The market continues to be very choppy, as municipal bond yields reversed and are higher. Top-shelf muni bond yields were up as many as 11 basis points in some maturities, according to traders.

Primary Market

The new issue market is getting ready to wind down for the week.

Barclays Capital priced the much anticipated Chicago Board of Education's $729.58 million of dedicated capital improvement tax bonds. The bonds were priced to yield 5.95% with a 5.75% coupon in 2033; 6.00% with a 5.75% coupon in 2034; 6.05% with a 5.75% coupon in 2035; at par to yield 6.10% in 2036 and a term bond in 2046 was priced to yield 6.25% with a 6% coupon. The bonds are rated A by Fitch Ratings and BBB by Kroll Bond Rating Agency.

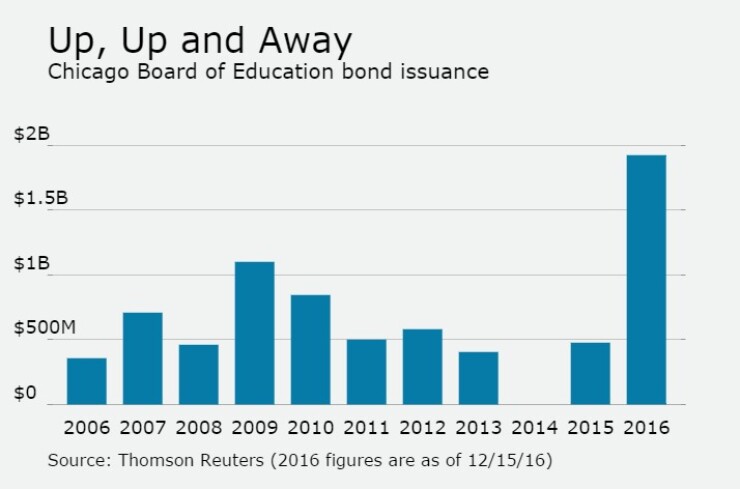

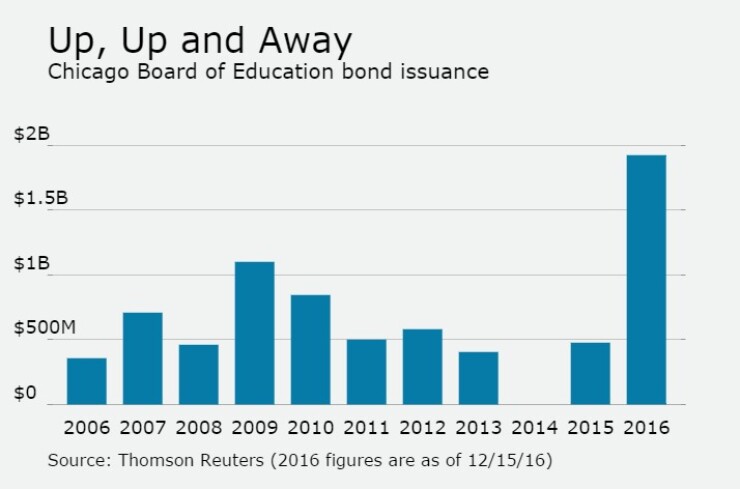

Since 2006, the Chicago BOE has sold about $8.56 billion of bonds, with the largest issuance occurring in 2009 when it issued $1.1 billion. The board didn't come to market in 2014, but it surpassed the $1 billion mark this year, only the second time in 10 years it has sold that much.

Piper Jaffray received the written award on the Tuscaloosa City Board of Education, Ala.'s $152.13 million of school tax warrants, series 2016. The bonds were priced to yield from 1.34% with a 4% coupon in 2018 to 3.66% with a 5% coupon in 2036. A term bond in 2041 was priced to yield 3.81% with a 5% coupon and 4.08% with a 4% coupon in a split maturity. A term bond in 2046 was priced to yield 3.87% with a 5% coupon and 4.13% with a 4% coupon in a split maturity. The deal is rated Aa3 by Moody's Investors Service and AA by S&P Global Ratings.

Secondary Market

Top-rated municipal bonds were weaker on Thursday around midday. The yield on the 10-year benchmark muni general obligation was between seven and nine basis points higher from 2.37% on Wednesday, while the yield on the 30-year increased between four and seven basis points, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mostly weaker on Thursday through midday. The yield on the two-year Treasury rose to 1.27% from 1.23% on Wednesday as the 10-year Treasury yield gained to 2.59% from 2.52%, while the yield on the 30-year Treasury bond was unchanged from 3.15%.

On Wednesday, the 10-year muni to Treasury ratio was calculated at 94.0% compared to 95.6% on Tuesday while the 30-year muni to Treasury ratio stood at 100.3% versus 101.1%, according to MMD.

Tax-Exempt Money Market Fund Outflows

Tax-exempt money market funds experienced outflows of $360.4 million, bringing total net assets to $130.60 billion in the week ended Dec. 12, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $870.9 million to $130.96 billion in the previous week.

The average, seven-day simple yield for the 237 weekly reporting tax-exempt funds was increased to 0.17% from 0.16% from previous week.

The total net assets of the 863 weekly reporting taxable money funds increased $19.94 billion to $2.592 trillion in the week ended Dec. 13, after an inflow of $4.58 billion to $2.572 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.17% from 0.15% from the previous week.

Overall, the combined total net assets of the 1,100 weekly reporting money funds rose $19.58 billion to $2.723 trillion in the week ended Dec. 13 after inflows of $5.45 billion to $2.703 trillion in the prior week.