Fresh from a successful taxable debt sale and a downgrade, Cornell University is back in the market with $305 million of tax-exempt bonds this week with a retail order period expected to begin tomorrow with institutional pricing on Wednesday. The Dormitory Authority of the State of New York will issue the bonds.

Standard & Poor's downgraded the Ivy League school to AA with a stable outlook from AA-plus last week as Cornell sold $500 million of taxable bonds to fund operating expenses.

"This is a lot of debt and it is issued primarily to meet working capital needs," said Standard & Poor's analyst Carlotta Mills. Mills said this approach wasn't the same as deficit financing, though the school does face operating deficits going forward.

"We are seeing more people go out for working capital these days," she said. "Some institutions are doing this because they don't want to liquidate their investments at what they perceive to be the very lowest point of the market. Typically they would turn to their endowment or their investments to do some of this."

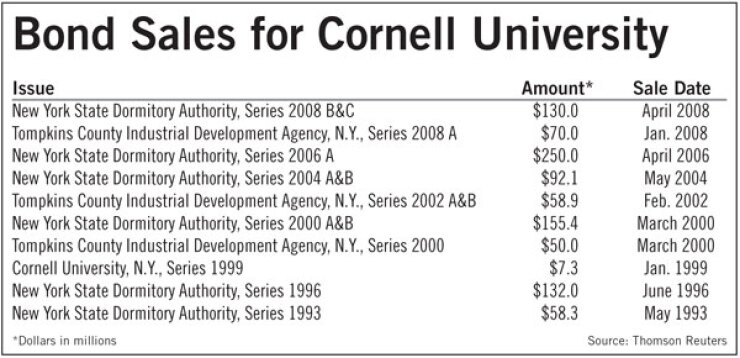

The value of the university's endowment has dropped to $4.5 billion this month from $5.5 billion in June 2008. The taxable and tax-exempt issues will increase Cornell's outstanding debt to almost $1.7 billion from $999 million. The school also has swaps and forward swaps with an aggregate notional amount of $1.5 billion. Last month the swaps had a negative $231.2 million value to the school.

The rating agency affirmed its short-term A-1-plus rating on various notes, bonds and commercial paper.

Moody's Investors Service assigned its Aa1 rating with stable outlook to Cornell's long-term debt and VMIG-1 rating to the university's short-term debt. Fitch Ratings does not rate Cornell.

JPMorgan will lead manage the sale of the Series 2009A tax-exempt 30-year, fixed-rate bonds.

Orrick Herrington & Sutcliffe LLP is bond counsel and Prager, Sealy & Co. is financial adviser. The bond proceeds will be used to refinance $150 million of commercial paper and for new money capital construction and renovation on the campus.

The taxable deal was split into two $250 million tranches. A five-year tranche priced to yield 4.367% on a 4.45% coupon while the other tranche, maturing in 2019, yielded 5.466% on a 4.35% coupon.

"For the taxable deal we're using it to make sure we have operating liquidity to support working capital," said Cornell treasurer Patricia Johnson. "We thought that at this point in time it was best for us to have liquidity with the uncertainty in the market."

Johnson said the school is adjusting its budget to deal with operating deficits, has slowed down its capital program, and hopes to get upgraded in the near term.

"We don't anticipate staying at this level," she said.

The university is a very selective private nonprofit institution in Ithaca, N.Y., that has medical colleges in New York City. Positive factors in Cornell's ratings include "stellar" demand for its academic programs, strong fundraising, and diverse revenue, Mills said.