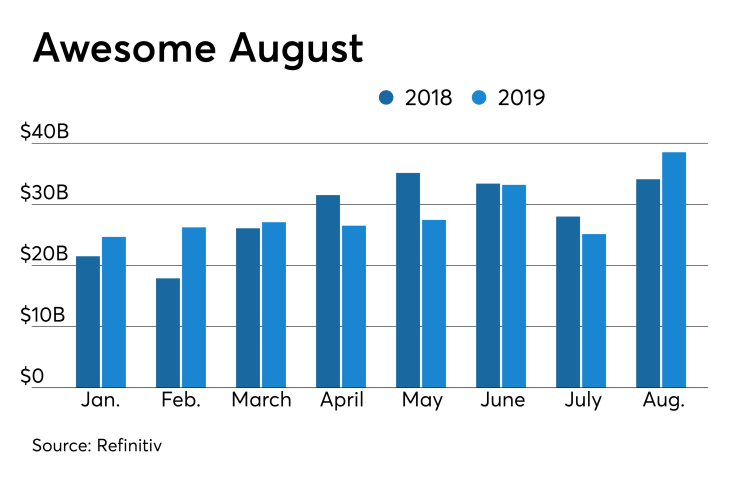

Municipal bond volume surged to a 20-month high in August, bouncing back from the second lowest total of the year in July, as issuers of long-term municipal debt came out in droves to take advantage of yields at historic lows.

Muni yields are playing a game of limbo, after dropping to record lows on Aug. 14 for both 10-year and 30-year bonds. That record lasted two weeks, as on Aug. 28 both records were reset with the 10-year falling to 1.21% and the 30-year to 1.83%, according to Municipal Market Data.

The month of August ends with $38.53 billion of municipal bonds sold in 904 transactions, an increase of 13% from $34.11 billion in 817 issues in August 2018, according to data from Refinitiv.

This marks the largest volume month since December of 2017, when the market was hit with $69.83 billion of issuance as issuers were racing to get deals in ahead of the overhaul of U.S. tax laws.

Tom Kozlik, head of municipal strategy and credit at Hilltop Securities, said that typically, the summer months are usually strong months for issuance and this June and July relative to past years were lighter than normal.

“So, it is not surprising that August was a stronger month for bonds sales,” he said. “This month somewhat made up for the lighter issuance in the beginning of the summer, so it is not surprisingly at all.”

The last comparable August also took place back in 2017 when volume totaled $37.54 and the last time the volume for the month of August was larger, was back in 2016 when it was $46.66 billion.

“It is likely that if issuers were on the fence, or had refundings that did not generate quite enough savings a month or two ago that they are likely re-evaluating their financing strategy now,” Kozlik said. “Therefore, because of the lower rates there could be a boost to September issuance that we would not have had otherwise.”

Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management, added that the pickup in supply was much needed.

“I still think there is plenty of cash waiting to get put to work,” he said. “The supply/demand picture could get more unbalanced; with yields lower now, you should see issuers start to come to market more.”

Refunding volume for the month rose 13.8% to $12.89 billion in 213 deals from $11.33 billion in 137 deals a year earlier. New-money volume increased 22.8% to $23.05 billion. Combined new-money and refunding issuance was 35.5% lower from August 2018 to $2.59 billion.

Issuance of revenue bonds gained 9.1% to $23.02 billion, while general obligation bond sales increased 19.3% to $15.51 billion.

Negotiated deal volume was up 5.8% to $28.35 billion. Competitive sales increased 87.6% to $9.86 billion.

Taxable bond volume more than doubled to $7.69 billion, while tax-exempt issuance increased 4.8% to $28.42 billion. Issuance of bonds with interest subject to the Alternative Minimum fell to $2.43 billion.

“The lower rates are making a more compelling argument for issuers to consider taxable over tax-exempt debt,” Kozlik said. “We are seeing an increased amount of interest from issuers who would have traditionally sold tax-exempt, but they are looking at the taxable option. So, we think the level of taxable issuance could continue or even increase in the near term.”

Variable-rate short put debt sank 34.1% to $356.8 million from $666.4 million and variable-rate long/no puts increased 27.6% to $1.29 billion.

“There is lots of money sitting in variable rate demand notes right now, so it will be interesting to see when and where that money gets put in terms of a permanent home,” said Heckman.

Deals wrapped by bond insurance for the month jumped up by 56.6% to $2.24 billion in 147 deals from $1.43 billion in 103 transactions the same month last year.

Private placements crashed 92.7% to $136 million from $1.87 billion.

“PPs have decreased dramatically, which makes me think that issuers believe that it is worth time and expense to go the public route of issuing debt,” Heckman said.

Six sectors gained from year-earlier levels, while issuance by the rest of the sectors declined at least 1.6%. Education muni deals were way up to $8.50 billion from $5.84 billion. Healthcare deals grew 29.3% to $5.57 billion from $4.13 billion.

Five types of issuers increased volume in August, while the rest suffered decreases of at least 10.8%. Issuance from local authorities rose 54.2% to $6.41 billion from $4.16 billion and colleges and universities surged to $1.08 billion from $427 million.

“I found it very interesting that cities and states did not participate in the supply surge we saw this month,” Heckman said. “It makes you wonder why these cities and states are not participating at one of the most optimal times to issuance muni debt. But on the other hand, it could mean that there will be another leg to this increase in supply if cities and states intend to take advantage of low yields and rates.”

California continued to lead all states in terms of muni bond issuance. Issuers in the Golden State have sold $35.88 billion of municipal bonds so far this year; Texas moved up one spot to second with $27.53 billion; New York dropped to third $23.69 billion; Florida was next with $11.91 billion; and Pennsylvania rounded out the top five with $11.78 billion.

Massachusetts was next with $8.50 billion, followed by Georgia with $6.99 billion, Colorado with $6.92 billion, then Ohio with $6.72 billion and finishing the top 10 is Michigan with $6.54 billion.

While Septemer will get off to a decent start with an estimated $7.6 billion for the first week of the month, Kozlik noted that there is the potential for October to be a big month this year.

“There are several factors playing into that including past experience, the calendar, potential refundings, etc., that lead us to believe that could be the case,” he said.