LOS ANGELES — The California's Legislative Analyst's Office released a review of the state sales tax May 6 as legislators wrangle over a variety of scenarios that could bring change to the state's tax code in 2016.

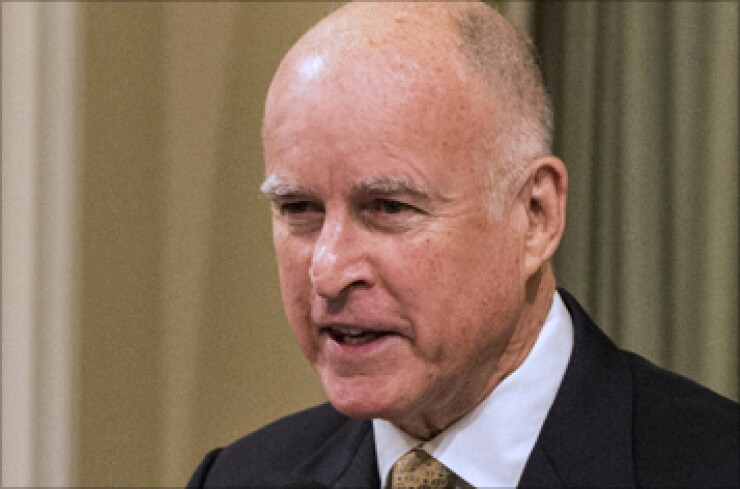

The state bumped up the sales tax and increased income taxes on high net earners to boost education funding in 2012, but those increases are due to expire soon. A push to extend the temporary tax increase Gov. Jerry Brown proposed and voters approved in 2012 is anticipated. That increase in the sales tax and the personal income tax expires fully in 2018.

Various measures aimed at expanding sales tax to apply to services provided as well as "tangible goods," are also being floated by lawmakers.

According to the LAO report, "in 2013-14, buyers and sellers of tangible goods paid $48 billion in sales tax, equivalent to roughly $1,300 for every resident of California."

Over time, the sales tax has become less reflective of the California economy, the LAO report said.

"The sales tax, for example, was designed in a time when goods were a much bigger part of the economy than services," according to the report. "Now the service economy is growing relative to the sale of goods."

Applying the sales tax to services would allow the state to dramatically lower the rate on all sales, according to the LAO.

The legislature is currently considering a Senate Bill 8, by State Sen. Robert Hertzberg, D-Los Angeles, that would create a broad sales tax on services with some specified exemptions.