The municipal bond primary market was active on Tuesday as a negotiated deal from the Dormitory Authority of the State of New York and a competitive sale out of state of Texas hit the screens.

Primary market

In the negotiated sector, Goldman Sachs priced and repriced the Dormitory Authority of the State of New York’s $605.905 million of Series 2019A tax-exempt revenue bonds for New York University and issued price guidance on DASNY’s $248.485 million of Series 2019B-1 taxable and Series 2019B-1 taxable green bonds.

The deal is rated Aa2 by Moody’s Investors Service and AA-minus by S&P Global Ratings.

Bank of America Merrill Lynch priced and repriced the University of North Carolina at Chapel Hill’s $150.925 million of general revenue refunding bonds, Series 2019A&B. The deal is rated triple-A by Moody’s, S&P and Fitch Ratings.

And BAML priced FYI Properties’ $229.305 million of lease revenue refunding bonds, the state of Washington DIS project green bonds. The deal is rated AA by S&P.

In the competitive arena, Texas sold $159.965 million of general obligation college student loan bonds subject to the alternative minimum tax.

BAML won the bonds with a true interest cost of 3.3541%.

The financial advisors are Hilltop Securities and YaCari Consultants; the bond counsel are McCall Parkhurst and Mahomes Bolden.

The deal is rated triple-A by Moody’s Investors Service and S&P Global Ratings.

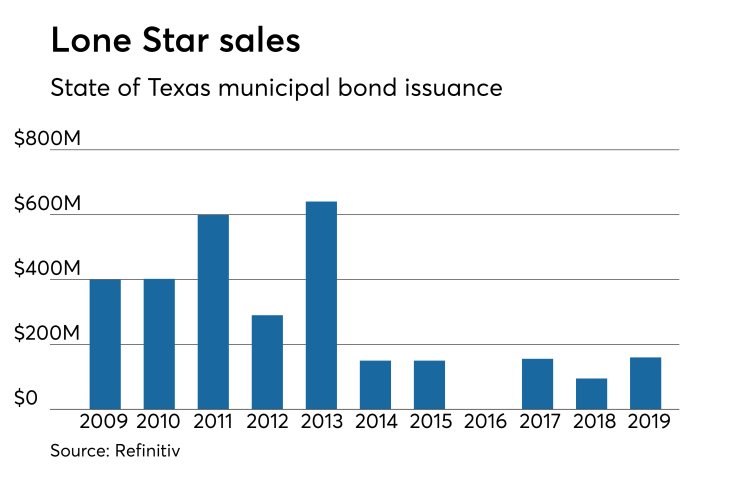

Since 2009, the state of Texas has issued about $3 billion of municipal bonds, with the most issuance occurring in 2013 when it sold $661 million. The state didn't come to market in 2016.

Richland County, South Carolina, sold $175 million of Series 2019 GO transportation sales and use tax bond anticipation notes. Wells Fargo Securities won the BANS with a TIC of 1.792%. The financial advisor is Southern Municipal Advisors; the bond counsel are Burr Forman McNair and Parker Poe.

The notes are rated MIG1 by Moody’s and SP1-plus by S&P.

On Wednesday, BAML is slated to price Washington, D.C.’s $941.48 million of general obligation bonds. The bonds are rated Aaa by Moody’s and AA-plus by S&P and Fitch.

Citigroup is set to price Oregon’s $519 million of GOs on Wednesday, consisting of Series 2019A tax-exempts, Series 2019B taxable sustainability bonds, Series 2019C taxable bonds and Series 2019D tax-exempts. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

In the competitive arena, the state of Delaware is selling $250 million of GOs on Wednesday. The financial advisor is PFM Financial Advisors; the bond counsel is Saul Ewing Arnstein. The deal is rated triple-A by Moody’s and S&P and Kroll Bond Rating Agency.

Tuesday’s bond sales

New York

Texas

North Carolina

South Carolina

Washington

Bond Buyer 30-day visible supply at $8.96B

The Bond Buyer's 30-day visible supply calendar decreased $90.3 million to $8.96 billion for Tuesday. The total is comprised of $2.42 billion of competitive sales and $6.54 billion of negotiated deals.

Schwab says high-yield munis `unattractive'

Yields for high-yield municipal bonds look unattractive right now, according to a report from Schwab Center for Financial Research.

“The additional yield for investing in high-yield munis is near its 2008 lows,” Cooper Howard, senior research analyst at Schwab, said in a report released Monday. “A small allocation to high yield munis can make sense for some investors but we would caution against adding to that position now.”

The Schwab

Schwab also highlighted that the size of the muni market hasn’t increased since 2009, unlike the Treasury and corporate bond markets. “A dwindling supply of munis outstanding combined with strong demand for tax-exempt income should serve as a tailwind for performance over the longer-term”

The report said the total amount of new issuance compared to the total amount that is called, refunded, or matures — known as net supply — has remained negative despite brief respites over the past five years.

“We don’t expect that trend to reverse anytime soon,” the report said.

Secondary market

Municipal bonds were mostly stronger Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the one- to 26-year maturities and were up less than a basis point in the 27- to 30-year maturities.

High-grade munis were stronger, with muni yields falling as much as two basis points in the one- to 29-year maturities and rising less than a basis point in the 30-year maturity.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation remaining unchanged while the yield on the 30-year muni maturity gained three basis points.

“The broader muni curve is up one basis point to two basis points in yield today, with the larger move from 2036 and longer,” ICE Data Services said in a Tuesday market comment. “The high-yield sector is unchanged today, and tobaccos are mixed.”

Treasury bonds were weaker as stock prices traded higher.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 79.0% while the 30-year muni-to-Treasury ratio stood at 99.6%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 35,347 trades on Monday on volume of $10.11 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 14.314% of the market, the Empire State taking 12.903% and the Lone Star State taking 11.448%.

Treasury to sell $50B 4-week bills

The Treasury Department said it will sell $50 billion of four-week discount bills Thursday. There are currently $30 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.