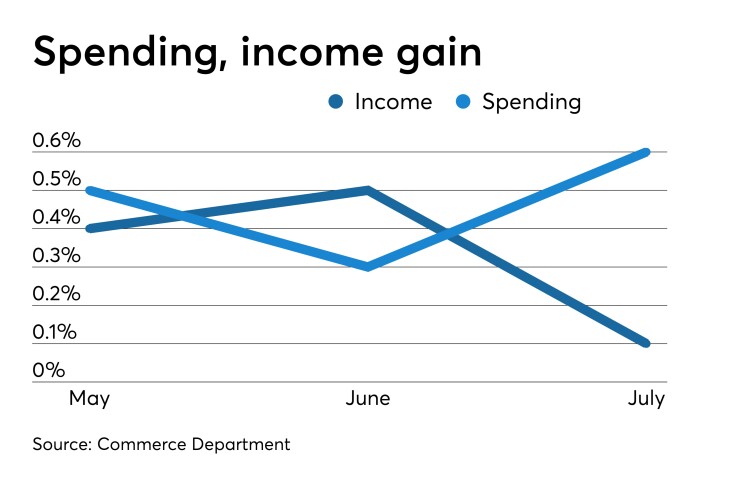

Consumers are still fueling economic expansion, with personal consumption gaining 0.6% in July after a 0.3% rise in June.

Personal income rose 0.1% in the month after a 0.5% increase a month earlier, the Commerce Department reported Friday morning.

Economists polled by IFR Markets expected income to grow 0.3% and spending to gain 0.5%.

Personal consumption expenditures grew 0.2% month-over-month and posted a 1.4% gain year-over-year.

The core PCE, which excludes food and energy, also rose 0.2% in the month, and climbed 1.6% in the year. Economists expected a 1.7% gain year-over-year.

Given the below-target inflation and the trade war with China, and the uncertainty it creates, the markets have priced in a 25 basis point cut in rates when the Federal Open Market Committee meets Sept. 17-18.

“The solid gain in consumption in July reinforces our expectation that healthy consumption growth should more than offset the U.S. and global industrial slump, sluggish business fixed investment and declining exports, and support sustained GDP growth,” Berenberg Capital U.S. Economist Roiana Reid wrote in a note. “Mounting uncertainties related to trade policy tensions and the associated heightened financial market volatility pose risks to this expectation, but as long as consumer confidence remains high and job growth continues, we remain optimistic about the U.S. consumer. The recent declines in energy prices, if sustained, should boost purchases of discretionary goods and services.”

Consumer sentiment

Consumer sentiment is flagging, according to the University of Michigan consumer sentiment index, which fell to 89.8 in August from 92.1 in the preliminary August read and 98.4 in July. The decline was the largest one-month drop since December 2012.

The current conditions index fell to 105.3 from 107.4 in the earlier read and 110.7 in July. Expectations fell to 79.9 from 82.3 in the preliminary read and 90.5 in July.

Chicago PMI

After two months of contractionary readings, the Chicago Business Barometer rebounded to 50.4 in August. In July, the index was 44.4. The three month average declined to 48.2, indicating weaker activity.

Milwaukee manufacturing

The seasonally adjusted Milwaukee Report on Business index increased to 47.29 in August from 46.44 in July, the Institute for Supply Management-Milwaukee reported Thursday.

This indicates contraction in the sector and is consistent with the weakness seen in manufacturing.

The Federal Reserve Bank of Chicago’s Midwest Economy Index was a below-trend negative 0.27 in July, narrowing from negative 0.30 in June. The relative MEI was unchanged at negative 0.06.

The MEI encompasses national and regional factors driving Midwest growth, while the relative MEI offers a view of Midwest growth relative to the nation, according to Chicago Fed.

All five states in the region made negative contributions to MEI, with Iowa making a negative 0.01 contribution, Michigan negative 0.03, Illinois negative 0.05, Wisconsin negative 0.09, and Indiana negative 0.10.