It’s 1961. John F. Kennedy is president of the United States. Gas costs 27 cents a gallon and a new car will set you back $2,850. A new house will cost you about $12,500 while your salary averages out to around $5,315 a year.

And in New York of that year, Herman Charbonneau begins his career in municipal finance. Though he doesn’t know it yet, he’ll become one of the more successful and long-lived investment bankers in the municipal bond arena in a career that will span over half a century.

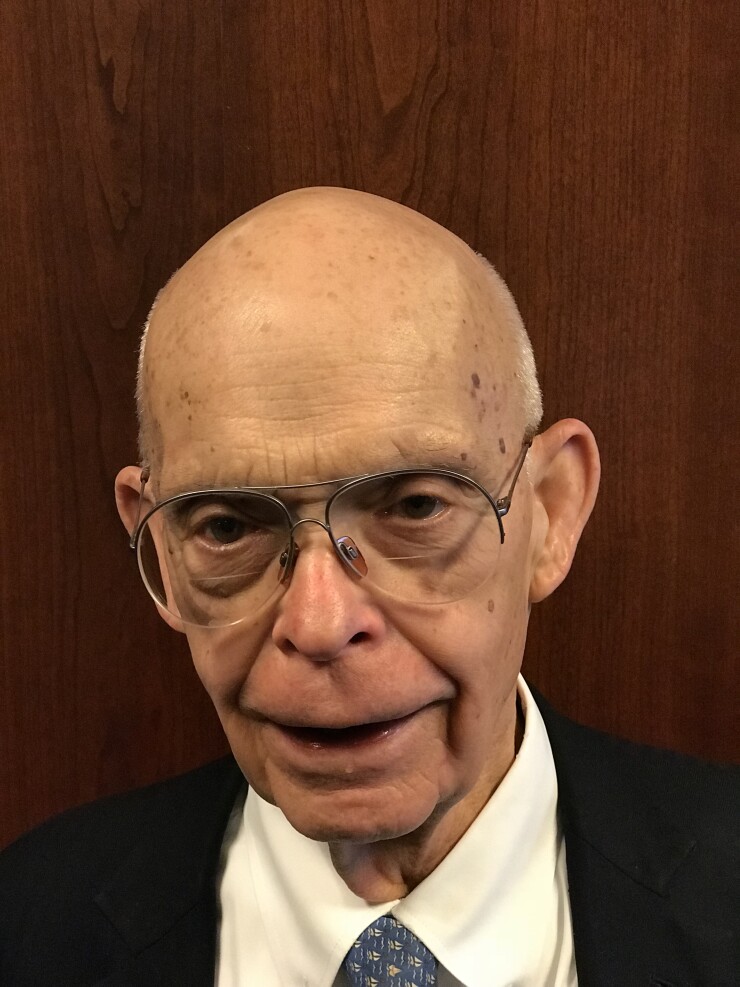

Charbonneau, now executive vice president and manager of public finance at Roosevelt & Cross Inc., is getting ready to retire at the end of this month at the age of 84.

Charbonneau started his career as a municipal credit analyst in 1961 at Dun & Bradstreet after spending two years in the U.S. Army. He moved on to Chemical Bank in 1963 and worked his way up to head of public finance in 1988. He then went to work for Roosevelt & Cross in 1992.

“I started out on the credit side of the business and I think it’s a good place for people to start,” he told The Bond Buyer. “It provides a good foundation for everything else in the business. At the time I started, the guys there were veterans from World War II -- all strong and intelligent guys -- and I learned a lot from them.”

Charbonneau is recalled fondly by his colleagues in the industry.

Richard Baggott, founder of Executive Search Placements, has known Charbonneau since 1991 and said that he’s a fun guy who’s very straightforward.

“He’s trained an awful lot of good people in the industry,” Baggott said. “Roosevelt & Cross is a very well-known firm in the Northeast. It’s one of those firms you get in and then you are part of the family.”

Roosevelt & Cross was established in 1946 by Archibald Roosevelt — son of President Theodore Roosevelt — and Edwin Cross, an underwriting specialist.

“Herman has been at the helm of Roosevelt & Cross’ public finance efforts since 1992, but he has made meaningful contributions to our firm in many different ways. He is a rare resource and a unique and gifted individual,” said Gregory Finn, R&C’s chairman. “He exhibits an unusual ability to distill complicated issues down to their rudimentary parts, and dispense clear and coherent advice based on simple principles that all can understand. His communication skills, along with his historic knowledge gleaned from a 57 year career in our business make him one of a kind.”

“He’s a really positive, hardworking guy,” said Frank McKenna, director of municipal finance at Academy Securities. “He really came in to the job and helped build up the business over many years. He’s extremely knowledgeable about the municipal bond industry.”

Other colleagues said he was a mentor for decades in the municipal public finance industry and is viewed as a throwback to the heyday of municipal public finance.

"He's had a wonderful long career, and he's just a great guy to work with," said Sam Ramirez, president and chief executive officer of Ramirez & Co., who has over 50 years of finance experience on Wall Street and worked on many financings over the years with Roosevelt & Cross, particularly New York deals with Charbonneau as banker.

"He's a really good guy, and just a real gentleman," Ramirez said of his long-time colleague.

"He is Roosevelt & Cross. When you think of the firm, you think of him," said John Mousseau, director of fixed income and portfolio manager at Cumberland Advisors, who himself has been in the industry for over 30 years. "He's been a constant in a world of change and he will be missed," Mousseau said.

Finn cited Charbonneau’s varied experiences in the business as a key to his success.

“At Chemical Bank, he had served as research analyst, trader, underwriter, bank portfolio manager, sales manager, financial advisor, public finance banker and department head,” Finn said. “Over his many years, he has become known in here as ‘The Walking Encyclopedia of Municipal Bonds.’ His considerable skills and knowledge have been a source of great pride for our team.”

John Hallacy, Contributing Editor at The Bond Buyer, had only good things to say about Charbonneau.

“I met Herman when I was a young analyst and he was leading the effort at Chemical Bank,” John said. “He really had command of the room in a respectful way. He encouraged participants to speak up and he asked great questions. No one knew the MSRB and other regulatory rules better than he did.”

“When I became a very seasoned senior analyst, he would call me to ask me my opinion. I was honored to be able to answer his insightful questions. What a prime example he is of a municipal industry legend,” Hallacy said.

“I’ve enjoyed everything I’ve done in the business,” Charbonneau said, adding that he especially liked a running public finance department.

“I liked solving the problems – working with the public sector side with public officials and facing off with the competition and making the deals.”

Charbonneau received his BS from the College of Holy Cross in 1956 and his MA from Fordham University in 1960.

And as to his future plans?

“I’m going to take six months off to recuperate and then decide what I’ll do next,” he said.

“We at Roosevelt & Cross are very grateful for his efforts over the past 26 years and for our public finance department’s accomplishments.” Finn said. "We want to thank him for all he’s done for us and for all he has taught us and we wish him a joyful and relaxing retirement.”

Christine Albano contributed to this story.