Three rulings by the U.S. Supreme Court this term will have a lasting impact on the finances of many municipal bond issuers, according to report released by Fiera Capital.

“As anticipated, the Supreme Court ruled against public sector unions in the high-profile case of Janus v. American Federation of State, County, and Municipal Employees. The Janus ruling will have important long-term credit implications for many state and local governments,” Bryan Laing, vice president of credit research at Fiera, wrote in a market comment released late Friday. “This case, along with the recent ruling on sports wagering and online sales tax collections combine for a busy season for state and local governments at the nation’s highest court.”

The impact of the Janus v. AFSCME ruling is more than likely to be a weakening of union finances, Laing said, which may have a dampening effect on their power over the longer term. He said it was an important long-term development for many municipal issuers, particularly those facing elevated pension burdens.

“Many states have made strides in addressing their underfunded pension liabilities,” Laing said. “States facing the most significant liabilities will likely need to continue to incrementally negotiate solutions with unions over the coming years and decades. This makes the balance of power in these negotiations important.”

Four of the five states with the highest unfunded pension liabilities in comparison to the size of operating budgets are Illinois, Alaska, Connecticut, and New Jersey, according to Moody’s Investors Service.

Laing said these states also have elevated credit spreads compared to AAA-rated municipals. “Notably, each of these states are poised to see public sector union finances weakened because of the ruling,” he said.

In the South Dakota v. Wayfair, Inc. ruling, the court said states can require companies to collect sales taxes from online purchases, even when the company doesn’t have a physical presence in the state.

Laing expects a modest increase in near-term revenues, and said the decision was a potentially important step in aligning tax structure to a 21st century economy.

“The court’s ruling in favor of South Dakota has the potential to pave the way for a more modern approach to taxing online sales and importantly prevents future erosion in sales tax revenues from shifts to online purchasing,” Laing wrote.

In Murphy v. National Collegiate Athletic Association, the court made sports betting legal where approved by the state, as federal legislation that blocked most sports betting was ruled to violate the U.S. Constitution.

However, Laing said the additional tax revenues associated with sports gambling are not anticipated have a lot of impact on most state budgets.

“While it will provide New Jersey with much needed additional revenues, the estimates are underwhelming,” Laing said. “In May, the Treasurer of New Jersey estimated that taxing sports betting would generate just $13 million in Fiscal 2019, compared to a $37.4 billion proposed budget.”

Fiera Capital is a global asset management firm with more than $100 billion of assets under management.

Puerto Rico sales tax bonds fall on budget news

Some Puerto Rico issues were trading lower after a federal control board approved a revised budget for the commonwealth that was at odds with that of the local government.

Over the weekend, the Financial Oversight and Management Board for Puerto Rico certified a revised, compliant $8.8 billion fiscal 2019 budget for the island. The board also adopted unanimous resolutions approving the budgets of the Government Development Bank, the Puerto Rico Highways and Transportation Authority, the University of Puerto Rico, the Puerto Rico Aqueduct and Sewer Authority and the Puerto Rico Electric Power Authority, in compliance with PROMESA.

In a letter to Gov. Ricardo Rosselló, Senate President Rivera Schatz, and House Speaker Méndez Núñez, the board noted that upon failure by the Puerto Rico Legislature to officially submit a compliant budget by June 30, it certified the revised budget, which went into effect on July 1.

“The approved budget is reasonable and consistent with the certified Fiscal Plan and the objectives and targets delineated in it. The course has been set; and although it will be challenging, we cannot afford to veer off,” José Carrión, chairman of the oversight board, said in a statement. “ We must all work together to stay that course towards building a stronger Puerto Rico and providing better opportunities for its people as soon as possible.”

The news halted a recent rally in bonds issued by the Puerto Rico Sales Tax Financing Corp.

In late trading on Monday, the COFINA Series 2007B revenue 6.05s of 2036 were trading at a high price of 85 cents on the dollar compared to 86.25 cents on Friday, 84 cents on Thursday and 83.1 cents on Wednesday, according to EMMA. Volume totaled $23.67 million in 19 trades on Monday compared to $8.89 million in 18 trades on Friday, $22.01 million in 32 trades on Thursday and $11.97 million in 30 trades on Wednesday.

The COFINA Series 2009A first subordinate revenue 6s of 2042 were trading at a high price of 42 cents on the dollar compared to 44.75 cents on Friday, 40.5 cents on Thursday and 38.5 cents on Wednesday, according to EMMA. Volume totaled $3.58 million in five trades on Monday compared to $13.03 million in 13 trades on Friday, $1.19 million in eight trades on Thursday and $290,000 in eight trades on Wednesday.

Secondary market

Municipal bonds were mixed on Monday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the six- to 13-year and 18- to 30-year maturities, rose less than a basis point in the one- to four-year and 14- and 15-year maturities, and were unchanged in the five-year and 16- and 17-year maturities.

High-grade munis were also mixed, with yields calculated on MBIS’ AAA scale falling less than one basis point in the one- to six-year, 12- to 14-year and 29- to 30-year maturities, rising less than a basis point in the seven- to 11-year and 16- to 28-year maturities and remaining unchanged in the 15-year maturity.

Trading was subdued on Monday. Financial markets will be closed on Wednesday in observance of Independence Day and the municipal bond market will close early on Tuesday.

Secondary market activity was at a bare minimum on Monday as muni trading began fizzling out two days ahead of the July 4 mid-week holiday, according to a New York trader.

“There’s very little activity -- it’s a summer Monday and it’s the week of July 4th on a Wednesday, so that’s not a good thing,” he said. “There are a lot of people out and the market has been pretty flattish and quiet anyway,” he added, pointing to the seasonal slowdown referred to as the summer doldrums.

The primary market has been driving the municipal industry lately, but even that is postponed until after the holiday-shortened week, he said.

He noted that even the July 1 redemption demand seemed light on Monday - in part due to the holiday mode, as well as some market jitters. “There’s money out there but people are kind of uncertain what to do. We didn’t get a big June reaction and so far, we are not getting a big July reaction,” he said.

“People are sitting on their hands,” he said. “I really don’t see it picking up,” until investors and market participants return from Independence Day celebrations the second week of July, he added.

"The market is slow and one of the things that's a serious problem is when they reduced the corporate tax rate; that had a strong impact on institutional buying of tax-exempt debt," said a Columbus, Ohio trader.

Municipals were unchanged on Municipal Market Data’s AAA benchmark scale, which showed the 10-year muni general obligation yield and the 30-year muni maturity remaining steady.

Treasury bonds were weaker as stock prices traded mixed.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 85.9% while the 30-year muni-to-Treasury ratio stood at 98.4%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 32,657 trades on Friday on volume of $9.53 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 17.178% of the market, the Empire State taking 10.679% and the Lone Star State taking 9.624%.

Prior week's actively traded issues

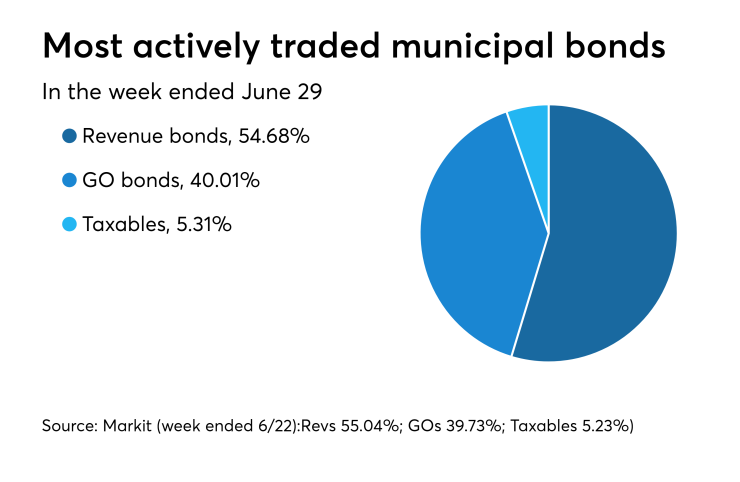

Revenue bonds comprised 54.68% of new issuance in the week ended June 29, down from 55.04% in the previous week, according to

Some of the most actively traded munis by type were from California, West Virginia and Puerto Rico issuers.

In the GO bond sector, the Los Angeles 4s of 2019 traded 175 times. In the revenue bond sector, the West Virginia Hospital Finance Authority 4s of 2051 traded 40 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp.6.05s of 2036 traded 23 times.

Prior week's top underwriters

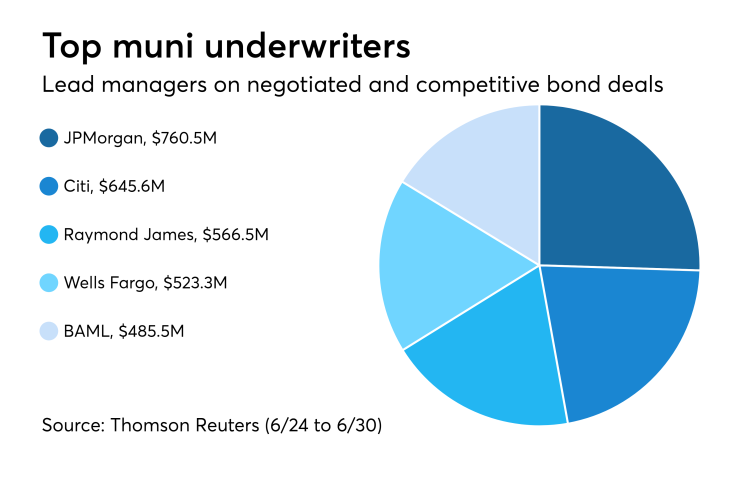

The top municipal bond underwriters of last week included JPMorgan Securities, Citigroup, Raymond James & Associates. Wells Fargo Securities and Bank of America Merrill Lynch, according to Thomson Reuters data.

In the week of June 24 to June 30, JPMorgan underwrote $760.5 million, Citi $645.6 million, Raymond James $566.5 million, Wells Fargo $523.3 million, and BAML $485.5 million.

Primary market

Ipreo estimates weekly bond volume at $73.8 million, down from a revised total of $4.69 billion this week, according to updated data from Thomson Reuters. The calendar contains no negotiated deals, just competitive sales.

Bond Buyer 30-day visible supply at $3.13B

The Bond Buyer's 30-day visible supply calendar increased $1.11 billion to $3.13 billion on Monday. The total is comprised of $1.74 billion of competitive sales and $1.39 billion of negotiated deals.

Treasury sells discount bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the three-months incurred a 1.940% high rate, up from 1.900% the prior week, and the six-months incurred a 2.085% high rate, unchanged from 2.085% the week before. Coupon equivalents were 1.977% and 2.136%, respectively. The price for the 91s was 99.509611 and that for the 182s was 98.945917.

The median bid on the 91s was 1.900%. The low bid was 1.875%. Tenders at the high rate were allotted 53.58%. The bid-to-cover ratio was 2.62.

The median bid for the 182s was 2.060%. The low bid was 2.040%. Tenders at the high rate were allotted 4.12%. The bid-to-cover ratio was 2.83.

Treasury auctions $35B 4-week bills

The Treasury Department Tuesday auctioned $35 billion of four-week bills at a 1.860% high yield, a price of 99.855333. The coupon equivalent was 1.889%. The bid-to-cover ratio was 2.45.

Tenders at the high rate were allotted 88.72%. The median rate was 1.830%. The low rate was 1.780%.

Gary Siegel contributed to this report

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.