Want unlimited access to top ideas and insights?

The municipal market rallied Thursday, with yields declining at least 10 basis points across the curve against a backdrop of the Federal Reserve’s announcement that it would purchase up to $500 billion of short-term municipal notes.

While the announcement signaled the Fed would prop up short-term munis, long-term bonds are not going to be a part of the programs, at least for now.

Many participants said the shift to a more constructive tone was based more on the fundamentals of the municipal market itself than the news that the Fed would selectively purchase up to 24-month securities from states — whose officials would then select which cities would have access to the programs.

“It doesn’t do everything, but the Municipal Liquidity Facility puts cash where it’s immediately needed. Not only do states and big cities have the largest exposure to the income tax delay, they also could choose, very directly, to push their pain into local governments service recipients, taxpayers, and pensioners. The Fed maybe hasn’t fixed the problem but their money will at least be part of the solution,” said Municipal Market Analytics Partner Matt Fabian.

“And steering money to and through the states not only lets the program roll out quickly, it probably allows the Fed to increase the MLFs total leverage. Which means more loans available for governments in the aggregate, and a bigger effect even in the private lending market.”

Others said the move was a smoke signal to calm individual investors in munis — “mom and pop” retail investors — that the municipal market has the Fed’s backing if it needs it to get through short-term pain that the coronavirus is causing.

Market sources said the Fed's decision on only buying selective short-term municipal bonds is the right, cautious move for the market. While some participants wanted the Fed to buy longer-term, more diverse, lower-rated munis, most observers noted that having the Fed as a creditor long-term for the muni market would be a net negative.

"You don't want the Fed as a creditor for Illinois or Jersey or Pennsylvania five, 10 years from now," a New York strategist said. "The Fed is simply following fiscal federalism and telling investors to remain calm. The definition of fiscal federalism is the municipal market. And with the Fed heading into it in only on the short end of the curve, and only until September of this year, is a smart move for the long-term stability of this market. And would you really want the Fed to be lending to a bunch of opaque local governments in the midst of a health crisis like this?"

Sources said it also sends a signal the Fed believes that munis can get through this crisis, but it also introduces a very tedious and complicated process for it to purchase bonds from this market.

The program will directly aid only the largest issuers, at least for now, relying on those issuers to provide support to smaller localities.

The Fed will buy notes directly from states, counties with a population of at least two million residents, and cities with a population of at least one million residents. Only one issuer per state, city or county is eligible, the Fed said. State-level issuers can use the proceeds to support additional counties and cities.

Each issuer that participates in the facility must pay an origination fee equal to 10 basis points of the principal amount of the notes purchased by the special purchase vehicle, the Fed said. The origination fee may be paid from the proceeds of the issuance.

An issuer can use the proceeds from selling notes to help manage cash flow impacted by delays income tax revenue and reductions in tax and other revenues and expenses related to the pandemic. The issuer can also use the proceeds for the payment of principal and interest on obligations relevant to their municipality and use the proceeds of the notes to buy similar notes issued by “political subdivisions and instrumentalities of the relevant state, city or county.

From a market perspective, though, the Fed has already been purchasing variable rate demand obligations since late March, which also had stabilized the short end of the market. Yields on the one-year muni reached above 3% for a few days mid-March.

The SIFMA municipal swap index weekly reset was at 0.74%, down from the 1.83% it was last week. The week of March 18, it was as high as 5.20%.

Notes eligible under the program are tax anticipation notes, tax and revenue anticipation notes, bond anticipation notes and other similar short-term notes as long as the notes don’t have a maturity of more than two years.

“I don’t think it’s a crazy amount and as I understand it, they are going to participate indirectly, with $500 billion in loans that will be made available to states and they will be parceled out to states and cities and counties by population,” said Jim Colby, senior municipal strategist and portfolio manager at VanEck . “Then they are buying in the short term market — BANS, RANS, and those types of structures are what they are targeting.”

He added that he doesn’t know if $500 billion across the 50 states is going to be significant enough or just a token amount in terms of the need to free up spending power for the same localities to issue longer-term debt.

“But any relief in the short-end of the marketplace for cash-flow management purposes is going to be very helpful,” he said. “I don’t have any fear that that amount is going to constitute government takeover of the market.”

That fear is real in some participants minds and is

The Fed’s plan also has a secondary loan program that will be given to smaller municipalities and towns and cities to use as they need to, for their ongoing operations.

“And that will be put in hands of local authorities, such as mayors and city council who know what their towns need in order to keep things afloat and essential services going such as water and sewer, fire and police departments and etc.,” Colby said.

He noted that the new-issue calendar has been meager and that $1 billion to $2 billion of deals a week “is not what the muni market is about.”

“Traders are and have been limited in terms of inventory and bidding power, as we continue to see days of $1 billion to $2 billion of bid-wanteds, and the capacity to meet that potential demand has not been there,” he said. “This Fed announcement could populate new-issue deals and there are so many transactions in the shadows waiting in the wings, I would be shocked if we didn’t see a substantial amount of new issuance next week, especially with the lower yields we are now getting.”

He noted that issuers need to work with the underwriters and be patient and careful and cautious as to not overwhelm the marketplace.

“I don’t think it’s the best time to come to market with billion dollar deals,” Colby said. “It’s hard to assess what the attitude is of the greater investor population, but the tax exemption is still in place and hopefully we will be at a place soon where most investors resume the appreciation for the product.”

We have seen unprecedented volatility and the reaction was absolutely understandable but once everything settles down to reveal that munis are at very attractive levels to other asset classes, we can get back to basics and touting the general high credit lower, tax advantage and low default rate, he said.

One of the biggest questions going forward is whether investors be swayed back to preferring general obligation bonds over revenues. Until last year, when the Puerto Rico ruling essentially altered the pristine allure of the GO bond, investors preferred the consistent stream of income from the revenue bond.

Now, as state and local government economies will be hamstrung for who knows how long, with the majority of businesses shut down, no one spending money or sales tax at stores, and no tourism revenue, will the GO bond have the upper hand once again?

“We don’t know how long this will last for and a lot of info is not available or readily apparent and will be critical of how we think about relative value,” Colby said. “We will have to wait and see on this but one thing that credit analysts will be calling for is more current and frequent reporting.”

Muni issuers do not report nearly as frequently as corporate issuers, making the situation even messier.

“Another thing to consider is that as time goes on, not every state and region will be the same,” Colby said. “You will see some areas that will be back to close to normal and other areas that will still be shut down or further behind.”

Some stabilization surfaced on Thursday, which gave hope for strength and positive trading and new-issue prospects next week, according to buy-side players.

“The market is better across the curve in very light trading,” said a New York trader Thursday afternoon.

“Bid wanteds are down again today,” he said. “The muni calendar is starting to pick up. The stabilization this week should increase our forward calendar."

Primary market

The Metro Atlanta Rapid Transit Authority (Aa2/AA+/ / ) sold $137.430 million of sales tax revenue bonds on Thursday, which were won by Bank of America Securities with a true interest cost of 2.8069%.

On Wednesday, Wells Fargo priced the Marshall University Board of Governors (A1/ /AA-/ ) $102.69 million of improvement and refunding revenue tax-exempt and taxable bonds. The entire deal was insured by Assured Guaranty and is the largest insured deal in over a month.

Once the market opens back up on Monday after the three-day weekend in observance of Good Friday, we will see which deals will come off the backlog of transactions that are currently on the day-to-day calendar.

There are 22 negotiated deals on the day-to-day schedule and two competitive deals from Florida issuers greater than $100 million or larger on the daily docket.

On Monday, Johnson County unified school district No.229, Kansas (Aa2/ / / ) is expected to sell $125 million of GO school bonds.

Secondary market

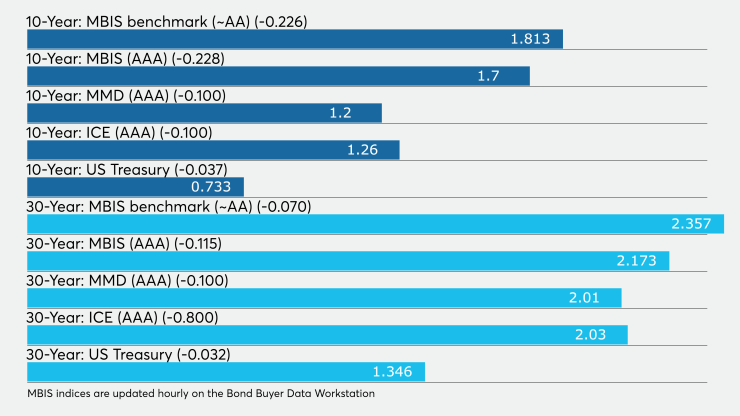

Munis were stronger on the MBIS benchmark scale Thursday, with yields falling by 22 basis points in the 10-year maturity and by seven basis points in the 30-year maturities. High-grades were also stronger, with yields on MBIS' AAA scale decreasing by 22 basis points in the 10-year and by 11 basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO fell 10 basis points to 1.20% while 30-year decreased 10 basis points to 2.01%.

The MDD muni to taxable ratio was 166.2% on the 10-year and 150.0% on the 30-year.

On the ICE muni yield curve late in the day, the 10-year yield was down 10 basis points to 1.26% while the 30-year was down eight basis points to 2.03%.

BVAL saw the 10-year fall seven basis points to 1.29% and the 30-year dropping eight basis points to 2.09%.

Stocks were positive as Treasury yields were mostly lower.

The Dow Jones Industrial Average rose about 2.16%, the S&P 500 index increased roughly 2.23% and the Nasdaq gained roughly 1.17%.

The three-month Treasury was yielding 0.247%, the Treasury two-year was yielding 0.212%, the five-year was yielding 0.408%, the 10-year was yielding 0.733% and the 30-year was yielding 1.346%.

Muni money market funds reverse into positive territory

Tax-exempt municipal money market fund assets increased by $6.49 billion, raising their total net assets to $133.86 billion in the week ended April 6, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds declined to 1.47% from 3.15% in the previous week.

Taxable money-fund assets were up $113.48 billion in the week ended April 7, bringing total net assets to $4.259 trillion.

The average, seven-day simple yield for the 797 taxable reporting funds was slipped to 0.28% from 0.37% the prior week.

Overall, the combined total net assets of the 984 reporting money funds grew by $119.97 billion to $4.393 trillion in the week ended April 7.

The asset total is the largest-ever since iMoneyNet began tracking money-fund assets, replacing the record that was set last week.