The upcoming week’s new issue calendar will be dominated by two issuers who are no strangers to the municipal bond market – New York City and the state of California.

Ipreo forecasts weekly bond volume will fall to $3.6 billion from a revised total of $4.5 billion in the prior week, according to updated data from Thomson Reuters. The calendar is composed of $1.6 billion of negotiated deals and $2 billion of competitive sales.

Volume is coming in on the low side during the holiday-shortened trading week, where financial markets close Monday in observance of Labor Day.

“I believe next week will be a continuation of what we saw this week; deals will come in and go, the market will be a little slow and sleepy,” Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management, said on Friday. “I am hopeful that once we get into the second and third weeks of the month, volume will pick up a little. Granted, I don’t think we will see a mega-week but certainly should be more than the tiny calendars we have been seeing recently.”

Heckman added the muni market continues to repeat the same old song in terms of the supply/demand imbalance and despite hearing rumors of issuance picking up, he doesn’t see that changing anytime soon.

“I don’t see us realistically getting a true surge in supply until 2019,” he said. “We have had some money come in through coupons, redemptions and maturities but that will slow down soon.”

Heckman cautioned that there is one potential danger lurking out there for money managers and investors. “I get the feeling a lot of people are too short right now and as the yield curve continues to flatten out, a lot of people are going to scramble to try and extend their duration and it’s going to cause chaos,” he said.

Primary market

There are several big bond issues awaiting buyers as they return from the long weekend.

The New York City Transitional Finance Authority will issue $1.4 billion of future tax secured subordinate Fiscal 2019 bonds.

On Thursday, Loop Capital Markets will price the TFA’s $900 million of tax-exempt fixed-rate bonds after a two-day retail order period. Additionally, the TFA is set to sell $500 million of taxable bonds in two competitive sales on Thursday.

The financial advisors are Public Resources Advisory Group and Acacia Financial Group and the bond counsel are Norton Rose and Bryant Rabbino. The deals are rated Aa1 by Moody’s and AAA by S&P Global Ratings and Fitch Ratings.

Proceeds from the sale will be used to fund capital projects, with the exception of proceeds from about $150 million of the tax-exempt fixed-rate bonds, which will be used to convert outstanding floating-rates into fixed-rates.

Also on Thursday, California is competitively selling over $989 million of general obligation and GO refunding bonds in three sales.

The offerings consisting of $516.035 million of tax-exempt various purpose GO refunding bonds, Bidding Group C, $338.38 million of tax-exempt various purpose GOs, Bidding Group B, and $134.855 million of taxable various purpose GO and refunding bonds, Bidding Group A.

The financial advisor is Public Resources Advisory Group and the bond counsel is Orrick Herrington & Sufcliffe. The deals are rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

Proceed from the sales will be used to refund certain outstanding debt of the state.

There are several higher education deals of note on the upcoming calendar.

Wells Fargo Securities is expected to price the University of Chicago’s $400 million of Series 2018C taxable fixed-rate bonds on Thursday. The corporate CUSIP deal is rated Aa2 by Moody’s, AA-minus by S&P and AA-plus by Fitch.

Stifel is set to price the University of North Dakota’s $92.99 million of tax-exempt and taxable green certificates of participation on Thursday form an infrastructure energy improvement project. The deal is rated A1 by Moody’s.

And Goldman Sachs is set to price Purdue University’s $90 million of student fee bonds. The deal is rated AAA by Moody's and S&P.

In the housing sector, Barclays Capital is expected to price the New Jersey Housing and Mortgage Finance Agency’s $165 million of multi-family revenue bonds. The deal is rated AA-minus by S&P.

Bond Buyer 30-day visible supply at $8.90B

The Bond Buyer's 30-day visible supply calendar increased $809.5 million to $8.90 billion for Tues. The total is comprised of $4.24 billion of competitive sales and $4.66 billion of negotiated deals.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Aug. 31 were from Puerto Rico and Texas issuers, according to

In the GO bond sector, the Puerto Rico 8s of 2035 traded 39 times. In the revenue bond sector, the Texas 4s of 2019 traded 238 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp. 6.35s of 2039 traded 18 times.

Week's actively quoted issues

Puerto Rico, Pennsylvania and California names were among the most actively quoted bonds in the week ended Aug. 31, according to Markit.

On the bid side, the Puerto Rico Aqueduct and Sewer Authority revenue 5.25s of 2042 were quoted by 92 unique dealers. On the ask side, the Allegheny County Sanitation Authority, Pa., revenue 5s of 2045 were quoted by 297 dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 18 dealers.

Secondary market

Municipal bonds were stronger on Friday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the two- to 30-year maturities and rose less than a basis point in the one-year maturity.

High-grade munis were also stronger, with yields calculated on MBIS’ AAA scale falling as much as three basis points in two- to 30-year maturities and rising less than a basis point in the one-year maturity.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation remaining unchanged while the yield on 30-year muni maturity fell one basis point.

Treasury bonds were stronger as stock prices traded mixed.

Previous session's activity

The Municipal Securities Rulemaking Board reported 38,174 trades on Thursday on volume of $11.70 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 13.722% of the market, the Lone Star State taking 14.071% and the Empire State taking 9.251%.

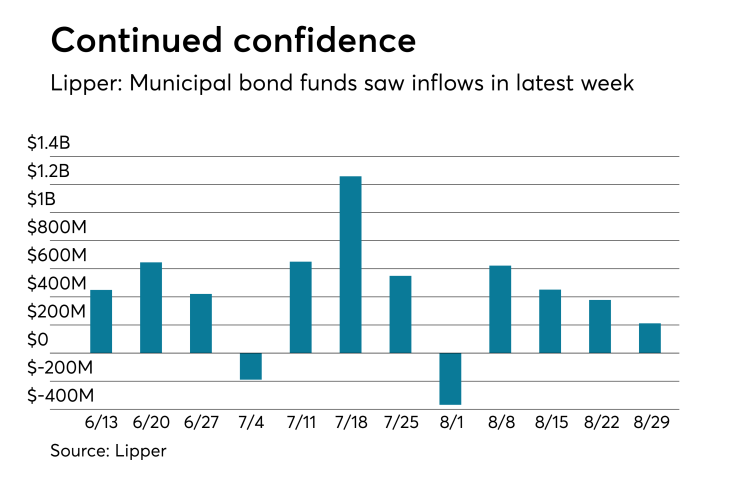

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds once again showed confidence and put cash into the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $212.052 million of inflows in the week ended Aug. 29, after inflows of $378.371 million in the previous week.

Exchange traded funds reported inflows of $57.435 million, after inflows of $82.831 million in the previous week. Ex-ETFs, muni funds saw $154.617 million of inflows, after inflows of $295.540 million in the previous week.

The four-week moving average remained positive at $416.251 million, after being in the green at $271.150 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $368.851 million in the latest week after inflows of $348.356 million in the previous week. Intermediate-term funds had inflows of $97.445 million after inflows of $90.321 million in the prior week.

National funds had inflows of $194.565 million after inflows of $338.960 million in the previous week. High-yield muni funds reported inflows of $222.454 million in the latest week, after inflows of $240.718 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.