BRADENTON, Fla. — Assured Guaranty Ltd. will provide Kentucky's Paducah Power System with surety bonds to free up some debt service reserves at the cash-strapped utility, according to PPS officials.

The utility's financial struggles stem from its costly stake in the controversial Prairie State coal-fired generating plant in Illinois.

Assured also agreed to provide surety bonds for some debt sold by the Kentucky Municipal Power Agency, a joint action agency created by PPS and nearby Princeton to issue $491.4 million of revenue bonds to finance a 7.82% ownership interest in Prairie State.

For Paducah, which contracted for 84% of KMPA's stake in the Prairie State, using the surety bonds will free up about $12.5 million in cash now held in its debt service reserves, PPS's finance director David Carroll said Jan. 23. Another $6.7 million in cash will come from KMPA's freed-up reserves.

Princeton will also see some savings from the KMPA surety.

Both utilities also expect additional savings from a refunding that is being planned by KMPA. The amount and timing of the deal is still under discussion, according to Carroll.

The use of sureties and the refunding are part of Paducah's plan to deal with a budget deficit and customers who have become enraged due to high power costs related to unanticipated expenses at Prairie State.

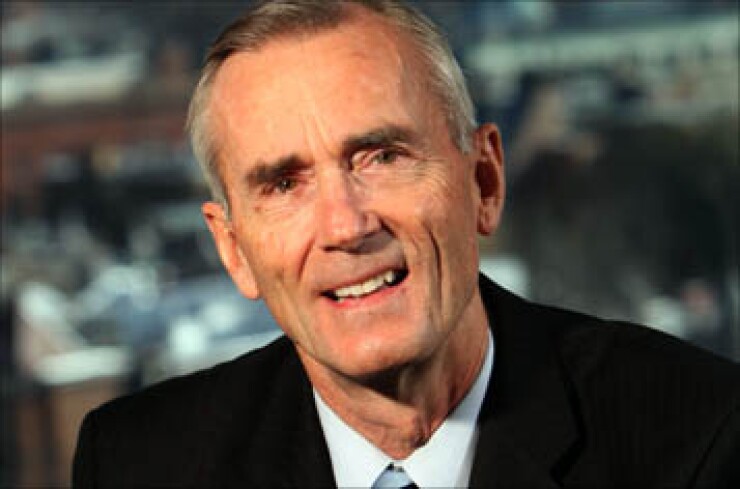

"One of the main goals in our recovery plan is to eliminate the deficit created by our current rate freeze and position ourselves financially to lower the power cost adjustment portion of customers' bills July 1, 2015," said PPS interim general manager Mark Crisson. "The surety bonds are a big step forward toward that goal."

PPS has also hired a new portfolio manager to assist in selling or leasing some of its excess power generating assets.

"We feel like we have a good plan in place," Carroll said. "Prairie State is operating better, which helps."

In December, Fitch Ratings downgraded PPS's bonds to BBB from A-minus after the utility presented rating agencies with details of its rate recovery plan. Fitch also assigned a negative outlook.

The two-notch downgrade applies to $153 million in 2009A revenue bonds, and $1 million in refunding revenue bonds issued in 2010, and is also related to budget pressures caused by higher power costs related to Prairie State.

Analyst Ryan Greene said Fitch viewed the rate recovery plan as a stopgap measure that is "more consistent with the lower rating until improved asset performance at the Prairie State Energy Campus provides longer-term relief through lower purchased power costs."

Moody's Investors Service assigns A3 ratings to Paducah's bonds.