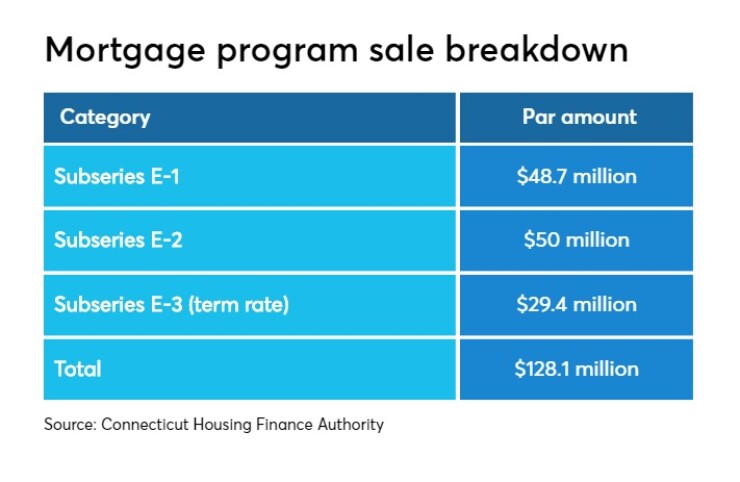

The Connecticut Housing Finance Authority intends to issue $128.1 million of housing mortgage finance program bonds through negotiation on Tuesday.

Raymond James is the lead manager and Lamont Financial Services is the financial advisor.

The Series 2019 sale will include $48.675 million Subseries E1; $50 million Subseries E2; and $29.4 million Subseries E3 (term rate).

The bonds are general obligations of the Rocky Hill-based authority. Revenues and assets pledged under the resolution secure them. They consist primarily of interest in first lien mortgages, investments and reserves held with the trustee, and all funds available to the authority.

A housing mortgage capital reserve fund backed by the state also secures the bonds.

In 2019, CHFA anticipates issuing roughly $625 million in bonds to enable continuous funding for single-family mortgage programs and new investment in the creation and preservation of affordable multifamily housing developments.

Last year the authority issued $741 million in bonds, which raised $499 million in lendable proceeds to fund single-family mortgages and $61 million to fund affordable multifamily housing developments.

State lawmakers created the self-supporting, quasi-public housing agency in agency in 1969. All 169 Connecticut towns have benefited from CHFA financing, according to the authority.

Moody’s Investors Service cited based a high overcollateralization of assets to liabilities, “very strong” program cash flows, a high percentage of government-insured loans and state support.

Both Moody’s and S&P Global Ratings rate the bonds triple-A with stable outlooks.

“The bonds benefit from … a solidly performing and generally low-risk loan portfolio,” said S&P, which also referenced CHFA’s “high-quality” investments and its strong opening asset-to-liability parity ratio of 123.7% at Jan. 1, down slightly from 124.3% in 2018.

Hawkins Delafield & Wood LLP and Lewis & Munday PC are co-bond counsel to the authority. Tobin, Carberry, O’Malley, Riley & Selinger PC is representing the underwriters.