bonds (post-2012).

“The PREPA revenue bonds were up 1/8 along with the 1998 Resolution Highway & Transportation revenue bonds,” ICE said. “The PRASA water revenue bonds were down 1/8 today.”

Some of the restructured Puerto Rico Sales Tax Financing Corp. (COFINA) bonds were among some of the most actively traded bonds, according to the MSRB’s EMMA website.

The COFINA restructured Series A1 5% bonds of 7/58 (principal amount of issuance of $3.479 billion), were trading Thursday at a high price of 97.531 cents on the dollar and a low price of 93.05 cents, according to EMMA. This compares with a high price of 97.176 cents and a low price of 93.20 cents on Wednesday. Trading volume totaled $38.128 million in 108 trades compared to $26.242 million in 212 trades on Tuesday.

The COFINA restructured Series Capital Appreciation zeroes of 7/46 (principal amount of issuance of $1.095 billion), were trading at a high of 19.723 cents and a low price of 16.92 cents, compared to 20.19 and 17.454 cents on Wednesday. Trading volume totaled $52.858 million in 190 trades, compared with $37.293 million in 222 trades on Tuesday.

The COFINA restructured Series Capital Appreciation zeros of 7/1/51 (principal amount of issuance of $631.551 million), were trading at a high 15.079 cents and a low price of 9.042, compared to 14.625 and 12.239 on Tuesday. Volume totaled $23.312 million in 183 trades versus $56.707 million in 217 trades on Wednesday.

Previous session's activity

The MSRB reported 42,683 trades on Tuesday on $10.83 billion of volume.

California, New York and Texas were most traded, with the Golden State taking 12.406% of the market, the Empire State taking 11.362% and the Lone Star State taking 10.144%.

Muni money market funds see inflows

Tax-free municipal money market fund assets increased by $640.3 million, rising their total net assets to $138.20 billion in the week ended Feb. 25, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds rose to 1.30% from 1.21% last week.

Taxable money-fund assets gained $21.29 billion in the week ended Feb. 26, bringing total net assets to $2.898 trillion.

The average, seven-day simple yield for the 804 taxable reporting funds was unchanged from 2.05% last week.

Overall, the combined total net assets of the 994 reporting money funds increased $21.93 billion to $3.036 trillion in the week ended Feb. 26. It marks the eighth consecutive week total money-fund assets have exceeded $3 trillion.

Treasury auctions bills

The Treasury Department Thursday auctioned $60 billion of four-week bills at a 2.410% high yield, a price of 99.812556.

The coupon equivalent was 2.455%. The bid-to-cover ratio was 2.78. Tenders at the high rate were allotted 1.04%. The median rate was 2.380%. The low rate was 2.350%.

Treasury also auctioned $35 billion of eight-week bills at a 2.410% high yield, a price of 99.625111. The coupon equivalent was 2.459%. The bid-to-cover ratio was 3.02. Tenders at the high rate were allotted 78.12%. The median rate was 2.395%. The low rate was 2.350%.

Additionally, Treasury sold $23 billion 41-day cash management bills, dated March 1, due April 11, at a 2.400% high tender rate. The bid to cover ratio was 3.34.

The coupon equivalent was 2.447%. The price was 99.726667. The low bid was 2.340%. The median bid was 2.380%. Tenders at the high were allotted 32.73%.

Treasury to sell bills

The Treasury Department said Thursday it will auction $48 billion 91-day bills and $39 billion 182-day discount bills Monday.

The 91s settle March 7, and are due June 6, and the 182s settle March 7, and are due Sept. 5. Currently, there are $36.002 billion 91-days outstanding and no 182s.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.