Deals from Cuyahoga County, Ohio; Wisconsin, the city of Los Angeles and the San Francisco BART hit the market in early activity on Tuesday. Municipal bond prices weakened, traders said.

Bank of America priced Cuyahoga County’s $915.8 million of Series 2017 hospital revenue bonds for the MetroHealth System.

The issue was priced to yield from 2.83% with a 5% coupon in 2023 to 4.26% with a 5% coupon in 2032. A 2042 maturity was priced as 5s to yield 4.63%, a split 2047 maturity was priced as 4 3/4s to yield 4.90% and as 5 1/4s to yield 4.73%, a split 2052 maturity was priced at par to yield 5% and as 5 1/2s to yield 4.85%, and a split 2057 maturity was priced as 5s to yield 5.10% and as 5 1/2s to yield 4.95%.

The deal is rated Baa3 by Moody’s Investors Service and BBB-minus by S&P Global Ratings and Fitch Ratings. The credit carries stable outlooks from all three agencies.

Citigroup priced Wisconsin’s $219.15 million of Series 2017A environmental improvement fund revenue bonds.

The issue was priced as 5s to yield from 1.03% in 2019 to 2.84% in 2035. A 2018 maturity was offered as a sealed bid.

The deal is rated AAA by S&P and Fitch.

Barclays Capital priced the San Francisco Bay Area Rapid Transit District’s $380.95 million of general obligation bonds for retail investors.

The $270 million of Series 2017A-1 election of 2016 green bonds were priced to yield from 0.88% with a 4% coupon in 2018 to 2.99% with a 5% coupon in 2037; a 2042 maturity was priced as 4s to yield 3.50%. No retail orders were taken in the 2033-2035 or 2047 maturities.

The $30 million of taxable Series 2017A-2 election of 2016 green bonds were offered as a sealed bid for the 2017 maturity.

The $80.95 million of Series 2017E election of 2004 refunding green bonds were priced as 4s to yield 0.88% in 2018, as 5s to yield 0.98% in 2019 and as 5s to yield 1.10% in 2020. No retail orders were taken in the 2036 or 2037 maturities.

The deal is rated triple-A by Moody’s and S&P.

Morgan Stanley priced Los Angeles’ $333.87 million of Series 2017A wastewater system subordinated revenue green bonds and Series 2017B refunding green bonds for retail investors.

The $225.74 million of Series 2017A bonds were priced as 5s to yield from 2.39% in 2028 to 3.11% in 2037; a 2042 maturity was priced as 5 1/4s to yield 3.13% and a 2047 maturity was priced as 4s to yield 3.63%.

The $108.13 million of Series 2017B bonds were priced to yield from 1.07% with a 4% coupon in 2020 to 1.40% with a 5% coupon in 2022 and to yield from 2.10% with a 5% coupon in 2026 to 3.25% at par in 2032, and to yield from 3.03% with a 5% coupon in 2035 to 3.51% with a 4% coupon in 2039.

The deal is rated AA by S&P, Fitch and Kroll Bond Rating Agency.

BAML is expected to price Hawaii’s $856 million of Series 2017 FK, FL, FM, FN, FO and FP refunding and taxable general obligation bonds. The deal is rated Aa1 by Moody’s, AA-plus by S&P and AA by Fitch.

Citigroup is set to price the Houston Independent School District, Texas’ $838 million of Series 2017 limited tax schoolhouse and refunding bonds. The deal is backed by the Permanent School Funding guarantee program and rated triple-A by Moody’s, S&P and Fitch.

Jefferies is set to price the Pennsylvania Housing Finance Agency’s $262.23 million of alternative minimum tax, non-AMT, and taxable bonds.

BAML is set to price the Monroe County Industrial Development Corp., N.Y.’s $152 million of Series 2017 tax-exempt revenue bonds for Rochester General Hospital. The deal is rated A-minus by S&P.

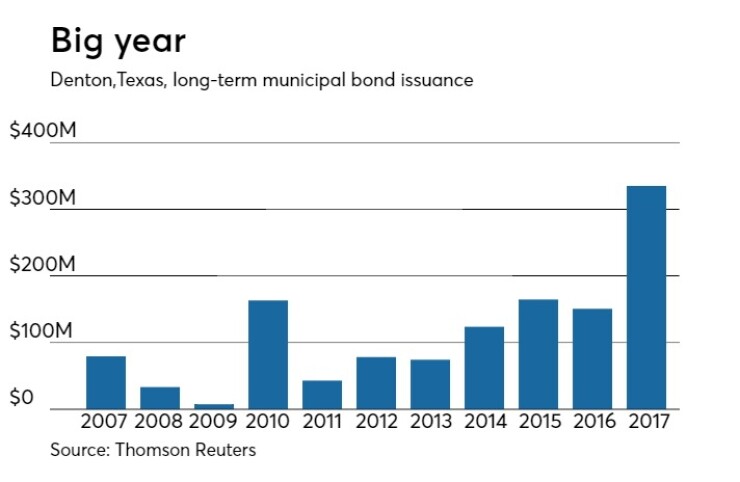

In the competitive arena, Denton, Texas, is selling $120 million of debt in two separate sales. The offerings consist of $90.96 million of Series 2017 certificates of obligation and $29.12 million of Series 2017 GO refunding and improvement bonds.

Both deals rate rated AA-plus by S&P and Fitch.

Since 2007, the city of Denton has issued roughly $1.47 billion of securities, with the lowest issuance occurring in 2009 when it issued $7.5 million. Before Tuesday’s sales, the city had already reached its highest yearly issuance total in a decade, with the next highest being $165 million in 2015.

Bond Buyer visible supply

The Bond Buyer's 30-day visible supply calendar increased $829.9 million to $16.30 billion on Tuesday. The total is comprised of $4.36 billion of competitive sales and $11.94 billion of negotiated deals.

Secondary market

The yield on the 10-year benchmark muni general obligation was as much as one basis point higher from 2.17% on Monday, while the 30-year GO yield was as much as one basis point higher from 3.03%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Tuesday. The yield on the two-year Treasury rose to 1.34% from 1.33% on Monday, while the 10-year Treasury yield gained to 2.40% from 2.37%, and the yield on the 30-year Treasury bond increased to 3.03% from 3.01%.

The 10-year muni to Treasury ratio was calculated at 91.3% on Monday, compared with 92.3% on Friday, while the 30-year muni to Treasury ratio stood at 100.5%, versus 101.4%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,337 trades on Monday on volume of $8.62 billion.