BRADENTON, Fla. - A Fulton County judge validated $278.3 million in revenue bonds to support financing of the Atlanta Falcon's new stadium, though the victory could be short-lived.

"We expect an appeal," attorney Douglass Selby with Hunton and Williams LLP said Friday.

Selby represents Invest Atlanta, the development authority that plans to issue the bonds, and the Georgia World Congress Center Authority, a state agency contracting with the Falcons to build the $1.2 billion retractable-roof stadium.

Five Atlanta residents who oppose the stadium and intervened in the validation case are represented by attorneys Thelma Moore and John Woodham. Woodham has a history of appealing bond-related cases all the way to the Georgia Supreme Court.

Neither attorney immediately responded to requests for comment about Glanville's ruling or whether their clients intend to appeal.

"The Series 2014 bonds and security for the bonds are sound, feasible and reasonable," the judge's ruling said in part. "The defendants presented sufficient evidence and the record establishes that these proceedings were lawful, and the requisite statutory proceedings were followed."

The purpose of the validation case was to determine whether various proceedings for the issuance of the bonds were lawfully conducted and there if there is adequate security for the bonds, which will be backed by a hotel/motel tax collected in Atlanta.

The stadium's opponents cited multiple legal reasons why the bonds could not be validated, including whether the deal was legal under Georgia's constitution.

They also raised issues about whether it was legal to use public and private funds for such a project and objected to the demolition of two churches to make way for the new stadium, the failure to address environmental impacts, and that the project was not reviewed as a development of regional impact.

"The overall funding of the new stadium project, and specifically sources of funding other than Series 2014 bonds and the city's hotel/motel tax proceeds, is not the issue before the court in this bond validation proceeding despite intervenors' contention to the contrary," Glanville wrote.

The ruling addresses each objection point-by-point, overruling them all and concluding that the state's constitution was not violated.

Atlanta chief financial officer Jim Beard said he was pleased that the court confirmed the validity of the hotel/motel tax revenue bonds.

"This was the final major hurdle to moving forward with the transaction," he said Friday. "Barring any appeal of the judge's ruling the city expects to price the bonds in the fourth quarter of the 2014 calendar year but this could change based on project timelines."

Some $200 million of 30-year bond proceeds will go toward stadium construction while the Falcons will pay $1 billion from the NFL's G-4 loan program, team debt, equity, and personal seat licenses.

Another $78 million of hotel/motel tax revenue will go toward paying anticipated interest on the bonds, costs and fees, according to the legal paperwork.

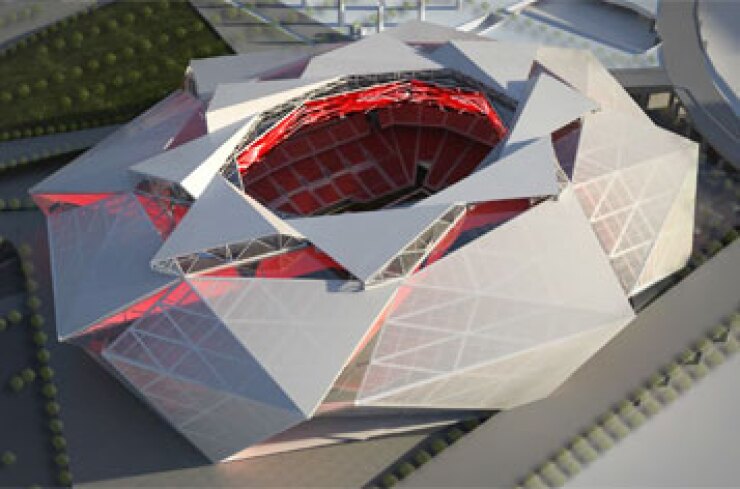

The eight-sided 71,000-seat stadium is expected to open in time for the 2017 season. The facility will serve the National Football League's Falcons and a Major League Soccer team. MLS awarded its latest franchise April 16 to Falcons owner Arthur Blank.