WASHINGTON — The District of Columbia will price about $700 million of general obligation notes in a competitive sale Oct. 11, the latest in a calendar year-end flurry of borrowing that could see the district sell about $2 billion of munis.

The deal represents the district’s annual short-term borrowing transaction and will be used for cash-flow purposes during fiscal year 2013, said interim deputy chief financial officer and interim treasurer Jeffrey Barnette.

The District of Columbia City Council authorized up to $800 million of borrowing Sept. 20, but thanks to an improving financial situation won’t likely need to go that high, Barnette said.

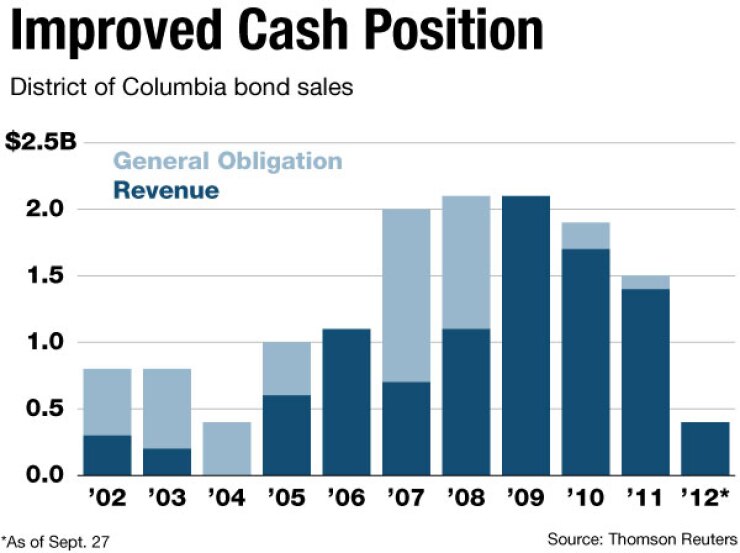

“We are currently finalizing numbers and only expect to borrow approximately $700 million,” he said. “This is a significant drop from the $820 million we borrowed last fiscal year. The lower borrowing need is based on our improved cash position.”

The notes were not yet rated as of Friday but the district’s general obligation ratings are A-plus from Standard and Poor’s, Aa2 from Moody’s Investors Service, and AA-minus from Fitch Ratings.

The district faces a number of obstacles that most political subdivisions do not, including the inability to tax either non-residents working within city limits or the 40% of commercial real property owned by the federal government. The city consequently often goes with alternate revenue sources to secure its debt, such as federal highway money-backed grant anticipation revenue vehicles or income-tax-secured bonds. The income tax bonds carry higher ratings than the city’s GOs.

The district is also subject to various regulations designed to maintain its fiscal health, such as a currently dormant control board that could return in the event of failure to make bond payments or city payroll. The district is also legally restricted from borrowing beyond 20% of projected revenue for the year. Those protections mostly stem from a particularly bleak period in the mid-1990s, when the district ran a more than $500 million annual deficit and the city’s GO debt was rated as junk.

Last week, the district sold $42.9 million of Garvees in the midst of news that Garvee debt was being downgraded by Fitch Ratings and evaluated for downgrade by Moody’s. Barnette said that sale was extremely successful despite the somewhat troubling news, which potentially affects all Garvee issuance and is not specific to the district.

“We had a very successful pricing,” said Barnette, noting that recent deal yielded an all-in true interest cost of 2.57% as opposed to a 3.98% TIC last year. “The deal was oversubscribed, so there is strong demand in the market for the Garvee credit,” he said. “Overall, we were very pleased with the pricing and the execution.”

“Obviously the timing of the potential downgrade news was not ideal,” Barnette added. “However, we recognize this is a potential sector change and not an issue only with the district. We continue to believe that we have very strong debt-service coverage on our 2012 Garvee series deal at 13 times through the bonds’ final maturity. This is information that investors may have taken into consideration and factored that into the prices they were willing to pay for the bonds.”

Barnette said the city intends to orchestrate a $45 million negotiated sale of deed-tax revenue bonds between Thanksgiving and Christmas, and another $900 million deal might be authorized soon.