Municipals remained stronger Wednesday, buoyed by election results around the country that indicated Democrats could attempt to revive a Build America Bonds type-program as part of an infrastructure bill.

Democrats took control of the U.S. House of Representatives, while Republicans kept hold of the Senate. Some have said a split Congress could bode well for progress on federal infrastructure legislation, because there is common ground between the two parties on that issue. But the issue of how to pay for the agreed-upon spending could keep anything from materializing.

“With a Democratic-controlled House, we have more of a chance to see legitimate infrastructure legislation,” said Jeffrey Lipton, head of municipal research and strategy at Oppenheimer & Co. “If you don’t seriously address the infrastructure crisis in this country, it then becomes an issue of national security.”

Lipton said he believes a split Congress could work collaboratively on infrastructure.

“I do think there is bipartisan support among both Democrats and Republicans to get some sort of infrastructure package,” he said.

It was all quiet on the primary front as no major sales hit the screens on Wednesday.

Secondary market

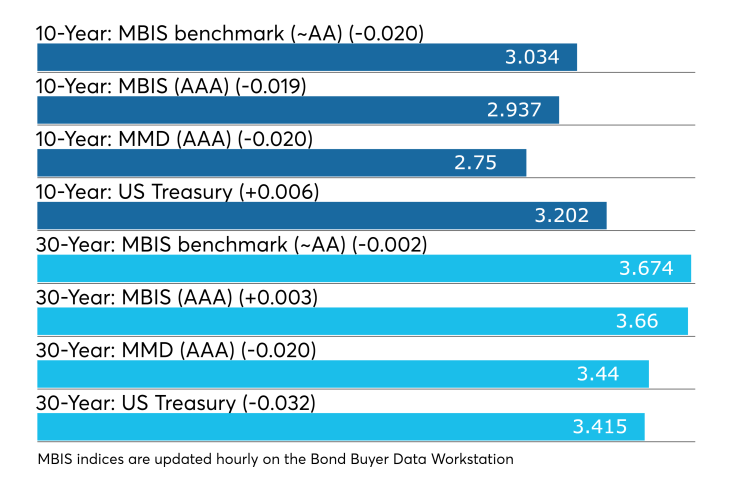

Municipal bonds were stronger on Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities.

High-grade munis were mostly stronger, with yields calculated on MBIS' AAA scale falling as much as one basis point in the one- to 28-year maturities while rising less than a basis point in the 29- and 30-year maturities.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity falling by two basis points.

Treasury bonds were stronger as stocks traded sharply higher. The Treasury 10-year stood at 3.202% in late trade while the Treasury 3-month bills was at 2.358%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 85.7% while the 30-year muni-to-Treasury ratio stood at 100.6%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 45,737 trades on Tuesday on volume of $11.96 billion.

California, Texas and New York were the municipalities with the most trades, with the Golden State taking 15.016% of the market, the Lone Star State taking 12.345% and the Empire State taking 11.783%.

Bond Buyer 30-day visible supply at $6.66B

The Bond Buyer's 30-day visible supply calendar increased $259.7 million to $6.66 billion for Wednesday. The total is comprised of $1.94 billion of competitive sales and $4.72 billion of negotiated deals.

Treasury sells $19B 30-year bonds

The Treasury Department Wednesday auctioned $19 billion of 30-year bonds with a 3 3/8% coupon at a 3.418% high yield, a price of 99.197082. The bid-to-cover ratio was 2.06.

Tenders at the high yield were allotted 72.32%. The median yield was 3.360%. The low yield was 3.270%.

Kyle Glazier and Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.