The last of the week’s big municipal bond deals came to market on Thursday – both from California issuers – as municipals finished weaker in secondary trading.

Primary market

Citigroup priced the Los Angeles Community College District’s $350 million of tax-exempts consisting of Series J 2008 election general obligation bonds and Series A-1 2016 election GOs.

The $300 million of Series J GOs were priced to yield from 1% with a 2% coupon in 2018 to 2.90% with a 4% coupon in 2039; a 2041 maturity was priced as 4s to yield 2.94%.

The $50 million of Series A-1 GOs were priced as 2s to yield 1% in a 2018 bullet maturity.

The deal is rated Aa1 and MIG1 by Moody’s Investors Service and AA-plus by S&P Global Ratings.

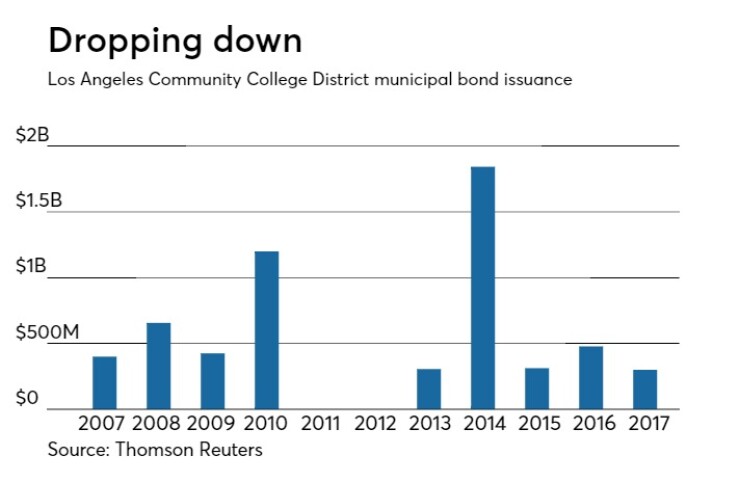

Since 2007, the Los Angeles CCD has sold about $5.9 billion of debt with the most issuance occurring in 2014 when it sold $1.8 billion. The district did not come to market in 2011 or 2012.

JPMorgan Securities received the written award on the San Diego Association of Governments' $194.14 million of Series 2017A toll revenue first senior lien bonds for the South Bay Expressway.

The issue was priced to yield from 1.02% with a 4% coupon in 2018 to 2.69% with a 5% coupon in 2038; a 2042 maturity was priced as 5s to yield 2.72%.

The deal is rated A by S&P and A-minus by Fitch Ratings.

Bond Buyer reports 30-day visible supply

The Bond Buyer`s 30-day visible supply calendar decreased $2.84 billion to $6.17 billion on Thursday. The total is comprised of $3.01 billion of competitive sales and $3.16 billion of negotiated deals.

Secondary market

The yield on the 10-year benchmark muni general obligation rose two basis points to 1.93% on Thursday from 1.91% on Wednesday, while the 30-year GO yield rose four basis points to 2.62% from 2.58%, according to the final read of Municipal Market Data`s triple-A scale.

U.S. Treasuries were mixed on Thursday. The yield on the two-year Treasury fell to 1.63% from 1.64%, the 10-year Treasury yield rose to 2.33% from 2.32% and the yield on the 30-year Treasury increased to 2.81% from 2.78%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 83.0% compared with 82.3% on Wednesday, while the 30-year muni-to-Treasury ratio stood at 93.5% versus 92.7%, according to MMD.

AP-MBIS 10-year muni at 2.232%, 30-year at 2.749%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale was weaker in late trade.

The 10-year muni benchmark yield rose to 2.232% on Thursday from the final read of 2.231% on Wednesday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session`s activity

The Municipal Securities Rulemaking Board reported 38,112 trades on Wednesday on volume of $13.33 billion.

Tax-exempt money market funds see inflows

Tax-exempt money market funds experienced inflows of $1.03 billion, raising total net assets to $129.24 billion in the week ended Nov. 6, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $133.1 million to $128.20 billion in the previous week.

The average, seven-day simple yield for the 199 weekly reporting tax-exempt funds slipped to 0.47% from 0.48% the previous week.

The total net assets of the 833 weekly reporting taxable money funds increased $553.9 million to $2.581 trillion in the week ended Nov. 7, after an outflow of $9.12 billion to $2.580 trillion the week before.

The average, seven-day simple yield for the taxable money funds was unchanged at 0.70% from the prior week.

Overall, the combined total net assets of the 1,032 weekly reporting money funds increased $1.59 billion to $2.710 trillion in the week ended Nov. 7, after inflows of $9.25 billion to $2.708 trillion in the prior week.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.