Use of municipal bond insurance swelled to $14.08 billion from $9.76 billion, a 44.2% increase year-over-year as COVID-19 has created credit concerns, thus leading to more insurance use.

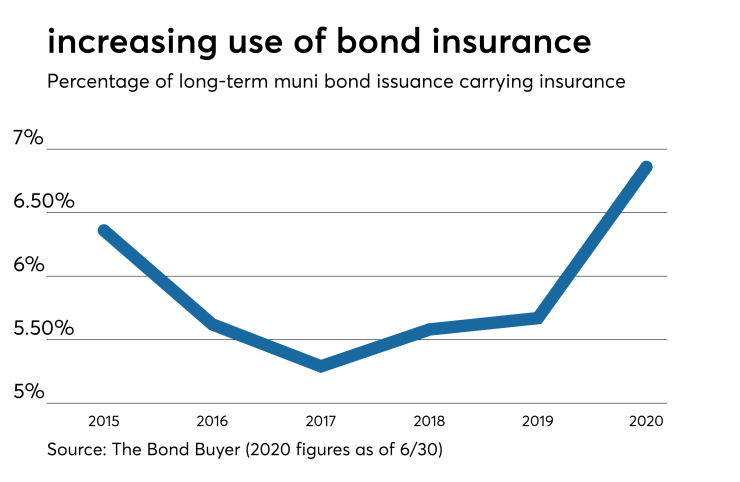

Assured Guaranty and Build America Mutual have combined for a 6.86% insurance rate compared to 5.6% in the first half of 2019. If the saturation rate stays above 6.36% at year end, it would be the highest since 2009 when the rate was sitting at 8.64%.

“The COVID-19 pandemic has caused investors to turn more of their attention to credit quality, ratings durability, trading value stability and market liquidity, all areas where Assured Guaranty’s product tends to add value and where financial guaranty insurance can be an excellent solution for issuers and investors,” said Robert Tucker, senior managing director and head of investor relations at Assured. “This trend was pronounced during the second quarter. Industry insurance penetration of 8.7% of total par issued was the highest quarterly level since 2009 and, during May, issuers used bond insurance on more than 10% of municipal par issued, only the third time monthly penetration has reached double digits in the last 10 years.”

Grant Dewey, head of municipal capital markets for BAM, said the uncertainty sparked by the COVID-19 pandemic drove a meaningful increase in demand for insured bonds by investors, which supported higher penetration, particularly in the second quarter.

“Institutional investors were active in the secondary market throughout the initial shutdown period, even as new-issues were delayed, because they recognized the opportunity to enhance the liquidity of their existing holdings and to protect against ratings volatility,” Dewey said. “BAM wrapped $1.5 billion with underlying ratings in the double-A category, more than twice the volume from the first half of 2019.”

There was a total of $4.91 billion of issuance in the first quarter, an increase of 35.6% year-over-year from $3.62 billion. For the second quarter, use of insurance was 49.3% higher to $9.17 billion from $6.14 billion.

Tucker noted that Assured’s production in the first half of 2020 represented a 45% increase over first-half 2019 production.

“We insured a total of $8.3 billion of insured par in the primary market, with a deal count of 481 (including three corporate-CUSIP deals totaling $310 million) and we guaranteed 58.1% of the insured new issues sold in the first half,” he said. “The heightened par volume was partly driven, especially during the second quarter, by large transactions, where we continue to be the insurer of choice. We insured large tax-exempt and taxable deals across a variety of sectors and underlying rating categories, including for example, single-A healthcare issues and double-A general obligations.”

He also said that Assured guaranteed 14 transactions of over $100 million in insured par during the first half, the largest of which was a $385 million school district transaction for the Dormitory Authority of the State of New York.

“First-half industry insured volume of almost $14 billion in primary-market par was 43% higher than in the first six months of 2019, driven by second quarter volume of more than $9.1 billion sold with bond insurance,” Tucker said.

Tucker added that Assured also saw more of a demand in the secondary market insurance after the pandemic began.

“Our second quarter secondary par of $533 million was 132% higher than in the first quarter,” he said. “In aggregate, Assured Guaranty’s par insured totaled $9 billion for the first half of 2020, up 42% year over year.”

Tucker continued to say the high value that investors place on its guaranty was visible among credits with underlying S&P or Moody’s ratings in the double-A category, where they insured about $1.3 billion of primary-market par in the first half.

Scott Richbourg, head of public finance for BAM, said the mutual insurer was very active on refunding transactions in the primary market in the first half, both before and after the COVID-19 outbreak.

“The low interest rate environment provided widespread opportunities for our member-issuers to lock in savings and achieve additional flexibility in their debt-service budgets, and insurance is a valuable tool, particularly for issuers who were attracting new investors in the taxable markets,” Richbourg said. “The BAM GreenStar program also helped issuers tap demand from investors focused on ESG issues. Year to date, we’ve verified more than $500 million of green bonds, about twice the pace from 2019.”