Rhode Island took a big step financially last month, passing a law to overhaul its public pension system, but its local governments face heightened credit pressure and possibly more ratings downgrades in 2012, according to Moody’s Investors Service.

Moody’s, in a special report issued Monday, determined that Rhode Island’s troubles are long-term. “The risk of an economic double-dip [recession] remains higher for Rhode Island than for the rest of the nation,” the report said.

Pressure points for the Ocean State include poorly funded, locally administered pension plans combined with escalating costs, a lagging statewide economy with exposure to federal budget cuts, and strained governmental revenues.

An auditor general’s report in September said 24 local pension plans spread across 17 of Rhode Island’s 39 municipalities were “at-risk,” all with funded ratios of less than 75%. Eighteen plans measured in at less than 50%.

“Rhode Island has a high proportion of local governments that administer their own pension plans and many of these plans are underfunded. That’s one of the primary pressures straining local communities,” said Geordie Thompson, a Moody’s vice president and senior credit officer.

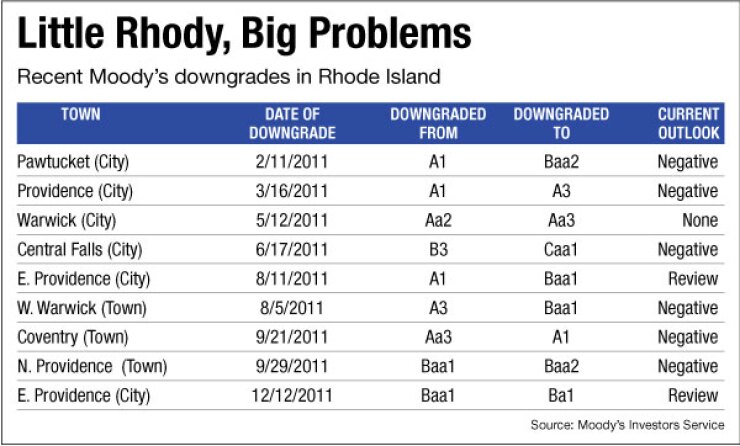

Eight communities in the state received downgrades from Moody’s in 2011; East Providence received two, dropping it from A1 to Ba1. Five of the downgrades — the pair for East Providence as well as West Warwick, Coventry, and North Providence — came after Central Falls, an 18,000-population community with an estimated $80,000 unfunded pension, filed for bankruptcy protection on Aug. 1.

Earlier in the year, Pawtucket, capital city Providence and Warwick received downgrades, as did Central Falls in June.

Moody’s late last week confirmed its Caa1 rating for Central Falls’ $20.8 million of outstanding general obligation debt, as well as a Ba1 rating for the Rhode Island Health and Educational Building Corp.’s Series 2007B bonds, affecting $17 million in debt.

Both have a negative outlook.

Not all is dim, according to Naomi Richman, a Moody’s managing director for public finance. “Remember, downgrades occur at different levels,” she said. “For example, Coventry is at A1 while Pawtucket is at Baa2. An A1 with a negative outlook indicates pressure, but it’s still a high rating.”

Thompson, Richman and analyst Vito Galluccio authored the Moody’s report.

Moody’s expects rating downgrades will continue to accelerate and distressed cities and towns will overwhelm the state’s largely untested oversight program. A law passed in 2010 created a three-tiered program for state oversight, ranging from fiscal overseer to budget commission to receiver. Stephen Bannon is overseer for East Providence; receiver Robert Flanders filed the Central Falls bankruptcy petition.

Rhode Island also enacted a law this year giving priority to bondholders on tax revenue. It passed six weeks before the Central Falls bankruptcy filing.

“That law set up Central Falls nicely,” said Jonathan Henes, a restructuring partner at Kirkland & Ellis LLP in New York. “Central Falls had to file bankruptcy and had to fix its pension issues. This provided the tools to negotiate with unions and retirees. In some ways, it was the perfect city for this strategy. It’s small and has a large pension liability — large for the city, but not in the greater scheme of things.”

Compounding the problem for local governments is the reliance on property taxes and state aid, both of which continue to decline as Rhode Island’s economy lags the weak national economy.

Moody’s cited the precedent the state set in passing the pension law.

“If similar pension reforms are made at the local level, it could produce budgetary relief for a rapidly growing budget item that often accounts for more than 10% of a local government’s total expenditures,” the report said.