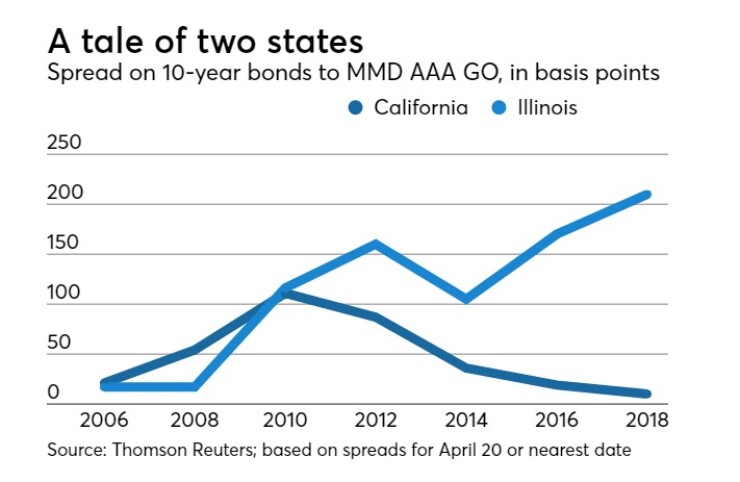

The divergent paths pursued by California and Illinois after the last recession illustrate why California has returned to structural fiscal health and Illinois is flirting with junk-bond status.

"With the added advantage of a capacity for stronger post-recession economic and revenue growth, California was able to stabilize and then improve its credit quality," said S&P Global Ratings analyst Gabriel Petek. "Illinois — which did little beyond temporarily raise taxes — saw the initial signs of its modest fiscal recovery quickly falter."

In the report “For California, the Road to Fiscal Recovery; For Illinois, the Road Not Taken,” S&P reviewed the similar struggles the two states faced as tax revenues plunged and pension fund ratios suffered during the recession and the glaring differences in each state’s responses.

Both headed into the recession having used similar one-shot maneuvers such as accounting gimmicks and borrowing to paper over red ink and managed through the initial post-recession years by deferring bills.

Much has changed for California from the dark days of 2007-2009 when Illinois and California ranked 41st and 42nd in terms of the worst economies in the nation.

Both states had operating deficits before the recession hit.

“Illinois had a negative balance sheet position and had accumulated these unpaid bills – and California had what Gov. Jerry Brown called its wall of debt,” Petek said.

Both had negative general fund balances in 2007, which was ominous given it was the peak of the economic cycle, Petek said.

The Illinois general fund was in the negative by 10% in 2007 compared to a couple percentage points for California, but both saw an explosion of budgetary debts from 2011 to 2012. By the time, the recession took full effect both state’s had fund balances that were negative by more than 20%, Petek said.

“I think of the severity of the budget problems California was having and the comparisons between California and Greece," Petek said. "And then, this many years later, California has improved fiscal conditions and budget ratings and Illinois continues to languish.”

Greece became the center of Europe’s debt crisis in 2010 during the global recession with discussions of insolvency regarding the debt-plagued country. That drew surface comparisons between California and the weakling of the Eurozone.

“Its revenue base was more volatile than Illinois,” Petek said of California; its revenues declined 19.8% from 2008 to 2009. Illinois experienced significant revenue declines of 9%, but it was spread across two years from 2008 to 2010, he said.

Unlike Illinois, California had an immediate cash flow crisis that led then-Controller John Chiang to take extraordinary measures.

“That is why when you look back on that time, California had a more acute fiscal crisis, because of the effect on cash flow,” Petek said. “California was also a perennially late budget adopter. They always had late budgets, back then, but especially when they faced a deficit.”

In July 2009, the state was $1 billion short, so Chiang, now the state’s treasurer, "did not give tax refunds for 28 days and I had to issue $2.6 billion in IOUs,” he recalled in speech he gave in 2015.

When Gov. Jerry Brown was inaugurated in January 2011, California faced a $27 billion projected budget deficit, according to the S&P report.

“Within four months of taking office, however, the governor navigated through the legislature a package of deficit reducing budget reforms,” S&P analysts wrote. “The fiscal measures reoriented the state general fund to a lower spending trajectory and improved the structural alignment of its finances.”

Voters approved a constitutional amendment in 2010 enabling the legislature to pass a budget with a simple majority, rather than a two-thirds supermajority.

“Over the course of that and subsequent budget cycles, the simple majority-vote budget process made it easier for the governor to get a sufficient number of legislators to cosign his agenda of fiscal restraint,” S&P analysts wrote.

California voters also approved temporary tax increases under Proposition 30 in 2012. The measure raised the state sales tax by 0.25% for four years and increased income tax on high earners. Voters agreed to extend the income tax portion of the measure in 2016.

“California matched the tax increases with spending cuts, but Illinois just increased taxes and did not do a lot of reforms," Petek said. "Illinois did pay down some of its unpaid bill backlog, but not enough to put it on more structurally sound fiscal footing, he said.

Today, California passes budgets on time and the private and public service vendors get paid on time. Voters passed a rainy day fund measure in 2014 that will help prevent the state from reverting back to the financial situation of a decade ago.

That is not to say that California has completely smooth sailing. Despite discussions of tax reform that would lessen its dependence on affluent taxpayers, that situation remains. A significant portion of the state’s revenues come from income taxes from high-net-worth residents tying the state’s fortunes to the ups and downs in the stock market, even more so after the passage of Proposition 30 and its extension.

Petek said California's AA-minus rating remains two notches below S&P's AA-plus median rating for U.S. states.

“The large backlog of deferred maintenance on infrastructure, the housing crisis and then couple that with volatility and pension liability – those are daunting,” Petek said.

Unlike California, Illinois did not pair spending cuts with its 2009 temporary income tax that partially expired in 2015.

While Illinois emerged from the recession with a higher bond rating than California, it suffered from weaker pension funding ratios that worsened as the state stuck with a backloaded funding schedule established in 1995.

At the pre-recession economic peak in 2007, the funded ratio was under 63%, “which foreshadowed its deterioration into fiscal distress,” the report says. The unfunded levels steadily crept up to $129 billion and the funded ratio slid to just 37.6% in fiscal 2016. The state Supreme Court rejected pension reforms lawmakers had approved.

"Illinois entered the recession burdened by the consequences of its practice of chronically underfunding its pension systems, which continues today. Only California has exhibited contribution discipline and established a path to full funding," said S&P pension analyst Todd Tauzer.

More recently, political paralysis due to the partisan divide between Republican Gov. Bruce Rauner, who took office in 2015, and the General Assembly’s Democratic majorities, has driven a steep dive to the weakest rating among states. Rauner inherited an A-minus rating.

“The state’s budget went from being a source of leverage in negotiations to collateral damage in a protracted ideological stalemate,” the report says.

Illinois’ economic growth averaged 1.1% from 2012 to 2016 which lags the nation at 2% and California at a stronger 3.4%. Its poor management during the previous economic bust leaves it poorly positioned to deal with the next one.

“The unprecedented downward slide of Illinois’ credit rating reflects both the magnitude and immutable nature of its long-term liabilities and the risk they present given its persistent fiscal imbalance,” the report says. “There is also an utter lack of consensus among Illinois’ political leaders on how to define the primary threats to solvency which serves to undermine their ability to work toward solutions.”

S&P Global Ratings dropped California to A-minus in January 2010. It hit BBB and Baa1 from Fitch Ratings and Moody’s Investors Service in 2009. The Golden State has since climbed back to AA-minus-level ratings across the board.

Illinois began 2009 in stronger rating shape at AA from S&P but its ratings have steadily tumbled, landing last year at the lowest investment grade level of BBB-minus as the state headed toward a third fiscal year without a full year’s budget. Fitch assigns its BBB rating, and Moody's its lowest-investment grade Baa3.

No state government has ever fallen to junk.