Bank of America Merrill Lynch stormed back in the second quarter to rank first among municipal underwriters for the first half of 2016, increasing its par amount and market share from a year earlier.

Public Financial Management Inc. remained atop the financial advisor league table and the state of California was the largest municipal issuer.

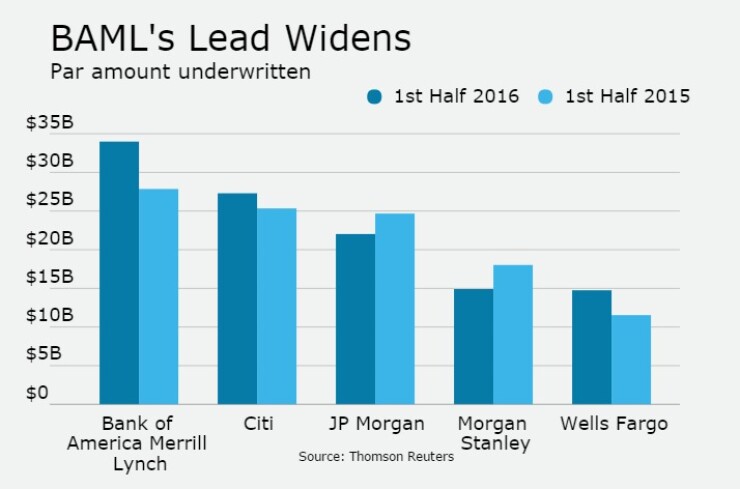

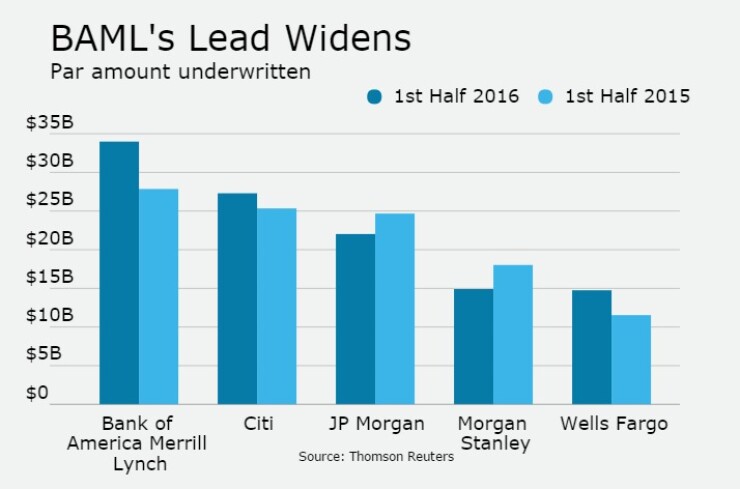

BAML closed the quarter with a par amount of $20.76 billion in 161 issues, or 17.5% market share for the second quarter. For the first half, the firm finished at $33.98 billion in 283 deals, for a 15.8% market share, up from $27.85 billion in 263 deals or 13% market share in the first half of 2015, according to data from Thomson Reuters.

Overall, the top 10 firms combined for a total par amount of $214.51 billion in 6,417 transactions compared to $215.01 billion in 6,839 transactions in the first half of last year.

"It's a spectacular opportunity right now and we are working hard at helping our clients to come to market and take advantage of the low rates," Jonathan Nordstrom, head of municipal sales and trading at Raymond James, which climbed two places to eighth in the first half ranking. "There is excellent interest in muni bonds and we are even seeing the international customer coming in, it's an incredible market right now but rates could go lower."

Citi, which finished in first place after the first quarter, dropped back down to second place with a total of $27.29 billion in 290 deals or 12.7% market share in the first half. That compares with to $25.34 billion in 279 deals or 11.8% market share in the same period last year, when Citi was also in second place.

For the second quarter, Citi had a par amount of $14.05 billion or 11.8% market share. Citi was the lead bookrunner on some of the largest deals so far this year, including the $2.9 billion general obligation sale in March from California and the $2.4 billion LaGuardia airport deal, which was the biggest airport and alternative minimum tax deal to ever hit the market.

JPMorgan finished both the quarter and first half in third place. For the quarter, the bank had $13.56 billion in 133 transactions or 11.4% market share. JPMorgan finished the half with $22.03 billion in 221 deals or 10.3% market share, down from $24.67 billion in 245 deals or 11.5% market share in the first half of last year, when it also ranked third.

Morgan Stanley finished the first half in fourth place, with $14.91 billion or 7% market share, down from $18.02 billion or 8.4% market share a year earlier. They also finished in fourth place for the second quarter, winding up with $7.92 billion or 6.7% market share for the past three months.

Rounding out the top five is Wells Fargo, which moved up one spot from last year and finished the first half with $14.75 billion or 6.9% of the market, which compares to $11.54 billion or 5.4% in the first half of 2015, which was good for sixth place.

RBC Capital Markets was sixth with $10.94 billion, followed by Stifel with $9.14 billion but had the most number of deals with 485.

Raymond James was the biggest mover, jumping up two spaces to number eight with $8.98 billion.

"We are pleased with how the year has gone, working hard to try and increase market share and influence and impact on our customers," said Nordstrom. "Our competitive underwriting desk has done a great job of pulling business and that is connected with our sales force, who continues to get better. We are seeing more engagement with customers and that has helped propel our performance."

Piper Jaffray was ninth with $8.13 billion and Barclays finishes the top 10 with $6.97 billion.

Financial Advisors

Public Financial Management was once again atop the first half league tables for financial advisors, as they increased its par amount and market share from last year. PFM finished the half with $39.50 billion or 21.9% market share, which was up from the $35.65 billion and 19.8% market share from the first half of 2015.

"PFM was pleased to increase our market share during the first half of the year compared to the first half of 2015, even as bond volume declined," said John Bonow, chief executive officer and managing director for the PFM Group. "We believe that the increase is due to two factors: our consistent ability to help clients identify refinancing opportunities in the prevailing low rate environment and a good number of clients focused on creative and sustainable ways to finance much needed projects and infrastructure."

Bonow said low borrowing rates seem to have real traction as the world digests the U.K. exit path from the European Union.

"Domestic economic indicators continue to be mixed, but worldwide financial and economic uncertainty will likely depress the appetite for the Federal Reserve to take action on rate increases and that may encourage many state and local governments to make longer-term commitments to infrastructure and social program investments," he said.

Bonow said he expects PFM to continue to bring effective solutions to its current and future clients who understand the value PFM provides through our practical and sustainable financial solutions to their challenges.

Hilltop Securities, which was in third place at the end of the first quarter, moved up into second place to finish the first half, the same position they were in at the end of the first half last year. Hilltop's par amount was $18.49 billion. Public Resources Advisory Group finished the half with $17.36 billion for third place, after finishing the first quarter in second place.

The two biggest movers in the ranking were the firms rounding out the top five: Acacia Financial Group Inc. and Kaufman Hall and Associates Inc.

Acacia moved up to fourth, after finishing the first half of 2015 in sixth place. The New Jersey based company finished the first half with $8.30 billion, up from the $4.21 billion in the first half of 2015.

Kaufman Hall and Associates moved into the fifth spot after posting $4.04 billion in the first half of this year.

Negotiated Underwriting

BAML claimed the top spot for underwriting negotiated deals, with a par amount of $22.39 billion for the first half this year, compared with $17.78 billion during the same period last year when it finished third. Citi remained in second, the same spot as in the first half last year, with $19.91 billion. JPMorgan, which was in first at this point last year, fell to third with $15.50 billion. Morgan Stanley was fourth with $10.83 billion and RBC fifth with $10.68 billion.

Wells Fargo ranked sixth with $10.61 billion, followed by Stifel with $8.74 billion, Piper with $7.00 billion, Raymond James with $6.84 billion and Barclays with $6.31 billion.

Competitive Underwriting

BAML finished the first quarter atop the ranking for competitive-only deals with $11.59 billion, followed by Citi with $7.39 billion. JP Morgan was third with $6.52 billion. Robert W Baird & Co., was fourth with $4.28 billion, moving up from sixth at this point last year and Wells Fargo was fifth with $4.14 billion, as it made the biggest year-over-year leap, moving up from sixth place a year ago.

Morgan Stanley was sixth with $4.08 billion, followed by Raymond James with $2.14 billion, Hutchinson Shockey Erley & Co. with $1.24 billion, Piper with $1.13 billion and FTN Financial Capital Markets with $885 million.

Top Issuers

The state of California is the No. 1 issuer for the first half of the year, retaining the top spot it held after the first quarter of the year. In total so far this year, the Golden State has issued $4.52 billion of bonds.

"Our general obligation bonds are what we issued the most of so far this first half," said Tim Schaefer, deputy treasurer, public finance, for California Treasurer John Chiang.

The Golden State came with a whopping $2.9 billion GO sale in March, which was more than half refunding. The final amount was split into $1.1 of new money and $1.8 of refunding, which gave the state $294 million of present value savings. In April, they came back with $1.5 billion, which was mostly refunding and they netted another $195 million of PV savings.

Schaefer said that refundings are driving the volume.

"With interest rates as low as they are, we are being very aggressive in refunding everything we can get our hands on as long as it makes economic sense," he said. "The market has been very kind to us in the last 18 months, offering us very attractive yields and trading at much tighter spreads from the MMD scale that our ratings would imply."

Schaefer also said that the state is in much better financial position than it has been in a long time and that the market appears to be telling us they have greater confidence in the state's ability to manage it out of tough situations.

"As long as the supply and demand stays this way, we will take advantage. We are high grade, but not yet triple-A, so that hand full of basis points of extra yield makes a difference."

Although an issuer from the west coast held the top spot, the east coast was well represented with four of the top five spots, including three issuers from New York City.

The New York Transportation Development Corp. was second with $3.25 billion, most of which came during the mega LaGuardia deal.

The NYC Transitional Finance Authority was third with $2.65 billion, followed closely by the Commonwealth of Massachusetts with $2.64 billion. The NYC Metropolitan Transportation Authority rounds out of the top five with $2.62 billion.