Municipal bond buyers grabbed big deals from New York City and California on Thursday, which traders said were in demand and aggressively bid.

Primary market

Loop Capital Markets priced and repriced the New York City Transitional Finance Authority’s $901.535 million of tax-exempt future tax secured subordinate fixed-rate bonds for institutions after holding a two-day retail order period.

The bonds were sold via the TFA’s underwriting syndicate, led by book-running lead manager Loop, with Bank of America Merrill Lynch, Citigroup, Goldman Sachs, Jefferies, JPMorgan Securities, Ramirez & Co., RBC Capital Markets and Siebert Cisneros Shank & Co. serving as co-senior managers. Additionally, the TFA sold $500 million of taxable bonds in two competitive sales. Proceeds from the bond sales will be used to fund capital projects in the city.

Jefferies won the $313.57 million of Fiscal 2019 Series B, Subseries B-3 with a true interest cost of 3.9548% while Morgan Stanley won the $186.43 million of Fiscal 2019 Series B, Subseries B-2 bonds with a TIC of 3.5695%.

The financial advisors are Public Resources Advisory Group and Acacia Financial Group. Bond counsel are Norton Rose and Bryant Rabbino.

The deals are rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings.

The TFA said that retail orders for the tax-exempt bonds totaled $481 million, of which about $410 million was usable. For the institutional pricing, the TFA said it received around $2.1 billion of priority orders, representing 4.3 times the bonds offered for sale to institutional investors.

“Given the strong market demand, yields were reduced by 4 – 5 basis points for the 4.00% coupon, 5.00% coupon and 5.25% coupon bonds maturing in 2034 through 2039,” the TFA said in a statement. “Final stated yields ranged from 1.80% in 2020 to 3.22% in 2038 for a 5.00% coupon bond, 3.60% in 2039 for a 4.00% coupon bond and 3.705% in 2040 for a 3.625% coupon bond.”

In the competitive arena, California sold over $989 million of general obligation and GO refunding bonds in three sales.

Citigroup won the $516.035 million of Bidding Group C tax-exempt various purpose GO refunding bonds. Goldman Sachs won the $338.38 million of Bidding Group B tax-exempt various purpose GOs with a TIC of 3.2481%. And Wells Fargo Securities won the $134.855 million of Bidding Group A taxable various purpose construction GO and refunding bonds with a TIC of 3.2621%.

The financial advisor is Public Resources Advisory Group and the bond counsel is Orrick Herrington & Sufcliffe.

The deals are rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

“The Cal deal was competitive and aggressively bid,” said one New York trader. “Clearly Cal buyers are still buying against the reduction in [state and local tax] deduction availability" under the new federal tax law.

Wells Fargo Securities priced the University of Chicago’s $400 million of Series 2018C taxable fixed-rate bonds.

The corporate CUSIP deal is rated Aa2 by Moody’s, AA-minus by S&P and AA-plus by Fitch.

Also on Thursday, Morgan Stanley priced Cleveland’s $109.685 million of Airport System revenue bonds consisting of $87.9 million of Series 2018A bonds subject to the alternative minimum tax and $21.745 million of Series 2018B non-AMT bonds.

The Series 2018A bonds are rated A3 by Moody’s, A by S&P and BBB-plus by Fitch except for the 2034-2048 maturities which are insured by Assured Guaranty Municipal and rated A2 by Moody’s and AA by S&P. The Series 201BA bonds are rated A3 by Moody’s, A by S&P and BBB-plus by Fitch except for the 2034-2043 maturities which are insured by AGM and rated A2 by Moody’s and AA by S&P.

Barclays Capital priced the New Jersey Housing and Mortgage Finance Agency’s $161 million of multi-family revenue bonds. The deal is rated AA-minus by S&P.

Goldman Sachs priced Purdue University’s $90 million of student fee bonds. The deal is rated AAA by Moody's and S&P.

Wednesday's bond sales

New York:

California

Ohio

New Jersey

Illinois

Indiana

Bond Buyer 30-day visible supply at $9.57B

The Bond Buyer's 30-day visible supply calendar increased $408.4 million to $9.57 billion for Thursday. The total is comprised of $4.61 billion of competitive sales and $4.96 billion of negotiated deals.

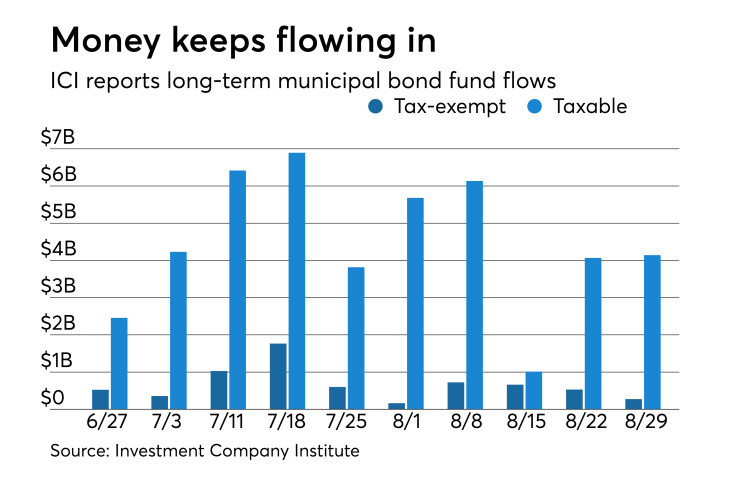

ICI: Long-term muni funds saw $273M inflow

Long-term tax-exempt municipal bond funds saw an inflow of $273 million in the week ended Aug. 29, the Investment Company Institute reported.

This followed an inflow of $531 million into the tax-exempt mutual funds in the week ended Aug. 22 and inflows of $662 million, $723 million, $163 million, $600 million, $1.765 billion, $1.028 billion, $356 million and $525 million in the eight prior weeks.

Taxable bond funds saw an estimated inflow of $4.142 billion in the latest reporting week, after seeing an inflow of $4.065 billion in the previous week.

ICI said the total estimated inflows to long-term mutual funds and exchange-traded funds were $1.977 billion for the week ended Aug. 29 after inflows of $5.598 billion in the previous week.

Secondary market

Municipal bonds were mostly weaker on Thursday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as ,much as one basis point in the two- to five-year, nine-year and 14- to 29-year maturities and fell less than a basis point in the one-year, seven-year and 10- to 13-year maturities and remained unchanged in the six-year, eight-year, and 30-year maturities.

High-grade munis were also mostly weaker, with yields calculated on MBIS' AAA scale rising as much as one basis point in the two- to four-year and 14- to 30-year maturities, falling less than one basis point in the one-year, six- to eight-year and 10- to 13-year maturities and remaining unchanged in the five-year maturity.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation remaining unchanged while the yield on 30-year muni maturity increased as much as one basis point.

Treasury bonds were mixed as stock prices traded mixed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 86.1% while the 30-year muni-to-Treasury ratio stood at 100.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 43,474 trades on Wednesday on volume of $12.90 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 14.229% of the market, the Lone Star State taking 9.496% and the Empire State taking 8.795%.

Muni market gears up for healthy fall season

Despite this week’s modest calendar and trading activity that's been below long-term averages this year, Matthew Gastall, head of municipal research at Morgan Stanley Wealth Management, said the market expects a healthy and eventful fall season in the municipal market.

The forward calendar is building, and there is a lot of cash on the sidelines waiting to take advantage of the current opportunities, Gastall said in an interview Thursday morning. “Things are gearing up but we’re just not there yet,” he said, reflecting on what he called “predictable” weakness in U.S. Treasuries earlier in the week.

“As everyone was returning from the holiday, it was a textbook laggard response,” he said. “We outperformed on Tuesday and caught up to some of the weakness yesterday. There’s been this confluence of dynamics and everything seems to be going well for munis,” he said.

“We are looking forward to a pretty healthy fall,” Gastall said. “There’s a lot of cash waiting on the sidelines and issuers are most likely going to be looking to capitalize on this period.”

Going into the fourth quarter, Gastall said investors will want to keep it simple in terms of investment strategy, and limit their credit and duration risks as much as possible.

“Additional compensation for taking considerable credit risk or duration risk is not as much as it was,” he said. “Investors will want to keep it high-quality and low duration because the market is as healthy as it is.”

Interest rates and global pressures may have an impact on municipals, he said. “Things have been going so well that means we are valued well versus Treasuries, but if interest rates rise due to the market transitioning toward inflationary expectations; federal borrowing; global monetary policy; or above-consensus growth, we’ll probably have to follow suit.

“We have trade tensions right now and the midterm elections approaching, and that can cause uncertainty in equities and a flight to quality in fixed income.” Gastall said that could lead to lower interest rates, and municipals could continue to do as well as they have on a relative performance basis.

Treasury details upcoming auctions

The Treasury Department announced these auctions:

- $15 billion of 29-year 11-month 3% bonds selling on Sept. 13;

- $23 billion of nine-year 11-month 2 7/8% notes selling on Sept. 12;

- $35 billion of three-year notes selling on Sept. 11;

- $26 billion of 364-day bills selling on Sept. 11;

- $42 billion of 182-day bills selling on Sept. 10; and

- $48 billion of 91-day bills selling on Sept. 10.

Tax-exempt money market funds see inflows

Tax-free municipal money market fund assets increased $313.6 million, raising their total net assets to $130.43 billion in the week ended Sept. 3, according to the Money Fund Report, a service of iMoneyNet.com.

The modest inflows now makes it three straight weeks of inflows, after seeing back-to-back billion-dollar outflows.

The average, seven-day simple yield for the 198 tax-free reporting funds was unchanged at 1.08%.

Taxable money-fund assets increased by $5.47 billion in the week ended Sept. 4, bringing its total net assets to $2.709 trillion.

The average, seven-day simple yield for the 831 taxable reporting funds rose to 1.60% from 1.59% last week.

Overall, the combined total net assets of the 1,029 reporting money funds increased by $5.78 billion to $2.839 trillion in the week ended Sept.4.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.