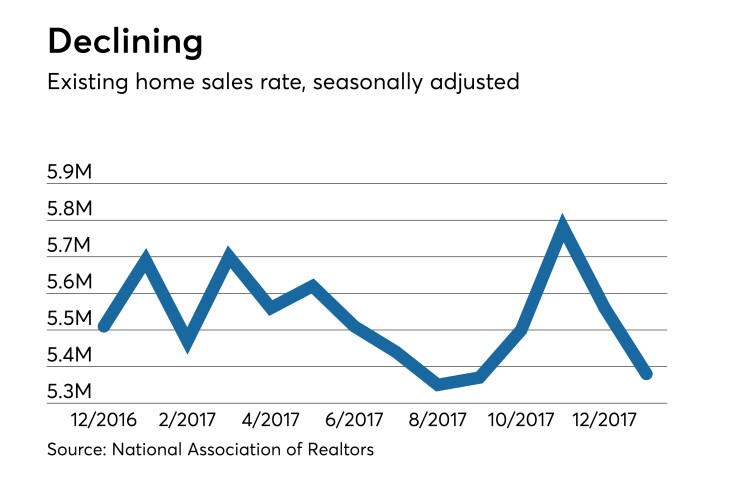

Existing home sales fell 3.2% to a seasonally adjusted 5.38 million-unit rate in January from a revised 5.56 million sales pace the previous month, first reported as 5.57 million, the National Association of Realtors announced Wednesday.

The January rate is a 4.8% decrease from the same month a year ago. The headline number was below the median 5.61 million unit pace predicted by economists polled by IFR Markets.

“The utter lack of sufficient housing supply and its influence on higher home prices muted overall sales activity in much of the U.S. last month,” said NAR chief economist Lawrence Yun. “While the good news is that Realtors in most areas are saying buyer traffic is even stronger than the beginning of last year, sales failed to follow course and far lagged last January’s pace. It’s very clear that too many markets right now are becoming less affordable and desperately need more new listings to calm the speedy price growth.”

Sales in the regions were lower in January. They were down 1.4% in the Northeast, 6.0% in the Midwest, 1.3% in the South, and 5.0% in the West.

The median sales price was $240,500 in January, off from $246,500 in December, but up 5.8% from a year ago.

Inventory levels rebounded 4.1% from the previous month to 1.52 million existing homes, representing a 3.4-month supply at the current pace. Inventory was down 9.5% from the January 2017 level.

“Another month of solid price gains underlines this ongoing trend of strong demand and weak supply. Another month of solid price gains underlines this ongoing trend of strong demand and weak supply,” said Yun. “However, there’s hope that the tide is finally turning. There was a nice jump in new home construction in January and homebuilder confidence is high. These two factors will hopefully lay the foundation for the building industry to meaningfully ramp up production as this year progresses.”