The fiscally embattled city of East St. Louis — which spent years under state oversight — is the latest Illinois local government that may face loss of its state revenue after falling short on its public safety pension payments.

The East St. Louis Firefighters Pension Fund submitted

The state Department of Insurance’s actuarial valuation reported the pension plan at just 11% funded at the end of fiscal 2018. The city has not conducted its own actuarial reports for 2015, 2016 and 2017, according to the claim.

The claims cover shortages on payments due in fiscal 2017 and 2018. The fund board approved the diversion request at a meeting Sept. 16 during which the city appeared but did not contest it, according to the claim.

The city did not return a request for comment on whether it would contest the intercept request and what impact the loss of funds would have on the city, which reported a nearly $4 million deficit last year and is facing a gap this year. The comptroller allows for a 60-day protest period and then makes a determination if the claim is valid before sending any funds.

The city's police pension fund is also expected as soon as later this month to approve an intercept request.

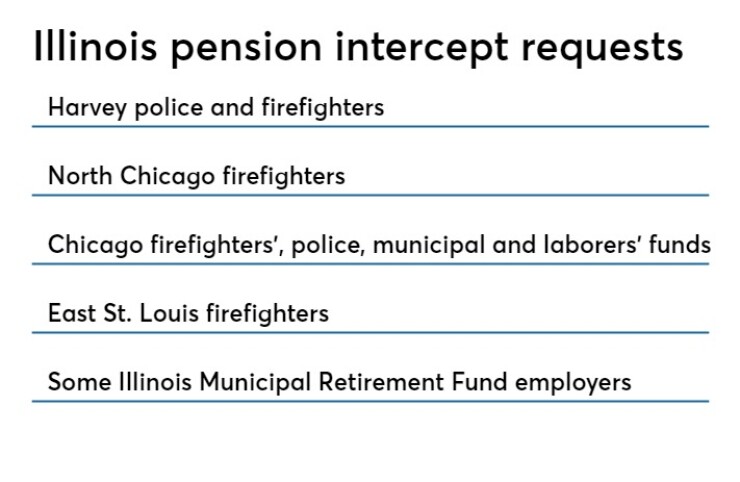

Pension funds that represent public safety workers in Harvey and North Chicago as well as all four of Chicago’s pension funds have sought to garnish the local municipality’s share of state tax funds — in Chicago’s case its state grants — since the comptroller put in a place an intercept process. The diversion began early last year to comply with state pension law changes, according to comptroller's office spokesman Abdon Pallasch.

The Illinois Municipal Retirement Fund, which covers non-public safety workers outside Chicago and Cook County, also has used the law on a handful of municipalities behind on their contributions. North Chicago’s claims were paid. Harvey settled a legal dispute with its firefighter and police funds in a deal that gave the two funds a smaller share of their requests.

Chicago is challenging several of the claims and is locked in a

East St. Louis, just across the Mississippi River from St. Louis, Missouri, has struggled for decades with a dwindling tax base, the loss of population and poor tax collections. The city sought out the distressed designation for home rule units of government in 1990 and it came under fiscal oversight of a special board.

The city was freed from two decades of state oversight in 2013 after paying down its 1994 debt issued under the Financially Distressed City Assistance Program. It met fiscal targets including balanced budgets to exit oversights, but has struggled since and began falling into the arrears on pension contributions. In 2015, the public safety pension funds filed a lawsuit against the city but the lawsuit stalled.

The city is far behind on its publication of formal audits. The last annual financial report and annual report submitted to the state comptroller by East St. Louis was for fiscal 2016 and it wasn't submitted until last month, according to the comptroller's office.

East St. Louis’ pension woes underscore the need for state intervention as Gov. J.B. Pritzker’s pension consolidation task force is weighing a minor fix that could cut some investment and management costs for the roughly 650 suburban and downstate public safety pension costs through some form of consolidation.

Their collective unfunded pension tab for grew by $1 billion to $11 billion in fiscal 2017, with the funded ratio recording its first decline since 2010, according to the latest figures submitted by the funds to the Department of Insurance. The collective ratio of 55.47% is down from 57.58%, according to the

Legislation could be submitted to the General Assembly during its late October veto session. Legislative sources say any proposal is not expected to at least initially include Chicago, as Mayor Lori Lightfoot has requested.

“Right after taking office, the Governor asked a group of experts and stakeholders to come together on a potential agreement and solution, and he’s pleased that they’ve made significant progress. He looks forward to reviewing their findings” on the suburban and downstate funds, Pritzker spokeswoman Emily Bittner said. The task force could then asked to explore additional options that could include Chicago.

Consolidation faces uncertain prospects. The Illinois Municipal League supports it but the Illinois Public Pension Fund Association warns of the risks of liquidation and reinvestment that would occur and believes some local funds will be opposed. “I would have serious doubts of whether there’s the political support to force something through without buy in from the two groups,” said one legislative aide.

Some researchers and municipal participants feared the pension intercept legislation would set off a flood of requests as hundreds of public safety funds have reported payment shortfalls. Sources say a handful of additional requests are expected, but the flood has yet to come to fruition. The intercept also has sparked worries that bondholders’ legal claims will fall behind pensioners as distressed governments try to preserve funding for critical services.