Southeast municipal bond issuance increased on a year-over-year basis in the first half of 2022, bucking the national trend.

Issuance in the Southeast rose 6.3% in the first half of this year to $40.7 billion from $38.28 billion in the same period last year, according to data compiled by Refinitiv.

Nationally, municipal bond issuance fell 11.2% in the first half compared to the same period in 2021.

Results were uneven across the first two quarters.

Volume in the Southeast during the first quarter surged 32.3% to $22.23 billion from $16.8 billion a year earlier while in the second quarter issuance was down13.9% to $18.47 billion.

Tax-exempt issuance rose 3.8% to $30.38 billion in 611 issues compared to $29.25 billion in 739 issues in the same period last year; taxable issuance fell 16.4% to $7.02 billion in 81 issues from $8.40 billion in 209 issues.

Bonds subject to the alternative minimum tax were up more than five-fold to $3.30 billion in 14 issues from $623.4 million in 10 issues in the same period in the prior year.

Many states in the Southeast have seen population growth driven by moves from other parts of the country.

Nearly one-third of Redfin.com users were looking to move in July, a record high according to data from the real estate brokerage, BofA Global Research said in a recent report.

Miami was the most popular migration destination in the second quarter as measured by net inflow by Redfin.

New York City was the top origin metro area for Miami, according to Redfin.

John Mousseau, president and chief executive officer at Cumberland Advisors, told The Bond Buyer that he expects the trend of migration from states like New York and California to continue.

"If they ever reverse SALT (the federal deduction cap for state and local taxes) it may halt the rush, but between that and the demographics of boomer retirement and relocation to lower taxes/lower cost, municipal needs in Southeast — and Texas — will continue as those areas grow," he said.

"As a side note states like Texas and Florida — and other Southeastern states — grow more blue politically yearly. Look for purple areas to get bluer and red areas to get more purple. And that has implications for more debt issuance."

The Louisiana Local Government Environmental Facilities and Community Development Authority brought the single biggest issue to market in the first half — a $3.19 billion sale on May 11 of taxable bonds for the Louisiana Utilities Restoration Corp. project, backed by charges to Entergy Louisiana LLC retail electric customers.

The deal, rated triple-A by Moody's Investors Service and S&P Global Ratings, was priced by J.P. Morgan Securities.

That deal pushed the authority to the top rank of Southeast issuers, credited by Refinitv with $3.283 billion in five deals. In the same period last year, the authority issued $302.9 million in seven offerings.

The second-biggest deal came from the South Carolina Public Service Authority, which issued $1.28 billion of tax-exempt and taxable revenue obligations on Feb. 9. BofA Securities priced the deal.

The

The Virginia Small Business Financing Authority had the fourth-biggest deal in the region with its sale of $1.14 billion of taxables and AMT bonds on Feb. 24. J.P. Morgan priced the deal.

The Virginia SBFA was the Southeast's second biggest issuer in the first half, coming to market with $2.414 billion in six deals. In the same period in 2021, the authority did not issue any debt.

The fifth-largest deal was from the Hillsborough County Aviation Authority, Florida, which sold $723.3 million Feb. 24 for the Tampa International Airport. BofA priced the deal.

Rounding out the largest deal table were the Kentucky Public Energy Authority with $685.5 million of bonds on Feb. 23 priced by Morgan Stanley; the state of Louisiana with $642.8 million of taxables and tax-exempts on Jan. 12 priced by Wells Fargo; the Southeast Energy Authority with $641.3 million of revenue bonds on June 2 priced by Goldman Sachs; the Virginia Small Business Financing Authority with $638.3 million on Feb. 3 priced by J.P. Morgan; and the Virginia College Building Authority with $632.2 million priced by Raymond James & Associates in May.

Among issuers the Black Belt Energy Gas District in Alabama ranked third, selling $1.54 billion of total debt.

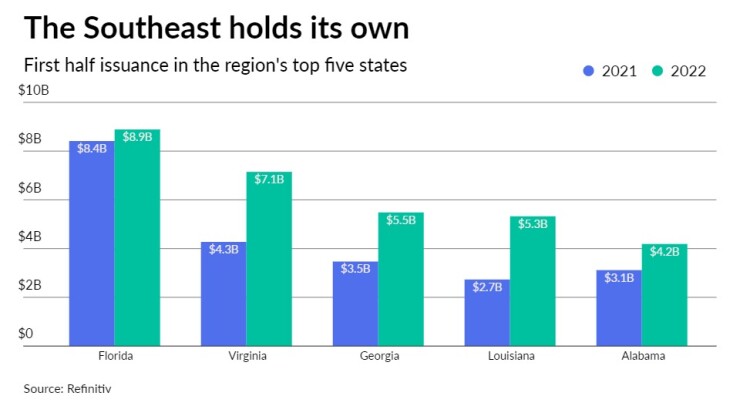

Issuers in Florida put the state on top of the Southeast state rankings, selling $8.88 billion of debt in the first half, up 5.5% from a year earlier.

They were followed by Virginia with $7.15 billion, Georgia with $5.48 billion, Louisiana with $5.32 billion, Alabama with $4.19 billion, South Carolina with $2.80 billion, Kentucky with $2.60 billion, North Carolina with $2.27 billion, Tennessee with $1.44 billion, Mississippi with $413.5 million and West Virginia with $151.7 million.

BofA topped the list of Southeast underwriters, credited by Refinitiv with $8.09 billion of bonds in the first half. It was followed by J.P. Morgan with $6.26 billion, Morgan Stanley with $3.66 billion, Wells Fargo with $2.98 billion and Goldman Sachs with $2.48 billion.

Rounding out the top 10 list were Citi with $1.97 billion, Raymond James with $1.94 billion, Stifel with $1.55 billion, RBC Capital Markets with $1.31 billion and Robert W. Baird & Co. with $828 million.

Looking at the financial advisor rankings, PFM Financial Advisors led the pack, credited with $6.04 billion of business followed by Estrada Hinojosa with $3.19 billion, Municipal Capital Markets Group with $2.86 billion, Public Resources Advisory Group with $2.55 billion and Frasca & Associates with $2.13 billion.

Butler Snow led the bond counsel table, credited with $4.79 billion, followed by Kutak Rock with $2.33 billion, Burr & Foman with $1.75 billion, Alston & Bird with $1.69 billion and Squire Patton Boggs with $1.67 billion.

Deals wrapped with bond insurance declined in the first half, dropping 10.4% to $2.28 billion in 70 deals from $2.54 billion in 118 deals last year.

New money deal volume in the Southeast was up 27.2% in the first half, rising to $32.60 billion in 579 issues from $25.63 billion in 575 issues in the same period last year.

Refundings dropped 39.5% to $6.51 billion in 104 issues from $10.77 billion in 333 issues last year. Combined new money and refunding issuance fell 15.5% to $1.59 billion in 23 deals from $1.88 billion in 50 deals the prior year.

Issues Refinitiv classified as being for transportation issues gained 91.0% to $7.46 billion year-over-year while healthcare issuance rose 49.9% to $3.36 billion.

Issuance for utilities rose 40.1% to $9.57 billion from $6.83 billion, making it the Southeast's largest sector.

Education issuance fell 21.7% to $6.39 billion.