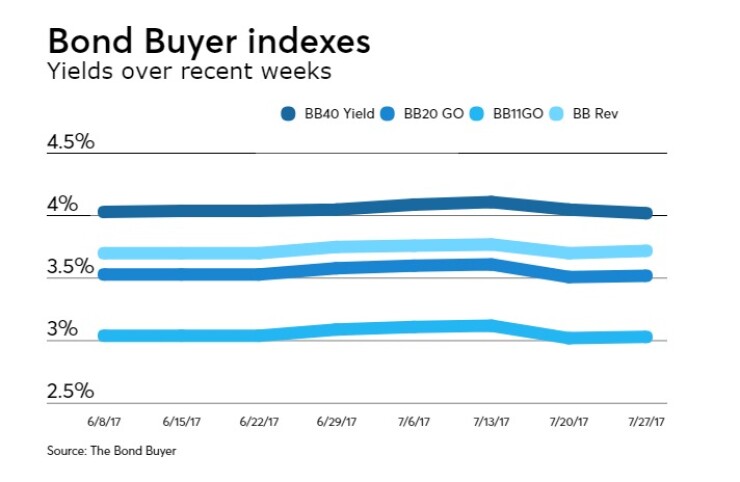

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices fell three basis points to 4.02% from the previous week's 4.05%.

The Bond Buyer's 20-Bond GO Index of 20-year general obligation yields increased one basis point to 3.52% from 3.51% the prior week. It is at its highest level since July 13 when it was at 3.61%.

The 11-Bond GO Index of higher-grade 20-year GO was one basis point higher to 3.03% from 3.02% the previous week. It is at its highest level in two weeks.

The Bond Buyer's Revenue Bond Index was up two basis points to 3.72% from 3.70% last week. It is at its highest level since July 13, when it was at 3.77%.

The yield on the U.S. Treasury's 10-year note was four basis points higher to 2.31% from 2.27%, while the yield on the Treasury's 30-year bond increased 10 basis points to 2.93% from 2.83% in the prior week.