BRADENTON, Fla. — Fitch Ratings downgraded Nashville’s water and sewer bonds on Thursday to AA-minus from AA, in part because of a consent decree that could require up to $1.5 billion in capital expenditures.

The downgrade affects $210.3 million of outstanding water and sewer revenue bonds rated by Fitch. The outlook is stable at the lower rating, the agency said.

The capital expenses related to the consent decree are projected to occur over 11 years, starting in September.

The city has approved a $592 million capital plan for the next five years that includes $392 million of projects not related to the decree.

“Funding for the capital improvement plan is expected to be derived almost exclusively from borrowed resources, which will lead to an elevated debt profile,” said Doug Scott, a Fitch analyst.

In addition to the pressures that could result from consent decree expenses, Scott said, the lower rating reflects a financial performance that is adequate “although somewhat weak,” as well as moderate rates and declining debt service.

A diverse economic base provides credit strength for Tennessee’s capital city, and a senior lien that was closed in December “affords some protection to prior-lien bondholders.”

Nashville, the state’s second-largest city, operates under a consolidated government with Davidson County.

The consent decree is related to system overflows that violate the federal Clean Water Act. City officials have until September to submit a corrective action plan that would be implemented over more than a decade.

The estimates for the costs of implementing such a plan have ranged from $1 billion to $1.5 billion.

To help offset rising costs, Nashville approved annual water rate increases of 5% for each of the next two fiscal years, as well as sewer rate increases of 8% for fiscal 2011 and 7% for fiscal 2012, according to Scott.

“While the escalating fixed costs are a credit concern, the system has some rate flexibility and structuring capacity to absorb these costs as they are added over the next several years,” he said.

Nashville Councilwoman Emily Evans, a former municipal bond underwriter, said recent revenue collections have not been as strong as anticipated, largely because of rainy weather, but the council anticipates addressing the sewer system’s needs in light of the pending corrective action plan.

“In 2009, the mayor proposed and the council approved water and sewer rate increases over the next three years to accommodate some of the CIP work,” she said. “In 2012, the last year of the currently scheduled rate increases, [Nashville] can re-evaluate and consider cost reductions or revenue increases.”

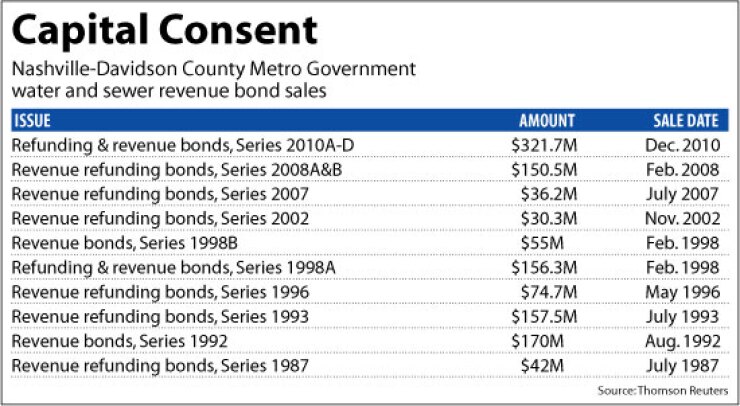

In December, Nashville sold $321.6 million of new and refunding water and sewer revenue bonds that were not rated by Fitch.

The transaction featured $104 million of Series A refunding bonds, $135 million of Series B taxable Build America Bonds, $75 million of Series C recovery zone economic development bonds and $7.61 million of Series D refunding bonds.

The bonds were issued under a new resolution as subordinate to $280 million of senior outstanding water and sewer revenue bonds.

The subordinate bonds were rated Aa3 by Moody’s Investors Service and AA-minus by Standard & Poor’s. Moody’s rated the senior bonds Aa2, but Standard & Poor’s made no distinction in its ratings between the senior and subordinate series.

The 2010 Build America Bonds priced to yield 6.39% in 2030 and 6.56% in 2037, according to Thomson Municipal Market Monitor.