Demand for municipals in the primary market should stay strong as volume is set to remain close to the yearly per-week average.

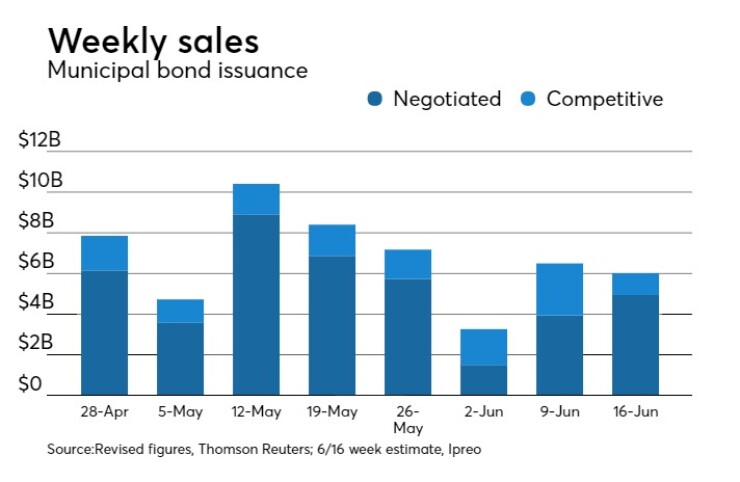

Ipreo estimates volume will slightly slip to $6.01 billion, after a revised total of $6.49 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $4.93 billion of negotiated deals and $1.08 billion of competitive sales.

There are 15 scheduled negotiated deals bond sales larger than $100 million and one competitive deal. It does not happen often, but the largest deal of the week will be unrated.

“Demand across the calendar should be strong given light supply and the large amount of available reinvestment funds flowing from maturities and redemptions in June and coming months,” said Alan Schankel, managing director at Janney Capital Markets.

The Wisconsin Public Finance Authority will be the conduit issuer for the New Jersey Sports and Exposition Authority’s two sales totaling $1.1 billion for the American Dream at The Meadowlands Project. Goldman will run the books on the $800 million of limited obligation pilot revenue bonds and the $300 million of limited obligation grant revenue bonds, both on Wednesday.

Morgan Stanley is scheduled to price the state of Mississippi’s $449.86 million of general obligation bonds on Thursday. The deal is rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

Bank of America Merrill Lynch is expected to price the state of Wisconsin’s $342 million of GO refunding bonds on Tuesday. The deal is rated Aa2 by Moody’s and AA by S&P and Fitch.

“The American Dream deal is the most interesting deal, but GO issues from Wisconsin and Mississippi should grab attention,” said Schankel. “There will be particular focus on Mississippi, since S&P recently placed a negative outlook on its AA rating. “

JPMorgan is slated to price the New York City Housing Development Corp.’s $272.73 million of multi-family housing revenue sustainable neighborhood bonds on Tuesday after a one-day retail order period. The deal is rated Aa2 by Moody’s and AA-plus by S&P.

The lone large competitive deal of the week will take place on Thursday when Rock Hill School District No. 3, S.C., auctions off $110 million of GO bonds. The deal is rated Aa1 by Moody’s and AA by S&P.

Secondary market

Top shelf municipal bonds finished weaker on Friday. The yield on the 10-year benchmark muni general obligation rose two basis points to 1.87% from 1.85% on Thursday, while the 30-year GO yield increased two basis points to 2.71% from 2.69%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Friday. The yield on the two-year Treasury rose to 1.33% from 1.32% on Thursday as the 10-year Treasury yield gained to 2.20% from 2.19% while the yield on the 30-year Treasury bond was unchanged from 2.85%.

The 10-year muni to Treasury ratio was calculated at 85.1% on Friday, compared with 84.4% on Wednesday, while the 30-year muni to Treasury ratio stood at 95.0% versus 94.2%, according to MMD.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended June 8 were from New Jersey California and Illinois issuers, according to

In the GO bond sector, the Union City, N.J., 2.25s of 2018 were traded 30 times. In the revenue bond sector, the Los Angeles County, Calif., 5s of 2018 were traded 112 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 46 times.

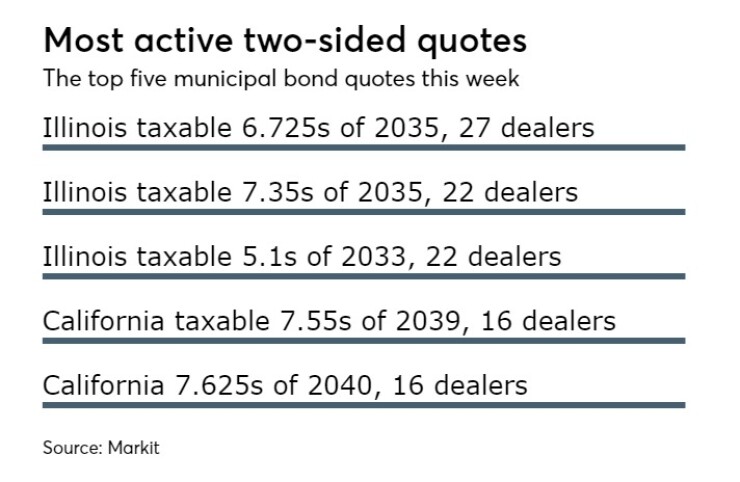

Week's actively quoted issues

Illinois and New York names were among the most actively quoted bonds in the week ended June 8, according to Markit.

On the bid side, the Illinois taxable 6.63s of 2035 were quoted by 74 unique dealers. On the ask side, the New York Hudson Yards Infrastructure Corp. revenue 4s of 2036 were quoted by 221 unique dealers. And among two-sided quotes, the Illinois taxable 6.725s of 2035 were quoted by 27 unique dealers.

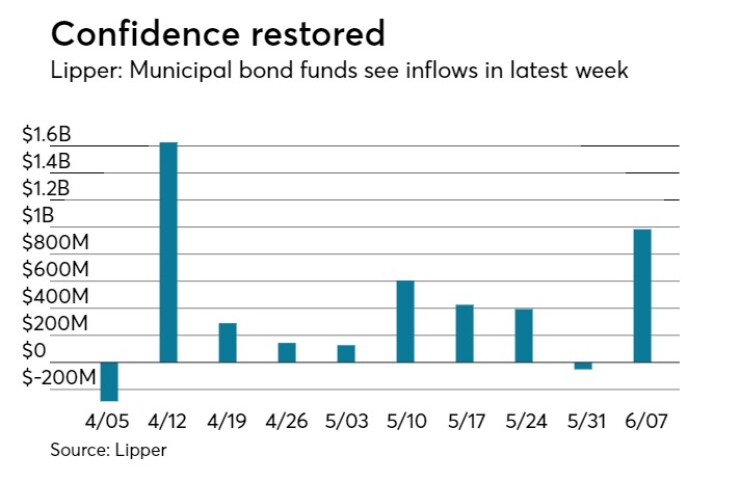

Lipper: Muni bond funds see inflows

Investors in municipal bond funds reversed course and put cash back into the funds in the latest week, according to Lipper data released late on Thursday.

The weekly reporters saw $985.092 million of inflows in the week ended June 7, after outflows of $50.837 million in the previous week.

The four-week moving average was in the green at $438.868 million, after being at positive $344.028 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $636.005 million in the latest week after outflows of $106.029 million in the previous week. Intermediate-term funds had inflows of $97.336 million after outflows of $96.676 million in the prior week.

National funds had inflows of $947.171 million after inflows of $77.134 million in the previous week. High-yield muni funds reported inflows of $336.996 million in the latest reporting week, after outflows of $7.485 million the previous week.

Exchange traded funds saw inflows of $113.843 million, after inflows of $64.657 million in the previous week.