Bond insurance rose 9% in 2021 as market demand continued to increase steeply, initially due to credit concerns caused by the pandemic.

As issuance hit $480.03 billion in 2021, the insurance industry wrapped 7.8%, up slightly from 7.1% in 2020. Deals with insurance totaled $37.522 billion, more than the $34.428 billion in 2020, according to Refinitiv data.

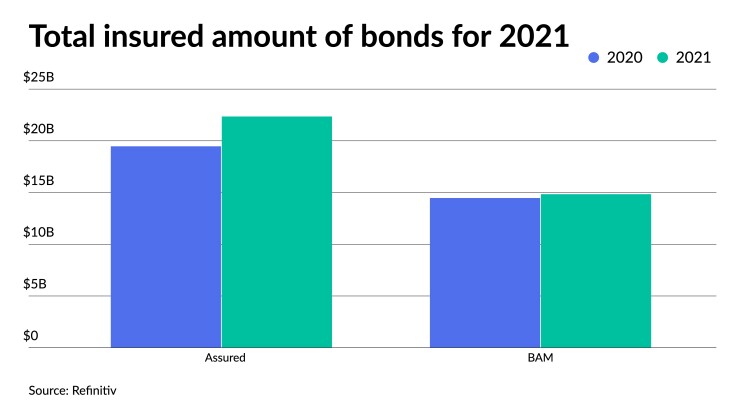

The top two insurers, Assured Guaranty Municipal Corp. and Build America Mutual, saw increases year-over-year. Assured Guaranty accounted for a total of $22.352 billion in 1,076 deals with 60.1% of the market share. Meanwhile, Build America Mutual insured $14.841 billion in 1,122 deals with 39.9% of the market share in 2021.

Tax-exempt issues insured grew 3.3% to $23.658 billion while taxables rose 19.6% to $12.009 billion. New-money issuance with insurance rose to $22.028 billion, a 9.3% gain while refundings climbed to $11.895 billion, or 6.5%.

Both Assured Guaranty and Build America Mutual said institutional investors, in particular, expanded their purchases of insured bonds to support broader portfolio management methods that optimize liquidity and rating stability.

"An important trend in recent years has been that institutional investors have continued to recognize the value of our guaranty, enabling us to help launch more of the market’s largest transactions," said Robert Tucker, Assured Guaranty’s senior managing director, Investor Relations and Communications.

“Overall, it was an important step forward for the industry, that a lot of institutional investors in particular, who had become buyers of insured bonds immediately following the pandemic, continued to see the value, even as credit conditions normalized,” added Michael Stanton, BAM’s head of strategy and communications.

Development issuance covered rose 84.1% to $387.2 million. Electric power climbed 281.1% to $315.9 million. Transportation rose 87.7% to wrap $1.552 billion. General purpose grew 75% to cover $3.062 billion.

State agency-insured debt hit $3.876 billion, or an 11.3% increase. Cities and towns accounted for $8.598 billion, up 31.3%. Local authorities dropped to $6.79 billion, down 4.9%. Colleges and universities rose to $1.584 billion, a 42.7% increase over 2020.

Tucker said for Assured, issuers using bond insurance have increased to the highest rate in more than 12 years at 8.7% in 2021. It was up from 7.6% in 2020 and 5.9% in 2019.

Assured provided $100 million or more of bond insurance for each of 48 large issues brought to market in 2021, up from 39 transactions in 2020 and 22 transactions in 2019.

In addition to the large issues guaranteed in 2021, Assured also provided bond insurance for hundreds of smaller issues, including 450 small enough to be bank-qualified, Tucker said.

"We delivered value for both large and small transactions, negotiated transactions, and competitive-bid transactions in many market segments and across a wide ratings spectrum," he said.

Build America Mutual's activity was part of a market-wide increase in bond insurance use: last year, 8.7% of all new issues were sold with insurance, the highest level since 2009.

For 2021, those transactions came from 39 states, versus 40 states in 2020.

Moreover, 20% of BAM's new-issue insured par had public underlying ratings in the double-A category from S&P Global Ratings or Moody's Investors Service, and BAM guaranteed 46 transactions with par of $50 million or more.

“It was another very strong year. We did $15.6 billion par in the primary market, which was a new high for us, and really reflected in the growth in the insurance market,” Stanton said.

The BAM GreenStar program remained the most active third-party verifier of municipal bonds that align with the green bond principles, bringing issuance to $1.7 billion in 2021 and more than $3.5 billion since the program’s launch in 2018.

"The biggest part of the BAM GreenStar program is sustainable water and wastewater investments. And these are projects that are being planned with a high level of sustainability and the issuers communicating that to the market by selling green bonds to finance," Stanton said. "That's becoming more common."